EUR / USD

Along with other major currencies, the dollar index closed at the opening level on Monday, which did not show any changes. On the back of this, the single European currency increased by 18 points, which is contrary to the political and economic events in Europe. Despite the populist statements of the winning parties in Italy regarding the exit from the European Union, there is no political party that could bring matters to the referendum. This is because Italy is strongly integrated into this union. This issue can only be used to blackmail the Brussels, but the latter already has wide experience of opposition. The main problem is the formation of the government which will be a negative background for the euro. Similarly, investors executed the statement of US President Trump about the introduction of duties towards the import of metal, with a small purchase of the euro and the logic of events should be considered sold. Specifically, the Canadian dollar continued to weaken and for the day CAD lost (on the chart rose) 84 points.

European investors even ignored the weak economic data. The final assessment of the business activity index in the service sector of the euro area for February was lowered from 56.7 to 56.2 points. While the investor confidence index in the eurozone Sentix for March fell from 31.9 to 24.0. Retail sales in the euro area fell by 0.1% against expectations of growth of 0.3%.

The US indices were slightly better than forecasts. ISM Non-Manufacturing PMI in February estimate was 59.5 against expectations of 58.9, although the previous indicator would be slightly higher by 59.9. The final evaluation of Services PMI from Markit remained at 55.9. The US stock market grew by 1.10% (S & P500) and based on opinions, it objectively corresponds more to political realities. If not mistaken, the fall of the euro should be expected in the near future.

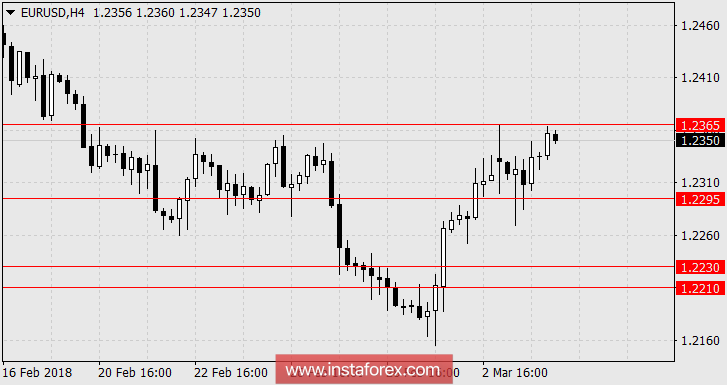

Today, the volume of industrial orders for January will come out - the forecast is -0.4% against the growth of 1.7% in the previous month. On the current background of optimistic sentiment for investors, data can be ignored. We are waiting for the euro to return to the range of 1.2210 / 30.

* The presented market analysis is informative and does not constitute a guide to the transaction.