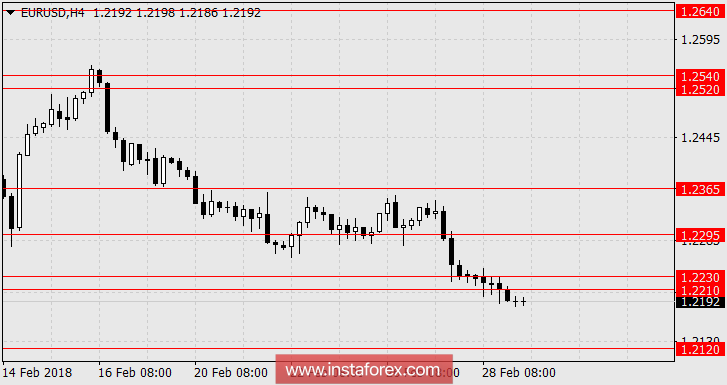

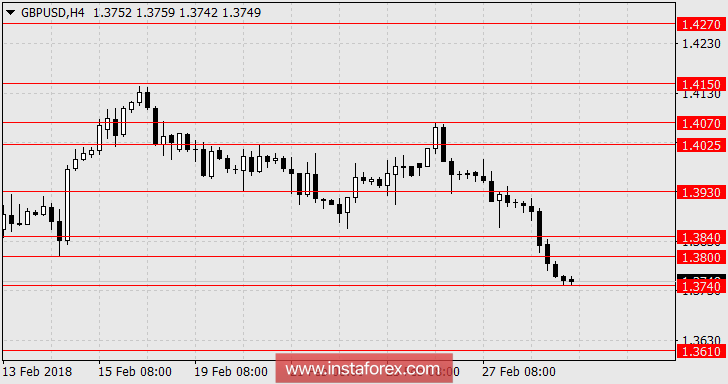

EUR / USD, GBP / USD.

The passive decline of counter dollar currencies continued on Wednesday after the optimistic speech of Jerome Powell in Congress on Tuesday, which allegedly showed the outlook of the fourfold rate hike. And, this idea began to develop in the media despite the fact that most FOMC members directly expressed for a maximum threefold increase earlier this week. In the earlier month, the beginning of the dollar's growth is linked with the hypothetical timeline when the Fed and the government will prepare a corresponding plan, and the events yesterday indicates that this plan has been prepared and started to be implemented (/en/analysis/19904 ...). Trading volumes were above average, along with the dollar's growth, while most of the markets were quoted in dollars. Oil lost 1.76%, copper -1.49%, lead -2.67%, meat futures lost from 0.62% to 3.67%. Apparently, the US monetary authorities did not wait for more favorable conditions, but developed only the existing ones, such as the elections in Italy, the slippage of the UK-EU negotiating process, and the traditional spring economic growth in the US. But the economic data of yesterday implied a little disappointment. The second assessment of the US GDP was lowered from 2.6% to 2.5%, as expected. The business activity index in the manufacturing sector of the Chicago region fell from 65.7 to 61.9, incomplete sales in the real estate market in January decreased by 4.7% against expectations of growth of 0.4%. Moderate-negative indicators also emerged in the euro area. The consumer price index in February fell from 1.3% YoY to 1.2% YoY, and the basic CPI remained at 1.0% YoY. The GfK's consumer climate index in Germany for the month of March decreased from 11.0 to 10.8 points.

Today, the final estimates of the production PMI for Germany and the February estimate in the euro area will be released, with the forecast remained unchanged at 60.3 for Germany and 58.5 for the euro area. The January assessment of unemployment rate in the euro area is expected to decrease from 8.7% to 8.6%.

In the United Kingdom, Manufacturing PMI for February could show a decline to 55.1 from 55.3. The number of issued permits for mortgage lending in January is expected at 62 thousand against 61 thousand previously, the volume of new loans for individuals is expected to increase to 5.4 billion pounds from 5.2 billion in December. The formal balance of the British current data is shifting towards the negative direction due to the draft agreement of the European Commission on Brexit. This erases the border with Ireland and stops the access of Britain to the single market. According to the publication of this project, the pound lost about 150 points on Wednesday.

In the United States, personal income of consumers for January is projected to grow by 0.3%, while consumer spending may increase to 0.2%. Construction costs of the same period are expected to increase by 0.3% versus 0.7% in December. The ISM Manufacturing PMI index is expected to fall for the current month, with the forecast at 58.7 versus 59.1 in January. The final estimate of Manufacturing PMI from Markit for the month of February is expected to be unchanged at 55.9 points.

Therefore, we expect a gap on risk correlations in the market. Currently, the growth of stock indices and the dollar will be strengthened. Also, the continuous fall of the stock market could show a possible scenario on increasing scale of risk avoidance and a large-scale transfer of investors to dollars. But this scenario is not the nearly possible, as the current situation shows the stock markets have not yet received a strong signal to decline. Meanwhile, we are expecting the euro at 1.2120, and the pound sterling is at 1.3610.

* The presented market analysis is informative and does not constitute a guide to the transaction.