Summarizing the results of 2017, we note that it has been a difficult year for the US dollar. At first, it turned out to be under pressure on a wave of uncertainty whether the tax reform will be adopted this year or not. The slowdown in the growth of consumer inflation also added pressure and brought to life new and old arguments concerning the Fed's stance if they will dare to raise rates three times. However, in the second half of the year, the decision is clear that the regulator will act within its plans. This was accompanied by an increase in interest rates both at the June and December meetings of the bank.

After the weakening of the dollar stopped, it continued to remain in the "outset" for the past few months and failed to turn up. Outgoing positive data from the labor market, as well as production figures and GDP figures, hampered its weakening. However, the growing likelihood of adopting the tax code, on the contrary, supported its course in relation to major currencies.

To date, the very idea of tax reform and its positive impact on the dollar has already been fully played on the market. Investors will wait for the impact of this law on the economy, which will become more or less clear in the next year. In the meantime, perhaps, either the prolonged period of consolidation will continue or the dollar may even be under pressure on the wave of the market rules from time immemorial "buy on expectations, sell on fact." The dollar has not risen in the last six month but has not fallen under the pressure of the absence of continued inflationary pressures on consumer inflation. So, the start of the new year may become negative for it. The market can switch from a positive tax reform to the reality of a lack of growth in consumer inflation, taking either a wait-and-see position or selling the dollar.

While this is only idle speculation, as sometimes it is, we will soon see. The risk of a virtual weakening of the dollar remains and this must be taken into account.

Forecast of the day:

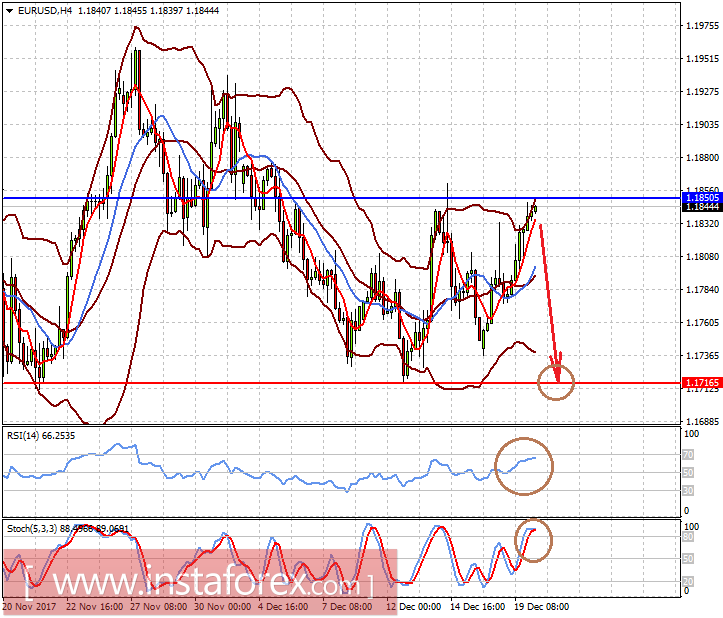

The EURUSD pair is likely to remain in the side range on the eve of the Christmas holidays and the publication of the final draft of the tax code in the States. We consider it necessary to sell the pair on growth from 1.1850 with a probable target of 1.1715.

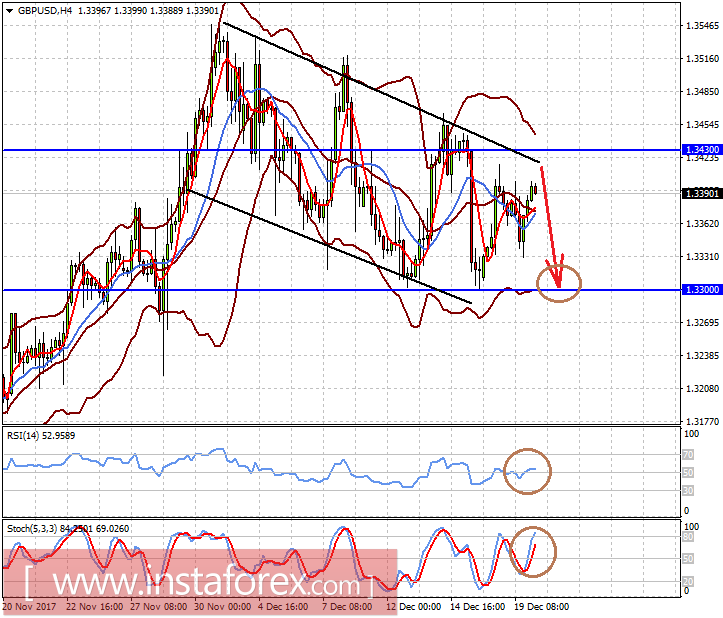

The GBPUSD pair is also likely to remain in the range in the wake of the news waiting for Brexit talks today. We believe that the pair on the growth should be sold with a local target of 1.3300.