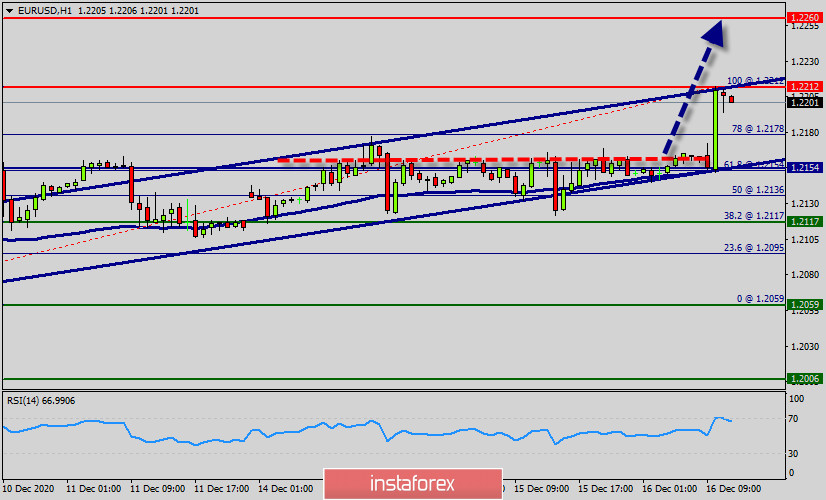

- Pivot : 1.2154.

The EURUSD pair, after the attempt to move to recent highs hit the 1.2212 and retraced back around the spot of 1.2190. The price is after the move in a descending channel is now moving in an ascending one.

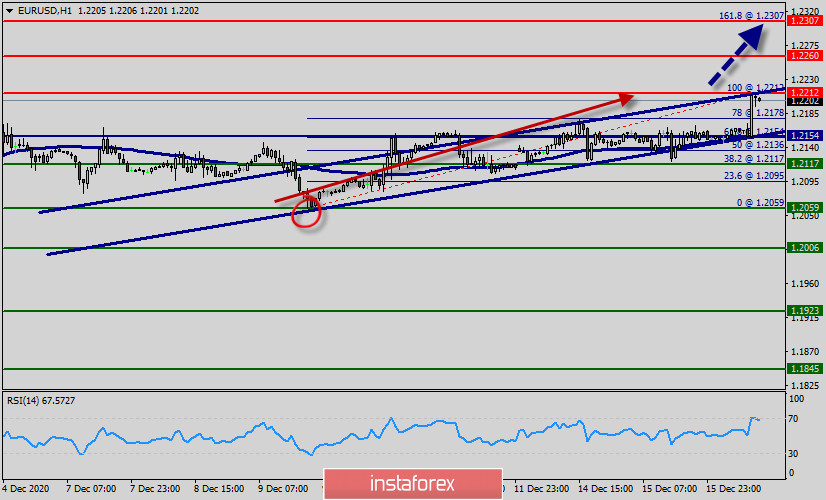

The EUR/USD pair leaps above the level of 1.2154, highest since April 2018, amid growing market optimism.

On the one-hour chart, the EUR/USD pair continues moving in a bullish trend from the support levels of 1.2117 and 1.2154. Currently, the price is in a bullish channel.

This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. As the price is still above the moving average (100), immediate support is seen at 1.2154, which coincides with a golden ratio (61.8% of Fibonacci).

Consequently, the first support is set at the level of 1.2154. So, the market is likely to show signs of a bullish trend around the spot of 1.2154.

In other words, buy orders are recommended above the golden ratio (1.2154) with the first target at the level of 1.2212 ( we should see the pair climbing towards the double top (1.0255) to test it.).

Further rally could be seen to cluster resistance at 1.0255 next, (100% retracement, high price (top)). This will remain the favored case as long as 1.2154 support holds.

Furthermore, if the trend is able to breakout through the first resistance level of 1.2212.

So it will be good to buy at 1.2212 with the second target of 1.2260. It will also call for an uptrend in order to continue towards 1.2307. The daily strong resistance is seen at 1.2307.

Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

The EUR/USD pair is still staying in strengthening from 1.2154 and intraday bias remains bullish. In case of another retreat, downside should be be contained by 1.2154 support to bring another rise.

It would also be wise to consider where to place a stop loss; this should be set below the second support of 1.2117.

Forecast :

Uptrend scenario :

An uptrend will start as soon, as the market rises above support level of level 1.2154, which will be followed by moving up to resistance level 1.2221. The movement is likely to resume to the point 1.2260 and further to the point 1.2307. Otherwise, the price spot of 1.2307 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.2307 is not breached.