EUR / USD

To open long positions on EURUSD, it is required:

The growth of the euro will directly depend on the false breakdown of the level of 1.1827, the formation of which can be expected to break and consolidate above 1.1850, which opens a good opportunity to update the weekly highs in the 1.1875 and 1.1900 areas, where it is recommended to lock in profits. In case of a decline in the euro in the morning under the level of 1.1827, it is best to go back to long positions in the area of 1.1806 or to rebound from 1.1777.

To open short positions on EURUSD, it is required:

Only the consolidation below 1.1827 will lead to the formation of pressure on the euro and the renewal of support at 1.1806. The main goal in the first half of the day for short positions will be the test at 1.1777, where it is recommended to lock in profits. In case of growth above 1.1850, it is best to postpone sales until 1.1875 is upgraded, or immediately on a rebound of 1.1900.

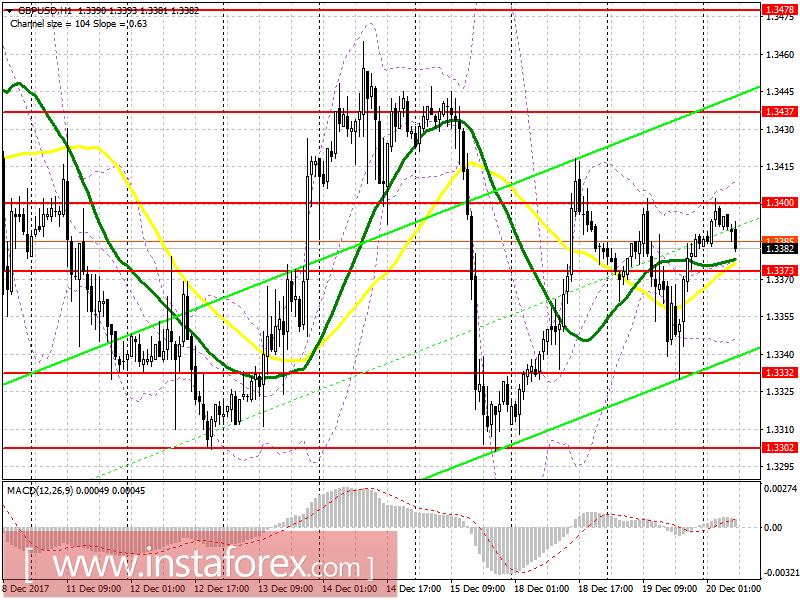

GBP / USD

To open long positions on GBPUSD, it is required:

The formation of a false breakout at 1.3373 or consolidation at 1.3400 would be a good signal to increase long positions in the pound with an exit to a new weekly resistance around 1.3437, where it is recommended to lock in profits. If the pound is lowered at 1.3373, consider opening long positions on a rebound from 1.3332.

To open short positions on GBPUSD, it is required:

The break and consolidation below the level of 1.3373 will form a new wave of pressure on the British pound, which will lead to larger sales with an update of 1.3332. The main target of the exit is at 1.3302, where it is recommended to lock in profits. In case of growth above 1.3400, it is best to go back to selling the pound on a rebound from 1.3437.

Indicator description

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20