The US dollar again loses its initiative and becomes cheaper throughout the market. Dollar bulls once again fail to consolidate their success, the USD index again looks for a level of 89 points, and the yield of 10-year bonds fell to 2.75%. The ADP report on the labor market situation is unlikely to radically change the situation, even if it goes better than forecasts: firstly, the market will wait for the release of the non-farms payroll data, and secondly - the macroeconomy has now fallen into the background against the backdrop of growing geopolitical tensions.

The most rapid increase in the price rate today is the New Zealand dollar. Paired with the American currency, it is selected for the 73rd figure, which it broke through more than three times this year. In general, the NZD/USD is growing due to the weakening of the greenback. However, the New Zealand dollar has its arguments for strengthening. Yesterday, another Global Dairy Trade auction took place on the cost of dairy products, which showed a less dramatic decline compared to previous results. This is quite enough to support the New Zealand dollar, and not only while paired with its American namesake. Paired with the Australian dollar, the New Zealander also significantly dominates, as Australia's currency is under the yoke of absolute pessimism (a decline in the commodity market amid the impending trade war between the US and China and the apathy of the RBA).

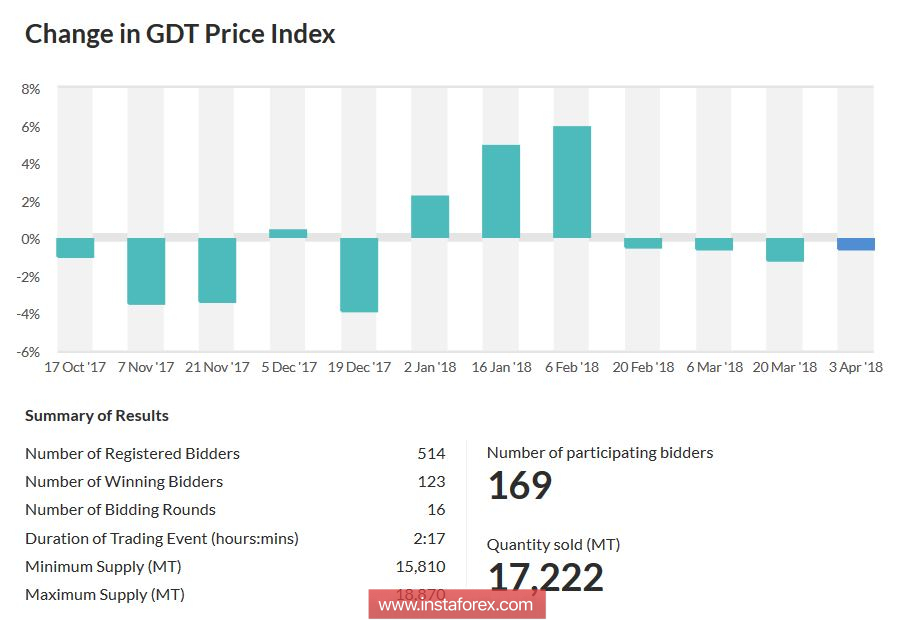

Here it is worth noting that dairy products for New Zealand plays a strategic, budget-forming role, therefore fluctuations in the price of "milk" affect the dynamics of the national currency. Low demand from China and Europe, overabundance of production, cost reduction - all these factors put pressure on the NZD/USD pair. Since the beginning of February, the price index for dairy products has been steadily declining, reaching the worst value last December from last December. Most experts predicted a further decline, so yesterday's data provided significant support to the New Zealand, despite the fact that the index remained in the negative area (-0.6%). This dynamics was due to a decline in prices for dehydrated milk fat and skimmed milk powder. However, prices for other stock products (dry whole milk, cheddar, casein, etc.) showed unexpected growth. Negative dynamics of the last three weeks was interrupted, and the bulls of the NZD/USD pair used this occasion for their revenge.

However, the main driver of the growth of the pair is the weakening US dollar. The trade war is gaining momentum, despite the negotiation process between the US and the PRC. China announced a list of possible countermeasures in response to the protectionism of Donald Trump, after which the greenback and other risk assets began to actively lose value.

After all, in the reciprocal list of Chinese people not only household chemicals, corn and soybeans, but also cars, tobacco products and even airplanes. In total, duties will affect more than one hundred kinds of goods imported from the United States for a total amount of about $ 50 billion. Literally the day before yesterday, the PRC ambassador in the States warned that his country is preparing "mirror measures", and today in the government of China published this list, however, with an open date of introduction. In other words, the parties "drew their blades" and every day the statement of the representatives of the United States and China only becomes tougher. And although last week the financial world hoped to reach a compromise (this factor was associated with the temporary growth of the dollar), today the chances for a peaceful outcome are becoming more vague.

In general, representatives of the Federal Reserve, which have the right to vote this year, have so far not changed the tone of their rhetoric, while remaining optimistic about the growth of the US economy. Almost all of the recent members of the regulator (Brainard, Mester, Harker, Bostic) hope for a further increase in inflation and do not focus on the actions of the White House in the sphere of foreign trade. However, the market independently prioritized its attention, so if the US-China relations continue to deteriorate, and the inflationary component of non-farms payroll outperform expectations, the dollar will continue to decline throughout the market - including when the currency is paired with the New Zealand dollar .

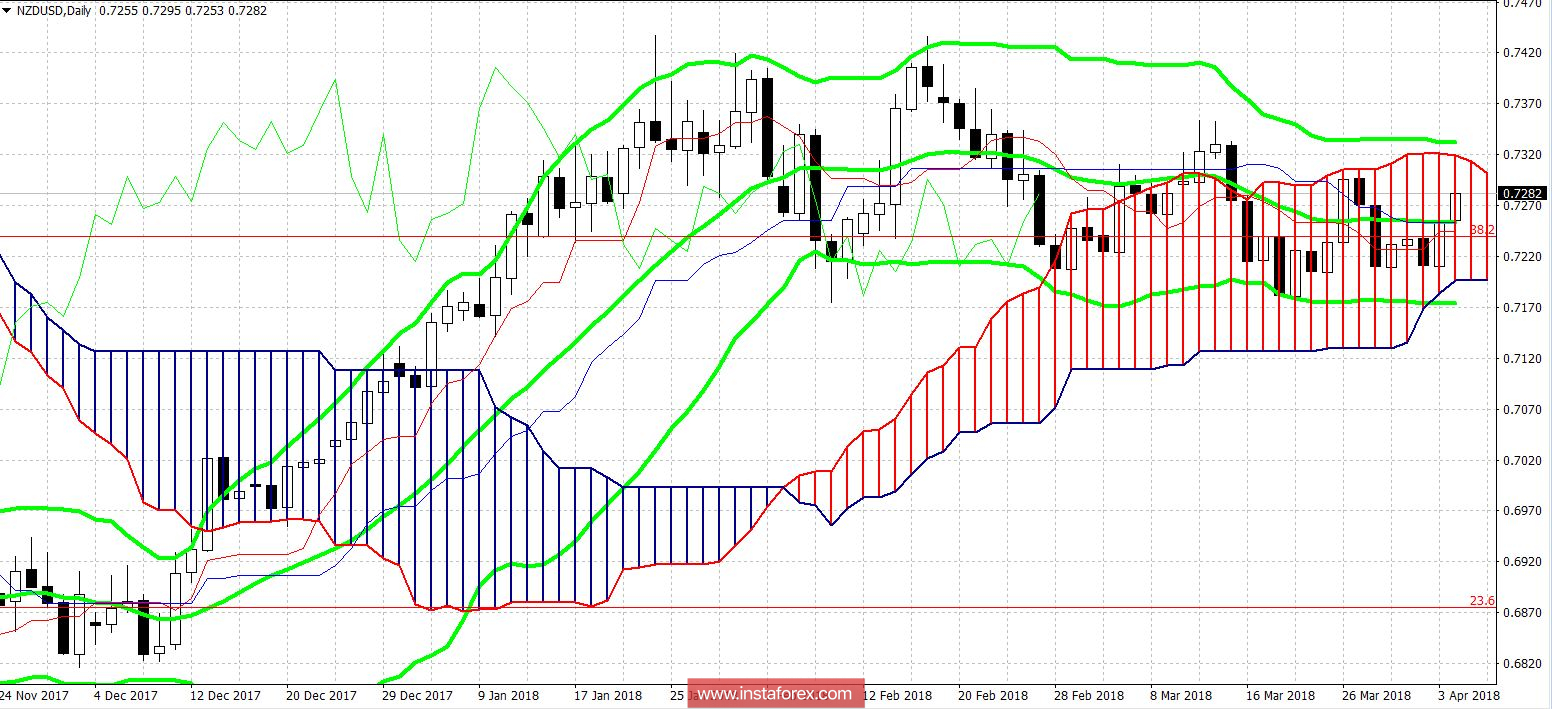

From the technical point of view, the situation is uncertain. So, on the daily chart, the NZD/USD pair is traded in the Kumo cloud of the Ichimoku Kinko Hyo indicator and on the midline of the Bollinger Bands indicator. This indicates the advantage of the flat movement, without a clearly expressed direction of price. At the same time, if the pair exceeds the 1.7301 mark and is fixed at the bottom of the 73rd figure, the upward trend will receive its confirmation. In this case, prices will come out of the cloud Kumo, and the indicator Ichimoku Kinko Hyo will form a bullish signal "Parade Line". The next upward target will be 0.7340 - this is the top line of the Bollinger Bands indicator on the daily chart. This scenario is very likely, if the Friday on-farms payroll data disappoint traders, and the US dollar will again fall under the wave of selling.