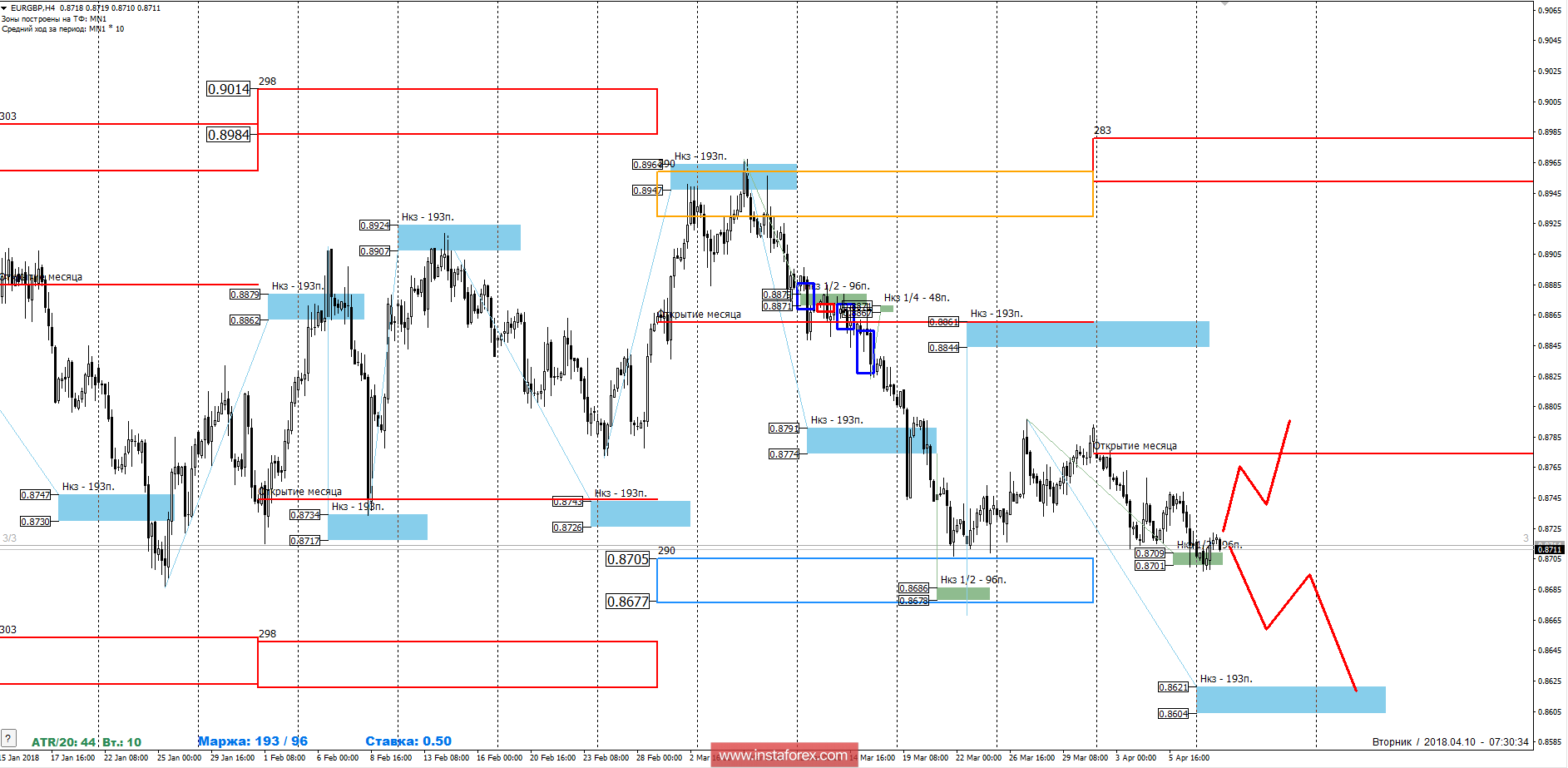

For the third week in a row, a medium-term accumulation zone is formed, the outflow of which will indicate a further priority. The close of trading last week suggests a high probability of continuing the flat.

Medium-term plan.

To continue the downward movement that started last week, you need to consolidate the pair below yesterday's low. This will allow us to consider the weekly short-term fault of 0.8621-0.8604 as a medium-term target. While there was no consolidation below the minimum, the probability of continuing accumulation is still high. The work from the borders of the flat comes to the fore. The pair is trading near the March low, which allows considering the partial fixation of medium-term sales, made after a retest of the weekly short-term fault of 0.8791-0.8774.

In determining the priority, it is necessary to focus on the control zones of the younger period, the test of which will allow to more accurately determine the moment of the change in dynamics and the beginning of a new impulse movement.

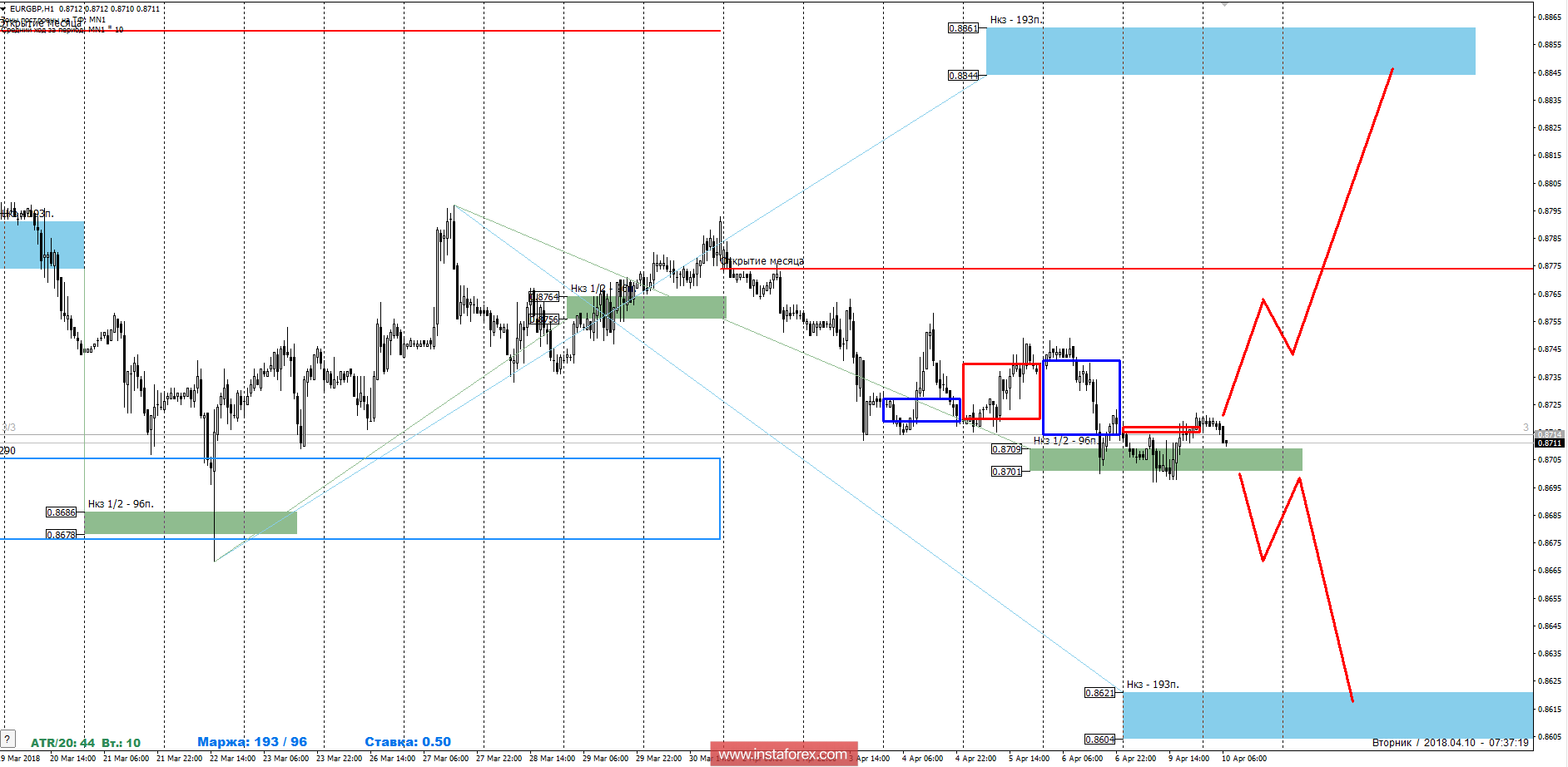

Intraday plan.

The fall of the pair was stopped by the NCP 1/2 0.8709-0.8701. While this zone is supporting, the upward movement remains a priority at the intraday level. In the formation of the reversal upward plan, purchases will be required, the first goal of which will be a weekly short-term fault of 0.8861-0.8844. The range of growth is large enough to make purchases profitable. To disrupt the upward structure, closing today's US session below the level of 0.8701 is required. If this happens, then sales will come to the fore, and the goal of the reduction will be a weekly short-term fault of 0.8621-0.8604.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.