GBP / USD

On Monday, the British pound was able to gain 48 points. UK Prime Minister Theresa May unexpectedly agreed within the framework of trade agreements under the transitional period from the EU to abandon the rigid border between Ireland and Northern Ireland. Currently, her statements about the impulsive resolution of the remaining differences do not appear to an ineffective speech. As of this writing, England is predicted to undergo a more intense flow of goods between the United States and Europe during the period of trade wars rather than holding out the UK's position in the EU. Also, there are projections that the reformation of the NAFTA agreement by Trump should be viewed through the integration of the new association and the UK. Because this will serve as a long-term factor in strengthening the dollar. Therefore, the United Kingdom will rise again in the renewed globalization project. However, this long-term perspective, as the current situation shows the pound is at the level in February 2016 and there were still five months for the Brexit referendum. Hence, this places the pound to the normalized response with respect to the dollar.

The business activity index in the UK service sector over the past month showed an increase of 54.5 from 53.0, with the expectation of a more modest growth to 53.3. The data supported the overall positive for the pound.

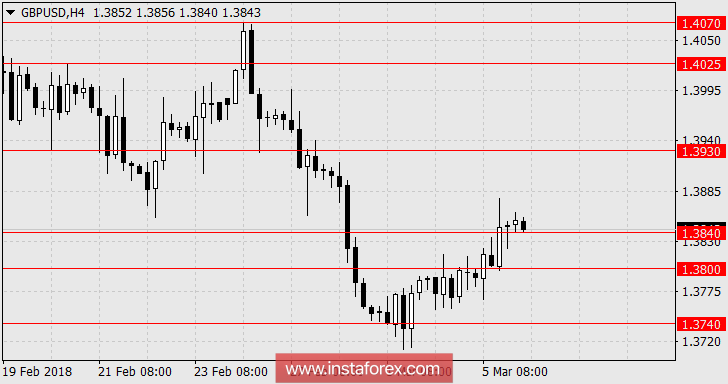

If the market will not be significant in the strengthening of the US dollar, the British pound is possible to increase to 1.3930 until Friday, upon the released of US labor data. The expectations for these data are optimistic and the dollar may turn to a more decisive strengthening. If there is no massive growth of the dollar, the main scenario that we can see is the potential decline of the GBP / USD currency pair to 1.3740.

* The presented market analysis is informative and does not constitute a guide to the transaction.