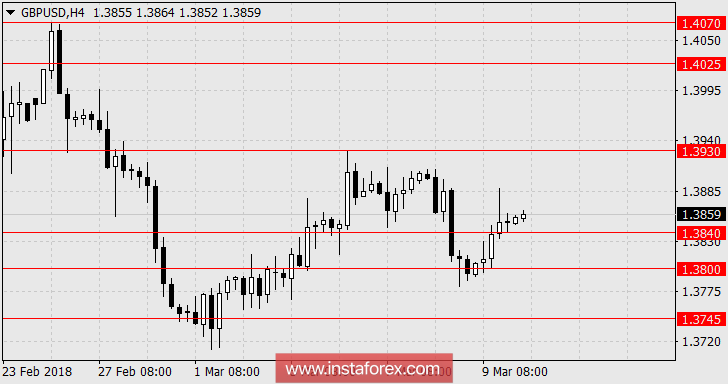

GBP / USD

The British pound safely ignored the Friday's weak economic data. The confusion of investors along with the release of strong employment data in the US helped the currency to gain a foothold in the growing position and further gained 40 points per day. The UK trade balance showed a downturn in January from -11.8 billion pounds to -12.3 billion. But the positive point is the upward revision of the previous December figure from -13.6 billion pounds. The UK GDP forecast from NIESR for February was 0.3% against 0.4% in January. Industrial production in January added 1.3% against the forecast of 1.5%. In December, Industrial Production was -1.3%, which showed zero growth. The volume of production in the construction sector in January shrank by 3.4% against the forecast of only -0.4%.

The UK macroeconomic calendar for the whole week is empty. Perhaps, a slight revival on Tuesday, when the draft budget will be published. In general, we are expecting for the strengthening of the dollar as a return to an adequate market response to US labor data and a new cycle of public debt placement.

We are expecting for the British pound at 1.3745.

* The presented market analysis is informative and does not constitute a guide to the transaction.