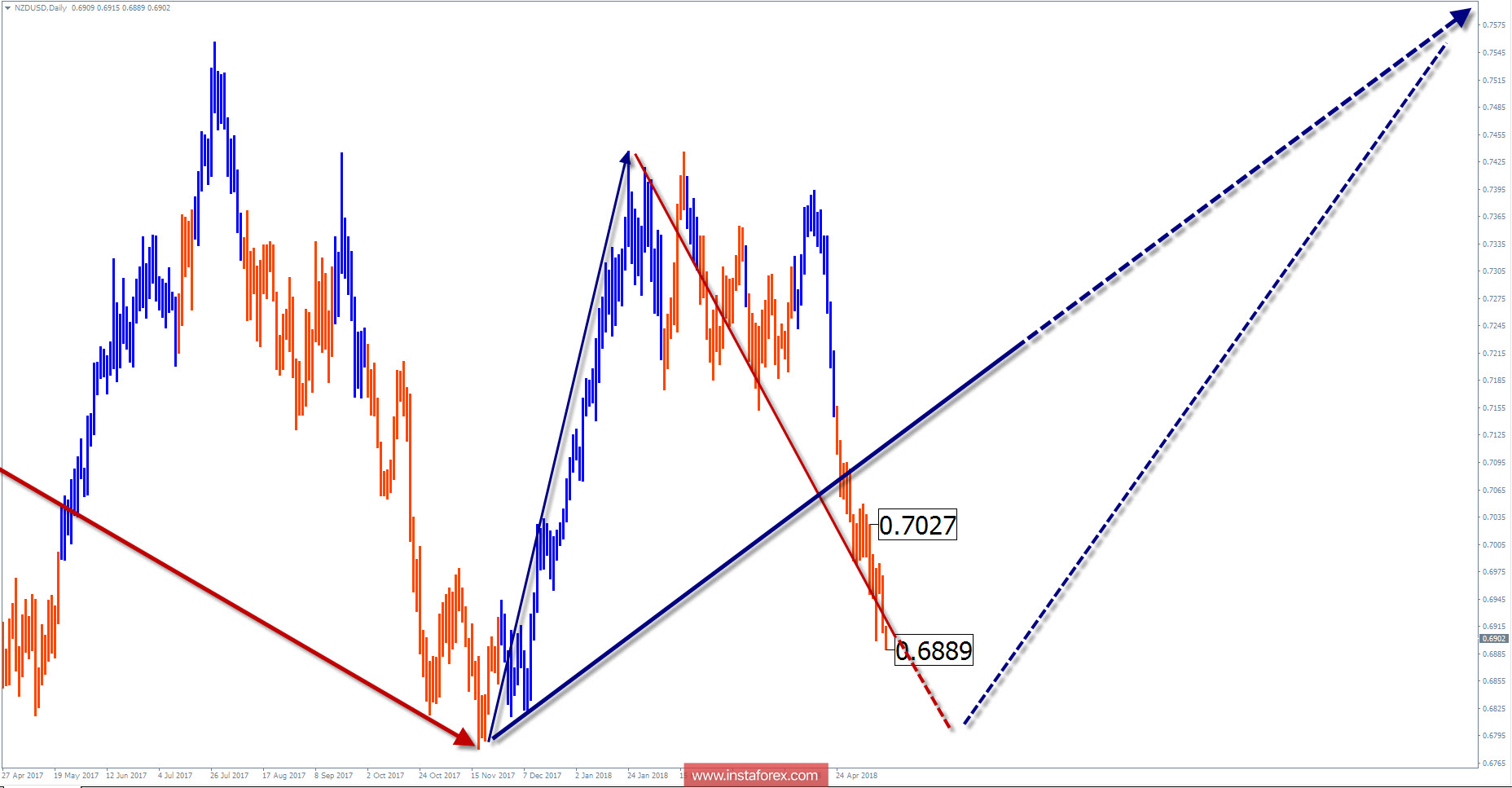

Wave picture of the D1 chart:

The main traffic vector since 2015 is directed to the "north" of the schedule. In the wave structure, the first two parts are completed. Since November of last year, a reversal structure is being formed for the final part (C).

The wave pattern of the H1 graph:

Since February this year, a bearish wave has formed but not yet completed. The price is close to the large scale zone of potential reversal with a width of about one and a half price figures. Estimated support is at its upper limit.

The wave pattern of the M15 chart:

On the scale of M15 / M30, the starting point was the last wave of April 13. The potential for a decline is close to completion.

Recommended trading strategy:

Sales are not recommended due to the low potential of the expected decline. For supporters of long-term trade offers are offered in the area of the target reduction zone.

Resistance zones:

- 0.6980 / 0.7030

Support zones:

- 0.6830 / 0.6780

Explanations to the figures:

A simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). The last incomplete wave for every timeframe is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the counting of wave according to the technique used by the author. The solid background shows the generated structure and the dotted exhibits the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need to confirm the signals used by your trading systems.