EUR / USD pair

As a result, the euro added 67 points in spite of the local risk aversion on Tuesday. Yields on the main US bonds fell 5-year-olds from 2.642% to 2.61% while 10-year bonds from 2.881% to 2.846%. Stock indexes closed with insignificant growth and gold rose by 1.14%. Moreover, avoidance of risk took place on formal mitigation of foreign policy risks. The U.S. Treasury Secretary S. Mnuchin said that higher metal tariffs would not apply to Canada and Mexico, if they agreed to reform the NAFTA agreement. Thus, it can be assumed that a far-reaching strategy of the White House trade war is beginning to be justified. In fact, this additional indication of markets for dollar purchases. A strong demonstrative foreign policy of the United States is gaining momentum but can not be based on a weak dollar. Inside the team of Donald Trump is not all smooth as the senior economic adviser to the president on the economy Gary Cohn resigns because of disagreement with protectionist policies. However, this is not the first case of a demonstrative departure of the "infidels" from the hastily formed Trump team, and these cases testify to the strength of the establishment in the foreign policy department.

North Korea's statement agreed to a moratorium on nuclear tests and was ready to start negotiations with the United States, which is a good news. The euro on this news has also grown .

Macroeconomic statistics provided little support for the euro. Business activity in the retail sector of the eurozone (Retail PMI) rose from 50.8 to 52.3 in February. The estimate on volume of industrial orders in the US decreased by 1.4% in January against the forecast of -1.3% and growth of 1.8% in December.

Today, the GDP of the euro area will be released for the 1st quarter in the 2nd assessment, the forecast is unchanged at 0.6%. Trade balance of France could get worse from -3.5 billion euros to -4.4 billion euros in January. In the US, it is expected that new jobs in the private sector will grow in the area of 195-199,000 in February after 234,000 in January. The U.S. trade balance may worsen from -53.1 billion dollars in January to -55.1 billion. A positive factor may be the growth of labor costs in the 4th quarter with the forecast of 2.1% against 2.0% in the previous period.

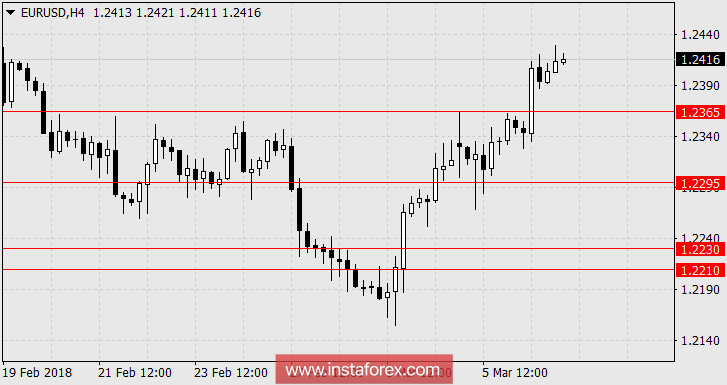

Similarly, we are waiting for the decline in the euro with a target of 1.2295, then the range will be found in the area of 1.2210 / 30.