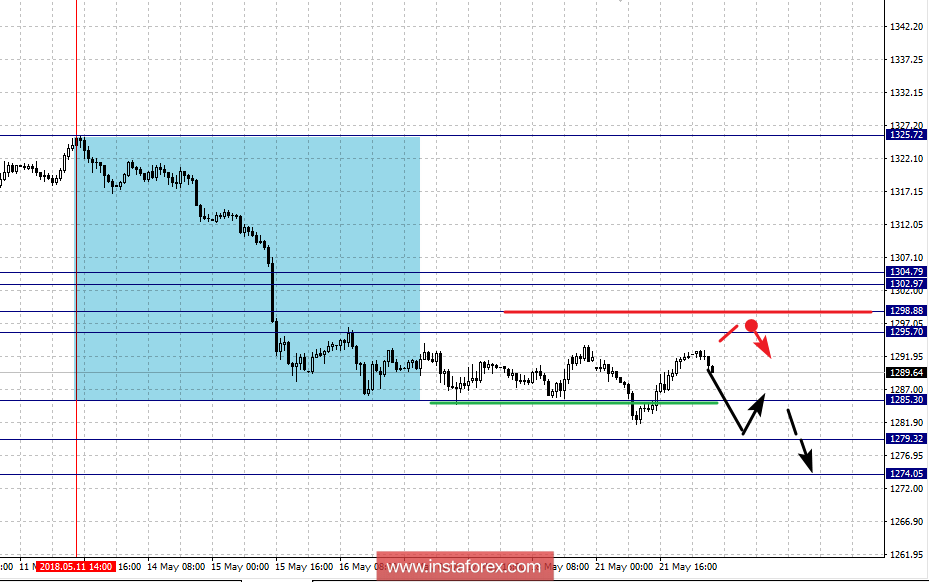

Forecast for May 22:

Analytical review on the H1 scale:

For Gold, the key levels on the H1 scale are 304.79, 1302.97, 1298.88, 1295.70, 1285.30, 1279.32 and 1274.05. Here we follow the local top-down structure of May 11 and consider it as a potential initial condition for a downward trend. The continuation of the downward movement is expected after the breakdown of 1285.30, in this case the target is 1279.32. The potential value for the bottom is still the level of 1274.05, which is near where we expect consolidation.

A short-term upward movement is possible in the corridor 1295.70 - 1298.88, breakdown of the last value will lead to in-depth movement. Here, the target is 1302.97 and expect noise in the range of 1302.97 - 1304.79. Prior to it, we expect the initial conditions for the upward cycle to be formalized.

The main trend is a local structure for the bottom of May 11.

Trading recommendations:

Buy: 1297.70 Take profit: 1298.80

Buy 1296.00 Take profit: 1298.00

Sell: 1285.10 Take profit: 1279.60

Sell: 1279.30 Take profit: 1274.25