GBP / JPY

Senior timeframes

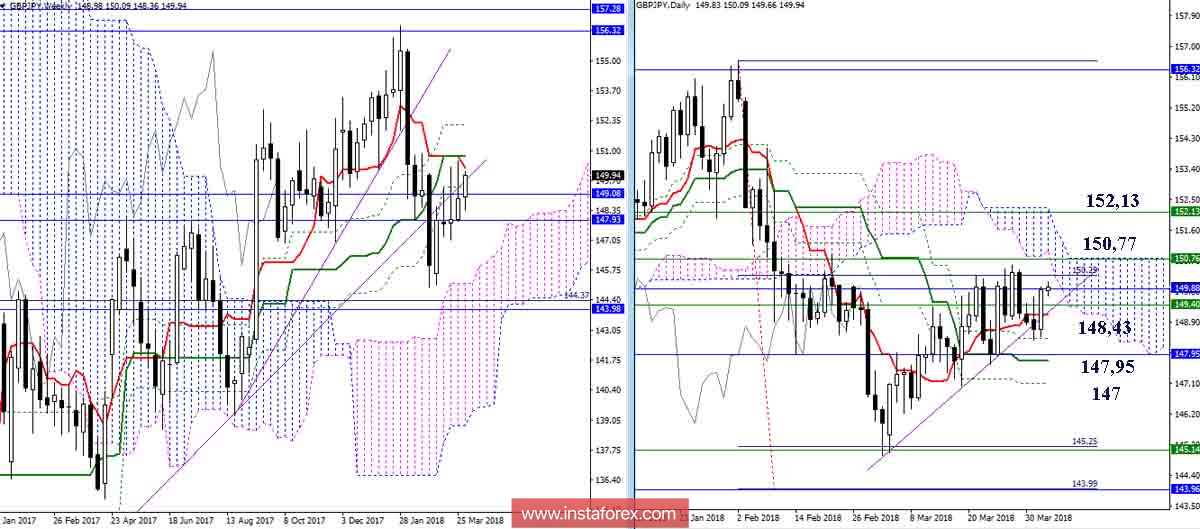

Again, the support of the day's cross (Fibo Kijun 148.43 + Tenkan 149.11) provoked a stop and the possible completion of another decline. To realize the potential for players to raise, it is now necessary to update the maximum extremum (150.57) and test the strength of the resistance of the weekly cross and the daytime cloud (150.77 - 152.13). Resistance is strong enough, several times in a row resulted in the formation of long upper shadows on the weekly candles, so the inability to overcome resistance and return to the support of the day's cross, and especially the securing below, can significantly change the current balance of power and restore bearish sentiment.

H4-H1

The players on the rise went beyond resistance and clouds, as a result, now support for the indicator Ichimoku almost completely, the case for Chinkou H4 and the gold cross H4, on the side of the bulls. The closest upward guidance is now the target for the breakdown of the H1 cloud, the maximum extremum (150.57) and the weekly Kijun (150.77). In the case of a downward correction, the most significant support zone today is the area of 149.07-40 (clouds H4 and H1 + high-time levels). The fastening under this zone will eliminate the existing advantages of the bulls and cancel their plans, after which a new assessment of the situation will be required.