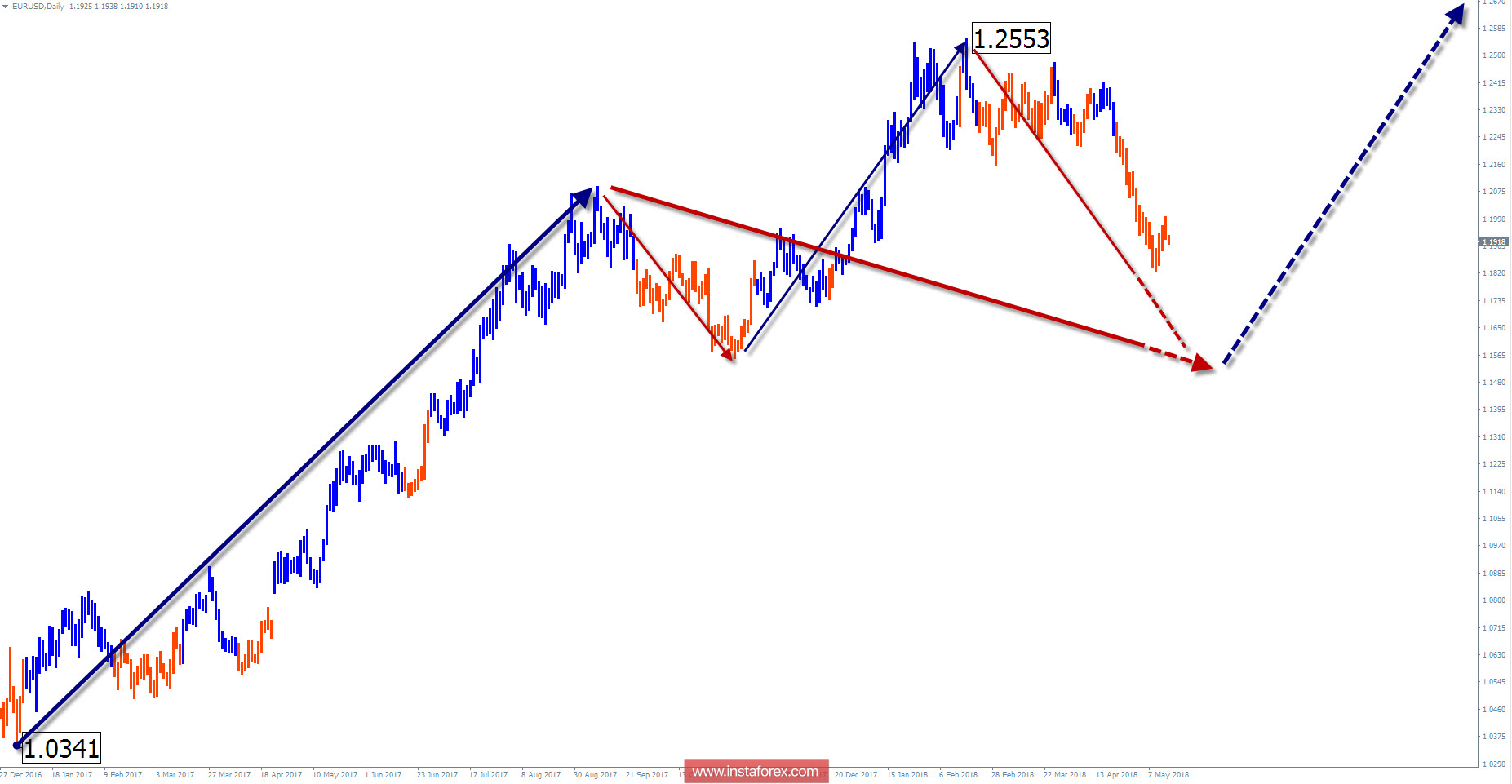

Wave picture of the D1 chart:

The long-term exchange rate of the euro's major pair since January last year is set by the rising wave. Its potential is not exhausted. The price reached the zone of potential reversal.

The wave pattern of the H1 graph:

Since January 25, the price forms a bear market. In a larger wave, it takes the place of correction. The completion is expected within the framework of the target zone with a width of about 2 figures. The estimated support runs along its upper boundary.

The wave pattern of the M15 chart:

As part of the short-term bearish trend since May 9, the price has been rolling back up and close to completion.

Recommended trading strategy:

Advocates for long-term trading have a reason to wait for the completion of the current short-term wave. Traders of inter-trading style and intraday are recommended to sell from the resistance zone.

Resistance zones:

- 1.2000 / 1.2500

Support zones:

- 1.1710 / 1.1660

Explanations to the figures:

A simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). The last incomplete wave for every timeframe is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the counting of wave according to the technique used by the author. The solid background shows the generated structure and the dotted exhibits the expected wave motion.

Advocates for long-term trading have a reason to wait for the completion of the current short-term wave. Traders of inter-trading style and intraday are recommended to sell from the resistance zone.