The European currency was not supported in the first half of the day by data on sentiments in business circles in Germany, which in December this year slightly deteriorated compared to the previous month. Many of the companies interviewed made a more moderate forecast and gave an average assessment of the prospects for the coming months.

According to the report of the Ifo Institute, the sentiment index in business circles in December 2017 decreased to 117.2 points against 117.6 points in November. Economists had expected the index to remain unchanged.

In the third quarter, the euro area saw a slowdown in wages, which would negatively affect retail sales, labor market indicators, and overall GDP growth. Weak data on wage growth may also puzzle the European Central Bank. They expect a further reduction in unemployment in the coming years, which will lead to an acceleration of inflation.

According to the report, salaries increased by 1.6% in the third quarter of this year compared with the same period in 2017 after rising by 2.1% in the second quarter.

The speech of ECB representative Weidman was not taken seriously by traders and investors. A small support for the euro was received after the statement that a faster completion of the bond purchase program is necessary, as well as a specific date for its completion. However, Weidman still believes that a soft monetary policy is appropriate even after the completion of the QE.

In the second half of the day, there were data on the number of bookings for new homes in the US, which slightly supported the US dollar despite the growth to the highest level in more than a year.

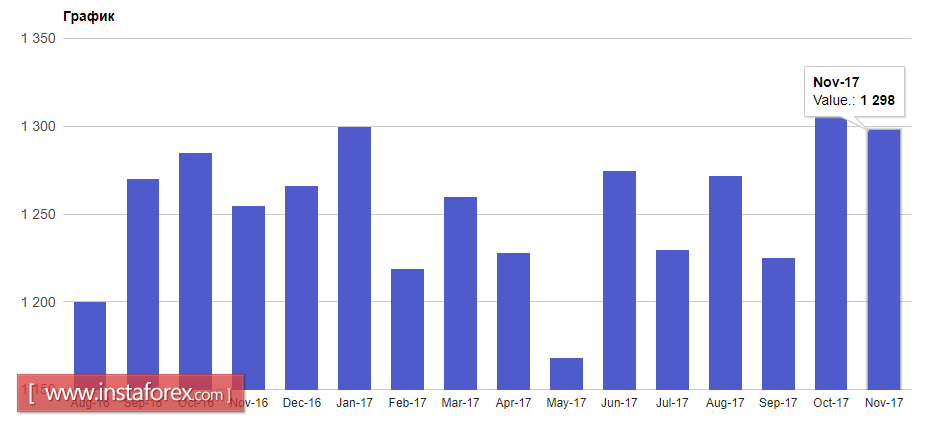

According to the report of the Ministry of Trade, the number of bookings of new houses in November this year increased by 3.3% compared to the previous month and amounted to 1.297 million homes per year. However, the number of construction permits decreased by 1.4% to 1.298 million homes per year. Economists had expected a fall in new house bookings by 3.1% and a decrease in construction permits by 2.3%.

As for the technical picture, buyers of risky assets are still in the market in the hope of continued growth of the euro in the resistance area of 1.1860 but this will happen only after the breakthrough at the resistance level of 1.1830, which is now resting on the main trade. In the event of an unsuccessful consolidation above 1.1830, we can expect a decrease in demand for the euro and a correction of the EURUSD pair to the level of 1.1800 by the end of the day.