The traders did not have time to "celebrate" the completion of the first stage of the talks between London and Brussels, as alarming information began to appear in the news, which indicate a lack of mutual understanding between the involved parties. The second part of the negotiation process promises to be just as intense and complex.

At the moment, all dollar pairs are focused on tax reform. Tonight (approximately 5-5:30 PM London time) voting is to be held in the House of Representatives, and tomorrow in the Senate (although the senators did not determine the final date). According to preliminary data, the lower house will approve the agreed legislation, and the probability of this is close to 100%.

But as for the Senate, it is impossible to speak of any certainty. Nominally Republicans have a majority of 52 out of 100. But because of a serious illness, the prominent Republican representative, John McCain will not be able to vote, thereby reducing the numerical majority. As a result, a nervous situation turns out: the stakes are high, the advantage is low. And this is despite the fact that in the camp of the Republicans initially there was no unanimous support for the proposed reform. In general, the chances of adopting the bill are high, but the situation, as they say, is "on the verge of a failure."

This fundamental picture has put "soft" pressure on the dollar, when in the absence of other significant news the market focuses on hypothetical problems.

In pairing with the pound, the dollar behaves somewhat differently. After yesterday's growth, the British currency froze flat against the backdrop of a worsening data background. The main recurring theme in the last days is a discussion of the special status of Britain in the system of future relations with the EU.

London is trying to maintain a privileged attitude to itself even after the "divorce," while Brussels repeats a clear message: there will not be a special status. A categorical position on this issue was voiced the other day by the head of the European negotiating delegation, Michel Barnier. He also added that Britain and the European Union can conclude a trade agreement in the future, but more than thirty parliaments will have to ratify it at the national and regional levels.

Obviously, such procedural moments will drag the process down for years, but, according to Barnier, "the British themselves have defined such boundaries." Also, the main European negotiator did not confirm the information on the compromise reached regarding the amount of "compensation". And this despite what Theresa May said earlier. Now the issue of compensation payments has frozen again in the air: official details can only be affirmed in January.

Discontent is also ripening in Britain. Representatives of the country's largest banks signed an appeal to the Prime Minister expressing a categorical disagreement with the negotiated version of the trade agreement with the European Union. Bankers called this option "a template copy of a similar treaty with Canada", criticizing its main provisions.

It should be noted that the free trade agreement between the European Union and Canada was signed last year (effective January 1, 2017). But the discussion of this document lasted 7 years, before the parties came to the final version. Literally at the last moment, the contract of CETA was almost disrupted, as the inhabitants of Wallonia (French-speaking region of Belgium) suddenly increased their demands for guarantees in the issues of labor, ecology, protection of farmers and consumer standards.

And if Europeans and Canadians still managed to find a compromise seven years later, the larger free trade agreement between the EU and the US (TTIP) remained on paper, despite years of negotiations. European farmers actually blocked discussion of this issue, and with the arrival of Donald Trump, Americans have completely lost interest.

Despite the fact that the trade agreement concluded between Canada and the EU has removed 99% of trade duties, British bankers call CETA "an unacceptable template." And it's not just about preserving a privileged relationship: the British want to see London as the financial center of Europe and after leaving the block, while at the moment there is a reverse process. Many large corporations, including those in the banking sector, are already planning to move their offices to the megacities of "continental" Europe, in order to maintain access to a single market. The tough stance of negotiators only accelerates this process and reduces the investment attractiveness of Britain.

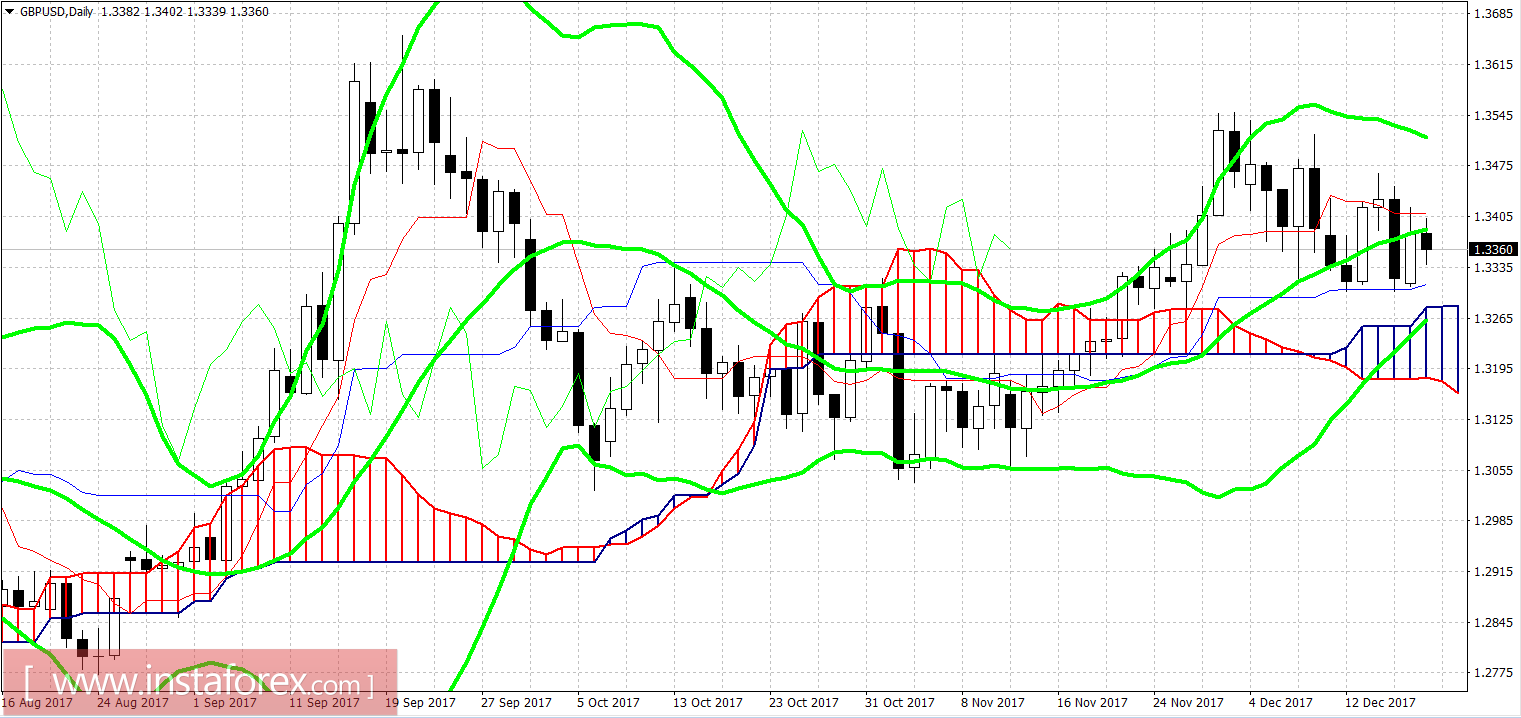

Such prospects put pressure on the pound. Against the backdrop of the continuing increase in inflation, the British currency is forced to literally "conquer" each point of growth. Since the beginning of the year, the GBPUSD pair has grown by more than a thousand points, although this dynamics was accompanied by deep corrective rebounds.

If we talk about the immediate prospects, then Mark Carney's speech tomorrow is worth mentioning. The head of the Bank of England will speak at a special committee of the Treasury with a report on financial stability. He is unlikely to talk about the planned date of the next round of rate hike, but at the same time he can positively assess the dynamics of inflation and the labor market. In the short term, this will support the GBPUSD pair - but only if the Senate does not approve (or, rather, will not have time to vote) the issue of tax reform.