Dear colleagues.

For the EUR / USD pair, the price forms a downward structure from March 7. For the GBP / USD pair, the development of the upward structure from March 1 is expected after the breakdown of 1.3896. For the USD / CHF pair, we continue to follow the upward cycle of March 2. For the USD / JPY pair, we follow the upward structure from March 2. The continuation to the top is expected after the breakdown of 106.91. For the of EUR / JPY pair, we follow the formation of the upward structure of March 5. The development of this level is expected after the breakdown of the level of 132.41. For the GBP / JPY pair, we follow the upward structure of March 2. The development of this level is expected after the breakdown of 149.10.

Forecast for March 12:

Analytical review of currency pairs in the scale of H1:

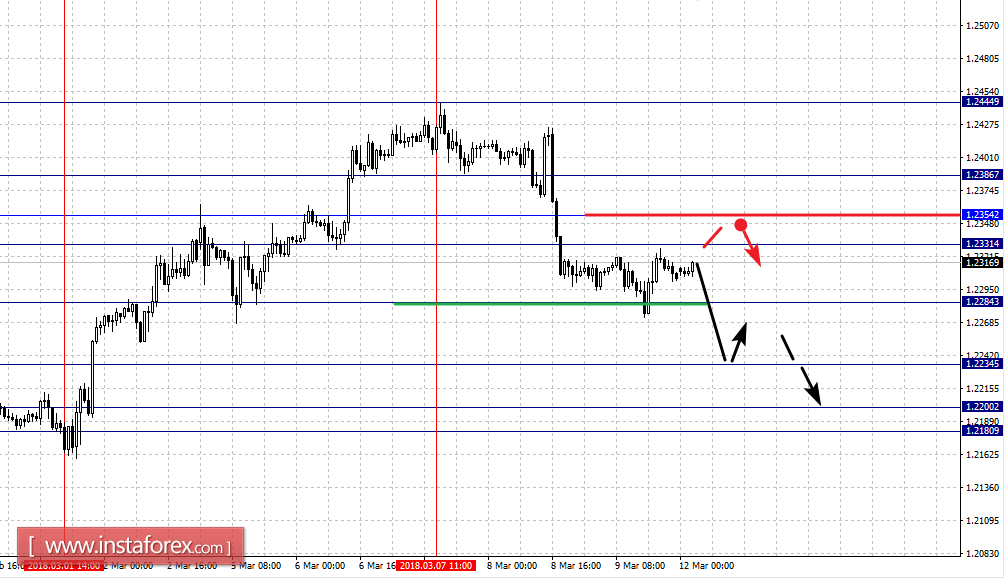

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2386, 1.2354, 1.2331, 1.2284, 1.2234, 1.2200 and 1.2180. Here, the price forms the potential for a downward movement from March 7. The continuation of the movement towards the bottom is expected after the breakdown of 1.2284. In this case, the target is 1.2234. Near this level is the consolidation of the price. For the potential value for the bottom, we consider the level of 1.2180. Upon reaching this level, we expect consolidated movement in the area of 1.2200 - 1.2180.

Short-term upward movement is expected in the area of 1.2331 - 1.2354. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2386. This level is the key support for the downward structure. Passing the price will allow us to count on the movement towards the first potential target of 1.2449.

The main trend is the upward cycle from March 1 and the formation of the downward movement is from March 7.

Trading recommendations:

Buy: 1.2331 Take profit: 1.2352

Buy 1.2356 Take profit: 1.2384

Sell: 1.2282 Take profit: 1.2236

Sell: 1.2232 Take profit: 1.2205

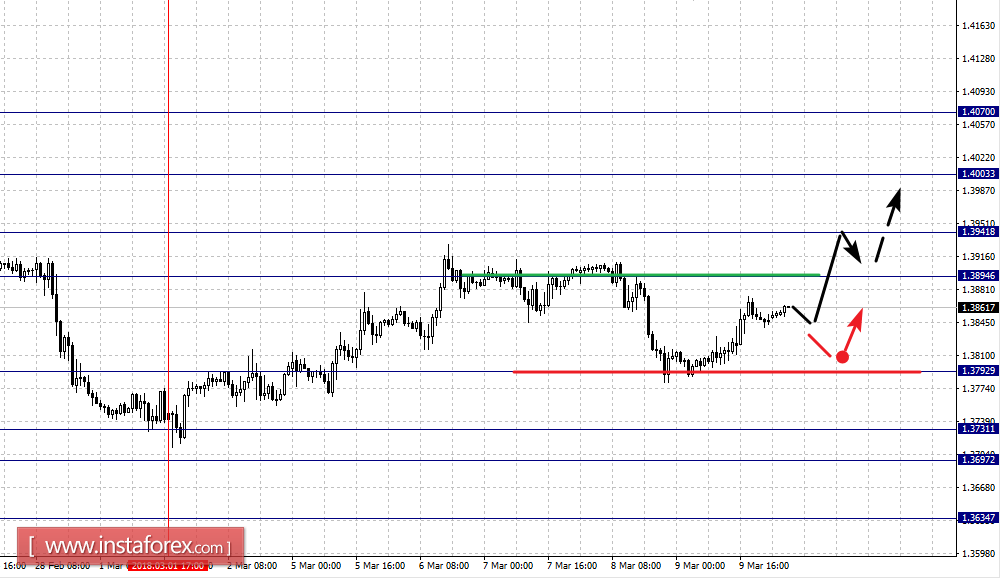

For the GBP / USD pair, the key levels on the scale of H1 are 1.4070, 1.4003, 1.3941, 1.3894, 1.3731, 1.3697, 1.3634 and 1.3583. Here, the situation has entered the equilibrium state: a downward structure from February 26 and an upward structure from March 1. In the range of 1.3894 - 1.3941, we expect short-term upward movement. The breakdown at 1.3941 will lead to the development of an upward trend to the level of 1.4003. For the potential value for the top, we consider the level of 1.4070.

The continuation of the movement towards the bottom is possible after the breakdown of 1.3792. In this case, the first target is 1.3731. In the area of 1.3731 - 1.3697 is the consolidation of the price. The potential value for the downward movement is the level of 1.3634.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3944 Take profit: 1.4000

Buy: 1.4005 Take profit: 1.4070

Sell: 1.3790 Take profit: 1.3740

Sell: 1.3695 Take profit: 1.3650

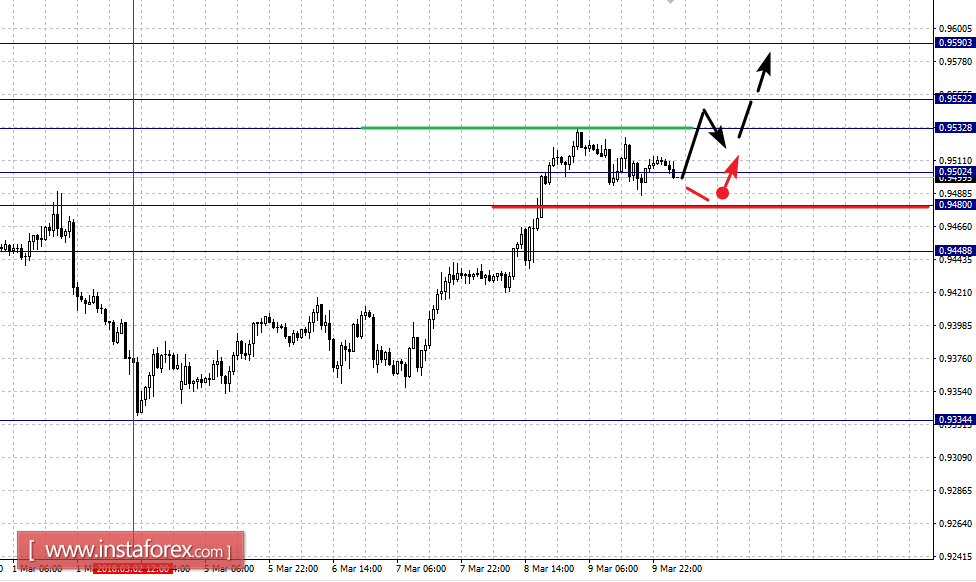

For the of USD / CHF pair, the key levels in the scale of H1 are: 0.9590, 0.9552, 0.9532, 0.9502, 0.9480 and 0.9448. Here, we follow the development of the upward cycle of March 2. Short-term upward movement is expected in the area of 0.9532 - 0.9552. The breakdown of the last value will allow us to count on the movement towards the potential target of 0.9590. From this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.9502 - 0.9480. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9448. This level is the key support for the top.

The main trend is the upward cycle of March 2.

Trading recommendations:

Buy: 0.9532 Take profit: 0.9550

Buy: 0.9554 Take profit: 0.9590

Sell: 0.9500 Take profit: 0.9485

Sell: 0.9478 Take profit: 0.9455

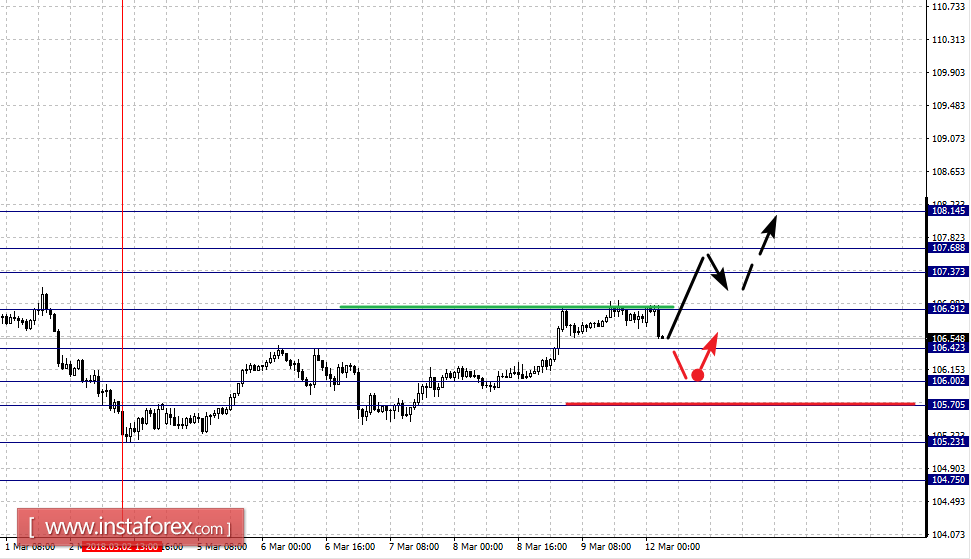

For the USD / JPY pair, the key levels on a scale are: 108.14, 107.68, 107.37, 106.91, 106.42, 106.00, 105.70 and 105.23. Here, we follow the upward structure of March 2. The continuation of the movement towards the top is expected after the breakdown of 106.91. In this case, the target is 107.37. In the area of 107.37 - 107.68 is the consolidation of the price. For the potential value for the top, consider the level of 108.14. Upon reaching this level, we expect a rollback to the bottom.

Going into correction is expected after the breakdown of 106.42. In this case, the target is 106.00. The range of 106.00 - 105.70 is the key support for the upward structure. Passing the price will lead to the development of the downward movement. In this case, the first target is 105.23.

The main trend is the upward structure of March 2.

Trading recommendations:

Buy: 106.92 Take profit: 107.35

Buy: 107.70 Take profit: 108.12

Sell: 106.40 Take profit: 106.05

Sell: 105.70 Take profit: 105.2

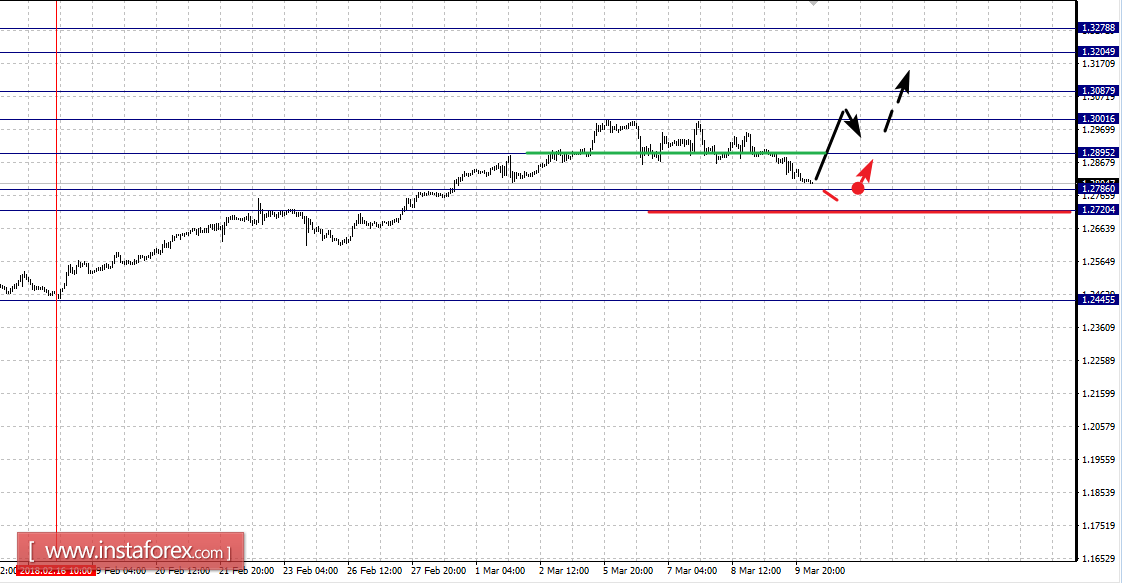

For the CAD / USD pair, the key levels at the H1 scale are: 1.3278, 1.3204, 1.3087, 1.3001, 1.2895, 1.2786 and 1.2720. Here, we continue to follow the upward structure of February 16. The continuation of the movement towards the top is expected after the breakdown of 1.2895. In this case, the first target is 1.3001. In the area of 1.3001 - 1.3087 is the consolidation of the price. For the potential value for the top, consider the level of 1.3204. Upon reaching this level, we expect consolidation in the area of 1.3204 - 1.3278, as well as a pullback to the bottom.

The range of 1.2786 - 1.2720 is the key support for the upward structure. Passing the price will lead to the formation of initial conditions for the downward cycle. However, we do not establish specific goals here.

The main trend is the upward structure from February 1, the correction stage.

Trading recommendations:

Buy: 1.2895 Take profit: 1.3000

Buy: 1.3001 Take profit: 1.3085

Sell: 1.2786 Take profit: 1.2722

Sell: Take profit:

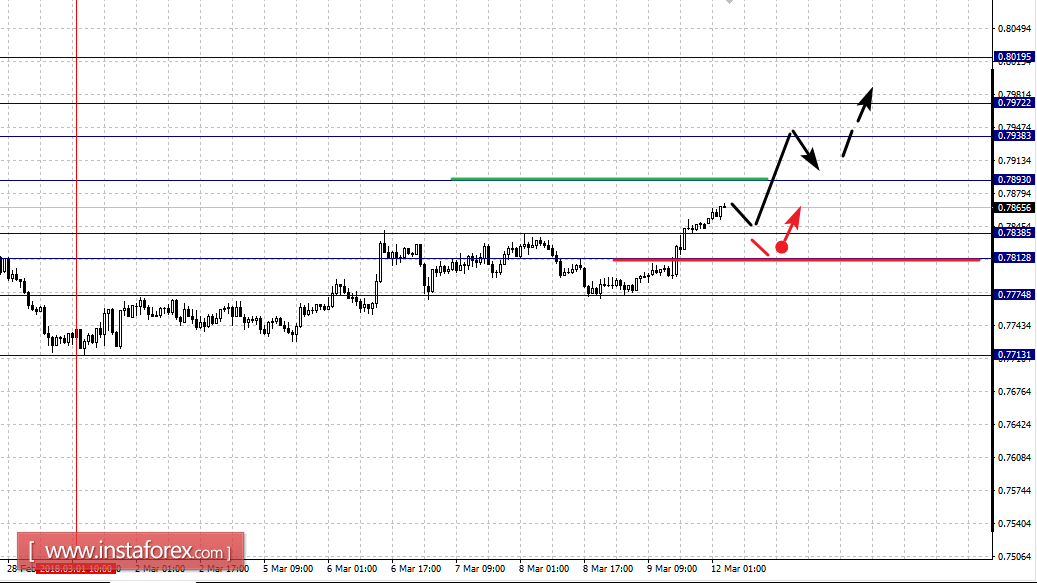

For the AUD / USD pair, the key levels on the scale of H1 are: 0.8019, 0.7972, 0.7938, 0.7893, 0.7838, 0.7812 and 0.7748. Here, we follow the development of the upward structure of March 1. The continuation of the movement towards the top is expected after the breakdown of 0.7893. In this case, the target is 0.7938. In the area of 0.7938 - 0.7972 is the consolidation of the price. For the potential value for the upward trend, we consider the level of 0.8019. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.7838 - 0.7812. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7774. This level is the key support for the top.

The main trend is the upward structure of March 1.

Trading recommendations:

Buy: 0.7895 Take profit: 0.7935

Buy: 0.7940 Take profit: 0.7970

Sell: 0.7838 Take profit: 0.7812

Sell: 0.7810 Take profit: 0.7776

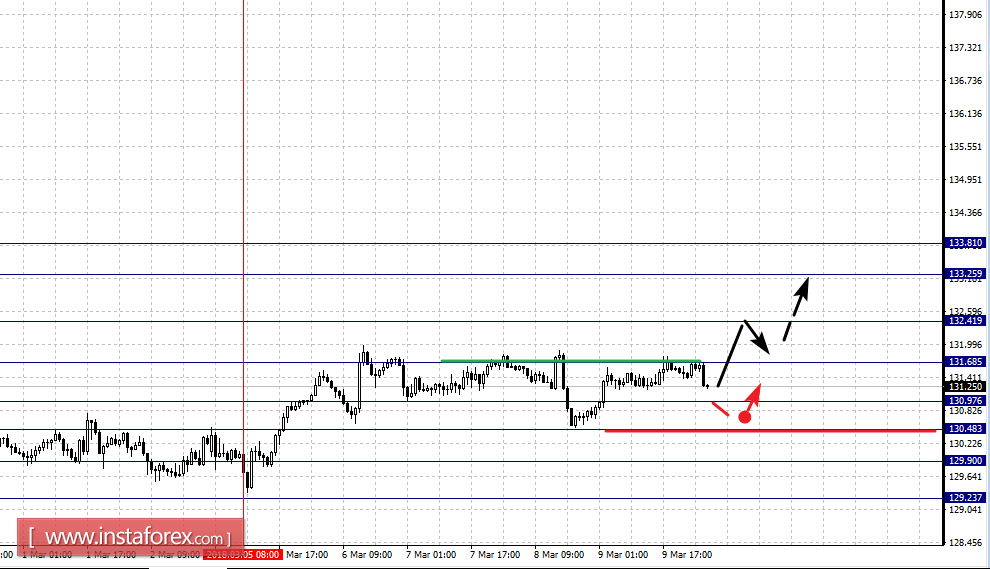

For the of EUR / JPY, the key levels on the scale of H1 are: 133.81, 133.25, 132.41, 131.68, 130.97, 130.48, 129.90 and 129.23. Here, we follow the formation of the upward structure of March 5. The continuation of the movement towards the top is expected after the breakdown of 131.68. In this case, the target is 132.41. Near this level is the consolidation of the price. The breakdown at the level of 131.41 should be accompanied by a pronounced upward movement. Here, the target is 133.25. For the potential value for the top, consider the level of 133.81. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 130.97 - 130.48. The breakdown of the last value will lead to in-depth correction. Here, the target is 129.90. This level is the key support for the top of March 5.

The main trend is the formation of the upward structure of March 5.

Trading recommendations:

Buy: 131.70 Take profit: 132.40

Buy: 132.50 Take profit: 133.25

Sell: 130.95 Take profit: 130.50

Sell: 130.44 Take profit: 129.95

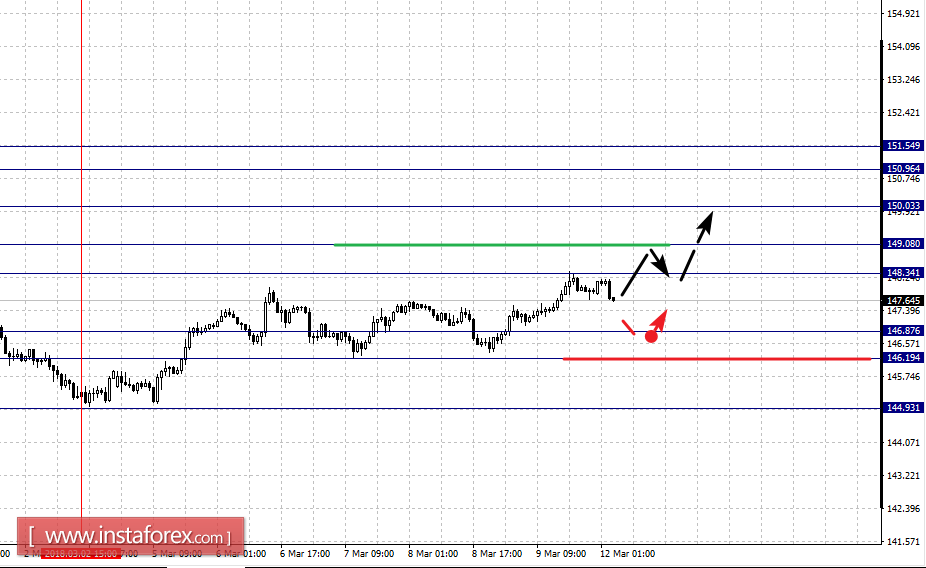

For the GBP / JPY pair, the key levels on the scale of H1 are: 151.54, 150.96, 150.03, 149.08, 148.34, 146.87, 146.19 and 144.93. Here, we follow the upward structure of March 2. Short-term movement towards the top is expected in the area of 148.34 - 149.08. The breakdown of the last value will lead to a movement towards the level of 150.03. Near this level is the consolidation of the price. For the potential value for the top, consider the level of 151.54. From this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 146.87 - 146.19. The breakdown of the last value will lead to the development of the downward movement. In this case, the target is 144.93. Up to this level, we expect the formalized initial conditions for the downward cycle.

The main trend is the upward structure of March 2.

Trading recommendations:

Buy: 148.36 Take profit: 149.05

Buy: 149.10 Take profit: 150.00

Sell: 146.85 Take profit: 146.20

Sell: 146.15 Take profit: 145.00