Yesterday, there were many surprises which brought a fair variety that shows what is happening throughout the region. In particular, the euro received unexpected support from data on the construction sector, whose growth rate slowed from 3.1% to 2.0%. However, it was almost twice as good as it was forecasted. Then, the euro consolidated at because of US statistics, which also turned out to be better than forecasts. The number of building permits, although reduced, was only down by 1.4% and not by 4.9%. The number of construction projects started, instead of declining, grew by 3.3%. As a result, the euro strengthened and the pound remained in place. So, the US statistics turned out to be multidirectional and it had nothing to rely on, unlike the euro.

Today, the performance of Mark Carney is worth paying attention to. Although only a few expect anything new from him, his words may serve as an excuse for weakening the pound. The number of questions to the Bank of England is growing every day. However, the department of Mark Carney, it seems, just does not understand what to do in the current situation and this is extremely frightening for investors. If the head of the Bank of England again confines itself to general phrases, as well as words about Brexit's risks to the UK economy, the pound will again have to surrender. Waiting for Mark Carney before anything else is not necessary.

The data on housing sales in the secondary market can support the dollar. According to recent estimates, they can show an increase of 0.9%. A couple of days ago, it was believed that sales would decline. So, there is reason for optimism.

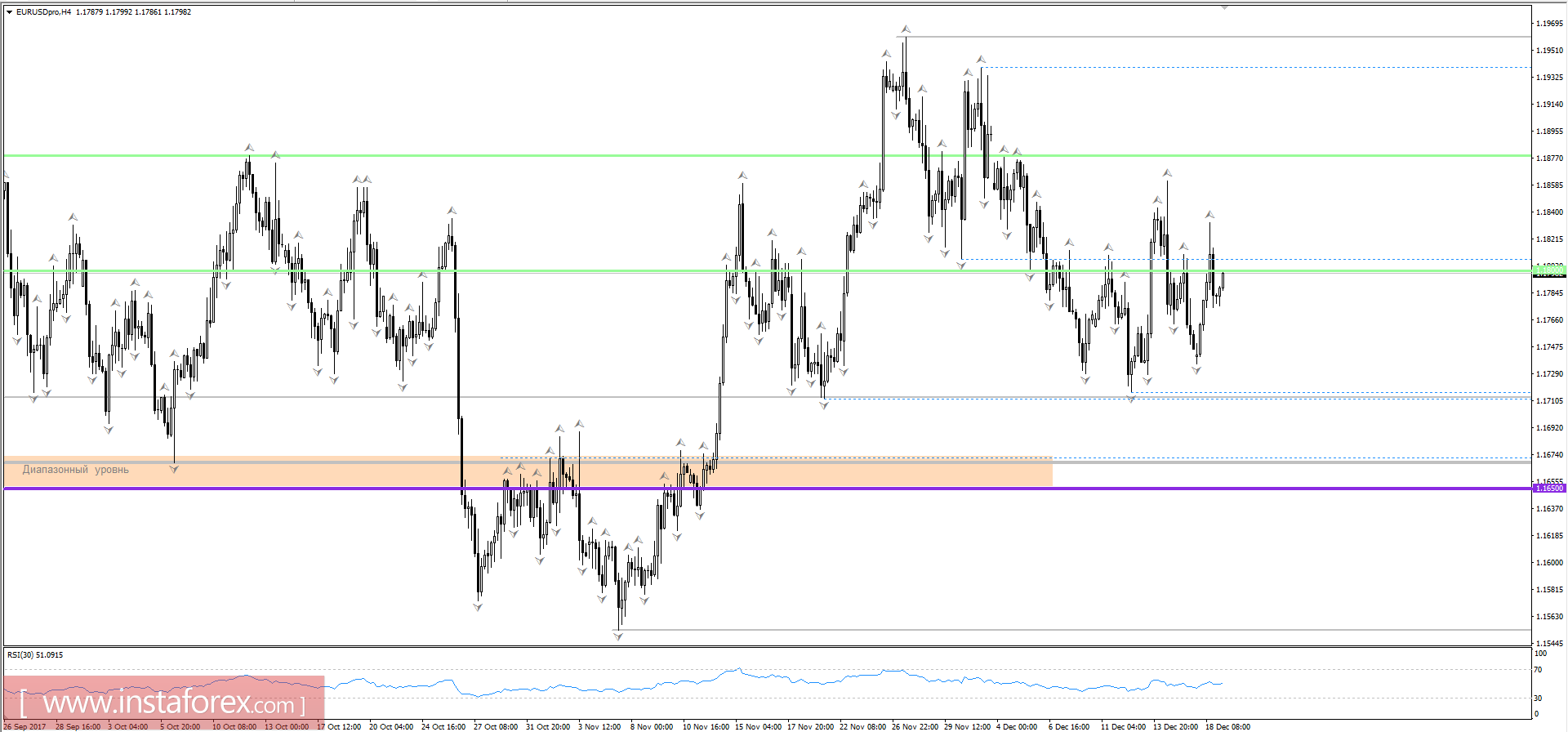

The EUR/USD pair will decline to 1.1800.

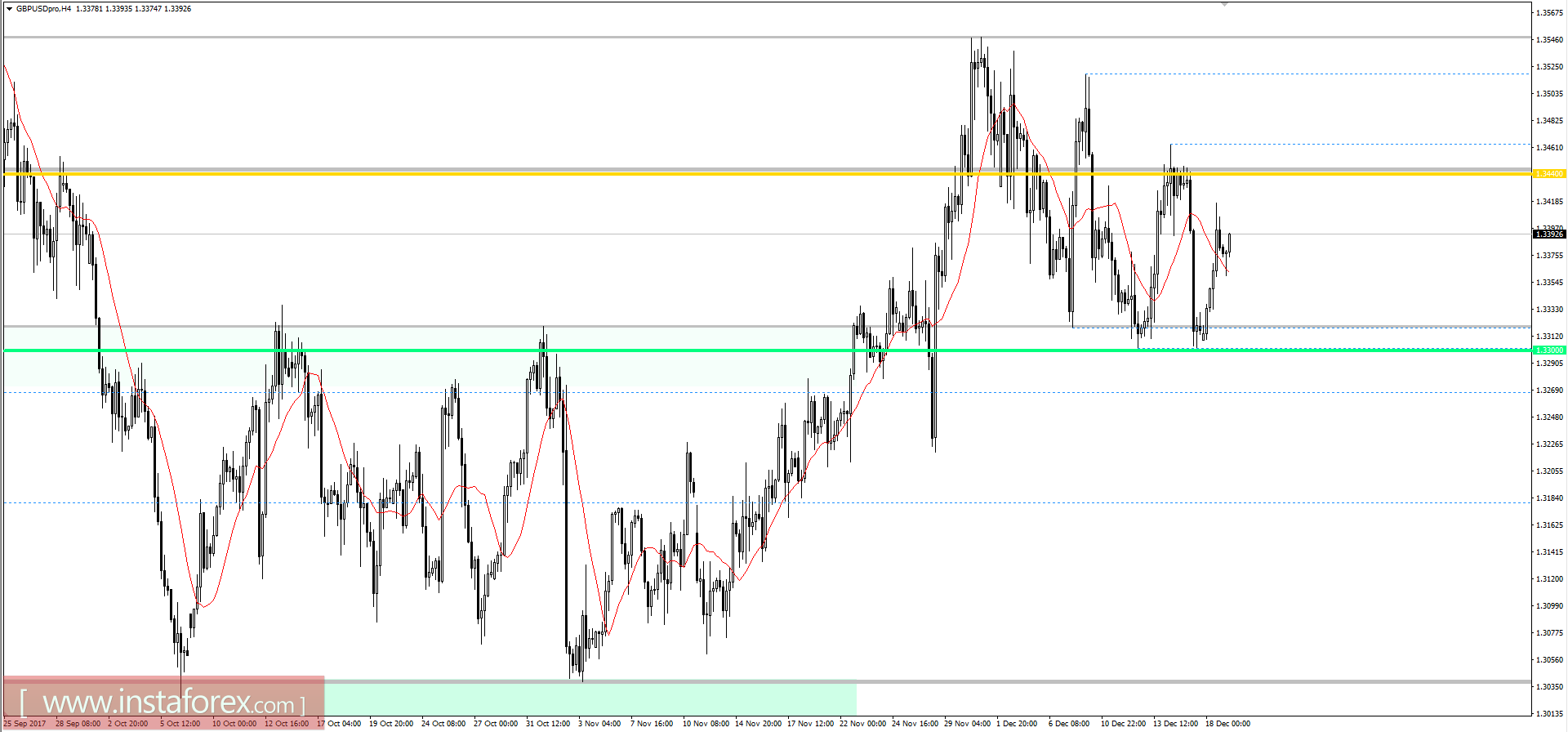

The GBP/USD pair will fall to 1.3350.