USD / JPY.

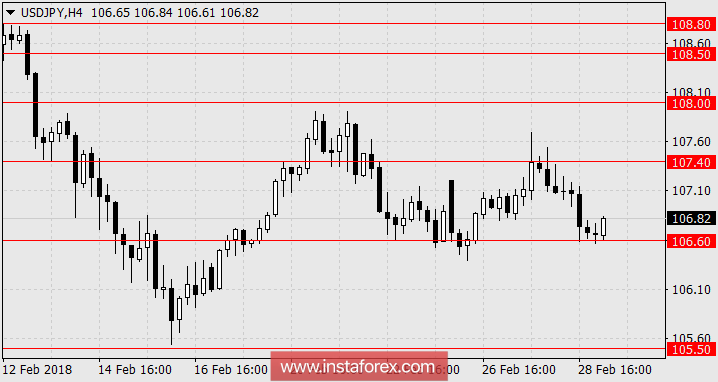

The Japanese yen continues to hold in the range of 106.60-107.40 in the last five sessions. The drop of the American Dow Jones was 1.50% and the Nikkei225 was declined today by 1.44%. The pessimistic economic data of Japan does not negatively affect the Japanese yen. Yesterday, the USD / JPY currency pair decreased by 64 points, while it grows slightly today.

The industrial production in January estimate showed a 6.6% drop yesterday. Retail sales on an annualized basis for the same month fell from 3.6% to 1.6%. The volume of new houses construction collapsed from -2.1% YoY to -13.2% YoY which is the largest monthly decline since December 2014. The growth was shown by fixed assets of capital investments during the fourth quarter, indicating an increase from 4.1% YoY to 4.3% YoY with the expectation of a fall to 3.1% YoY. The production PMI for February increased slightly by - 54.1 to 54.0 in January.

We are expecting for the recovery of the stock market growth and followed by the growth of the yen to the 108.00 level.

* The presented market analysis is informative and does not constitute a guide to the transaction.