Today, market dynamics will be determined only by US statistics, so no significant progress is expected until the afternoon. The main news will be the producer prices, whose growth rates may accelerate from 2.8% to 2.9%, and, given tomorrow's publication of inflation data, it should be a good support for the dollar. However, there is a possibility that investors will simply ignore all the inflation data, as the head of the Federal Reserve has already stated that an additional increase in the refinancing rate this year is not expected. In this case, the market can pay attention to data on commodity stocks in warehouses of wholesale trade, which should increase by 0.9%. This will mean that the reserves have been growing for nine consecutive months, which causes a lot of concern.

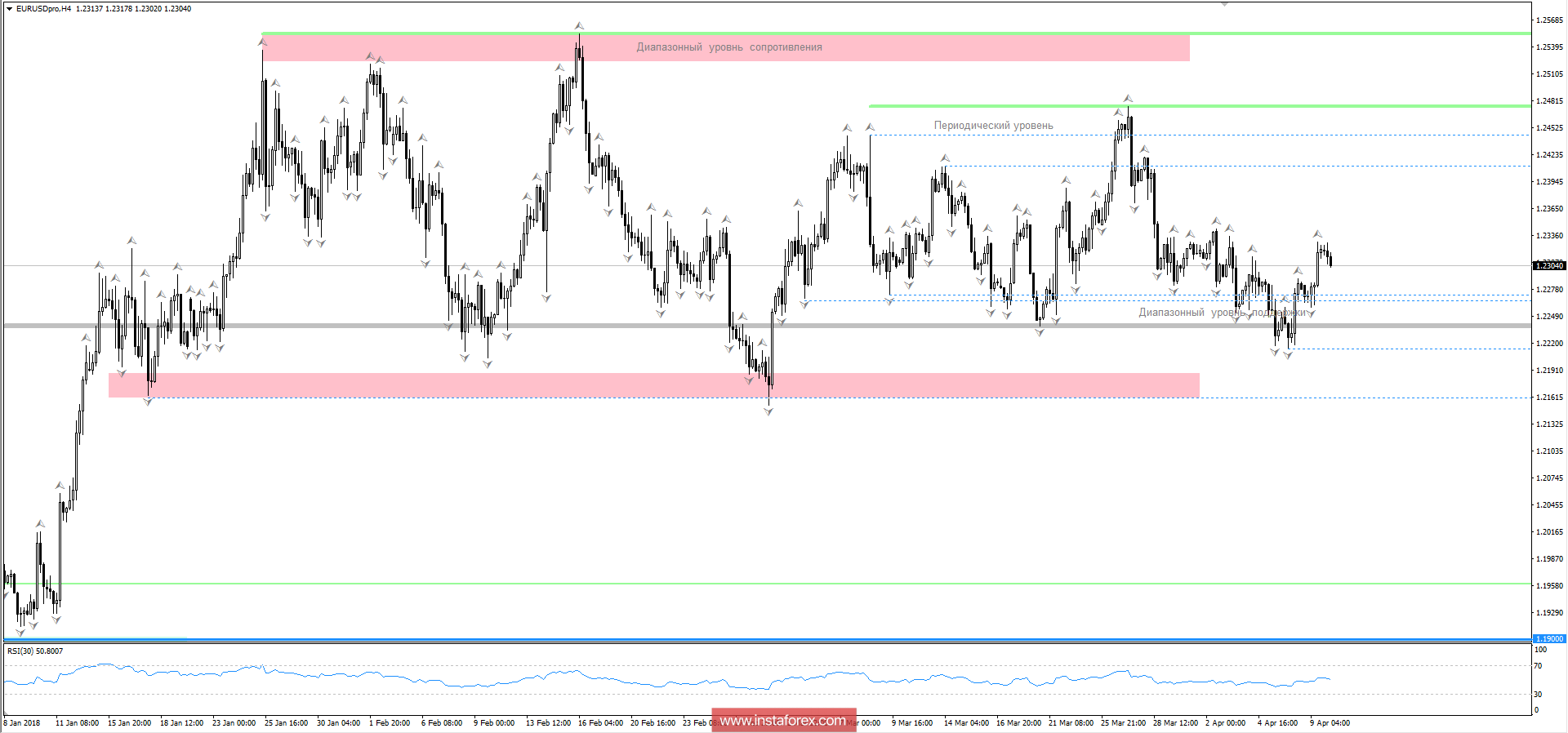

The euro / dollar currency pair managed to work out the value of 1.2240, which reflected the range level. Now, we see a touch of a periodic value of 1.2335, where the quotation felt a temporary ceiling slowing down the movement, forming a pullback. In this situation, it is possible to consider two variations: First, the quotation will decrease from the current value to 1.2270, forming a bolt thereafter. The second variation - in case of fixing the price above the value of 1.2345, the upward movement will recover, opening the way to 1.2400 / 1.2450.