Dear colleagues.

For the pair of Euro / Dollar, the price has formed a small potential for the top of May 21 in the correction of the downward structure. For the Pound / Dollar pair, we follow the downward structure from May 14 and we continue the downward movement after the breakdown of 1.3388. For the Dollar / Franc pair, we extended the downside potential from May 10 to 0.9820. For the pair of Dollar / Yen, the price is in the correction zone from the upward structure, the resumption of traffic to the top is expected after the breakdown of 110.98. For the pair Euro / Yen, the situation has shifted into a downward direction, the development of which is expected after the breakdown of 129.60. For the pair of Pound / Yen, the cancellation of the ascending structure from May 8 is possible after the breakdown of 147.80.

Forecast for May 23:

Analytical review of currency pairs in the scale of H1:

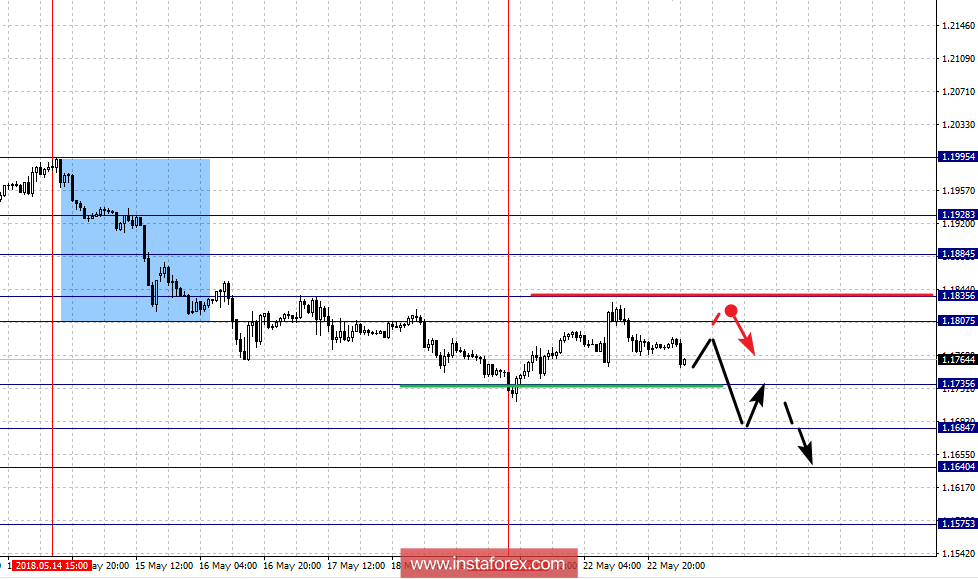

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1928, 1.1884, 1.1835, 1.1807, 1.1735, 1.1684, 1.1640 and 1.1575. Here, the price has set a small potential for the top of May 21 in the correction of the downward structure. The continued downward movement is expected after the breakdown of 1.1735. In this case, the target is 1.1684 and in the corridor of 1.1684 - 1.1640 is the short-term downward movement, as well as consolidation. We consider the level of 1.1575 to be a potential value for the downstream structure, after which we expect a rollback to the top.

The short-term upward movement is possible in the corridor of 1.1807-1.1835 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1884 and this level is the key support for the downward structure from May 14. Its breakdown will have to form the initial conditions for the upward cycle. In this case, the potential target is 1.1928.

The main trend is the local structure for the bottom of May 14, the correction stage.

Trading recommendations:

Buy: 1.1807 Take profit: 1.1833

Buy 1.1837 Take profit: 1.1884

Sell: 1.1735 Take profit: 1.1686

Sell: 1.1682 Take profit: 1.1642

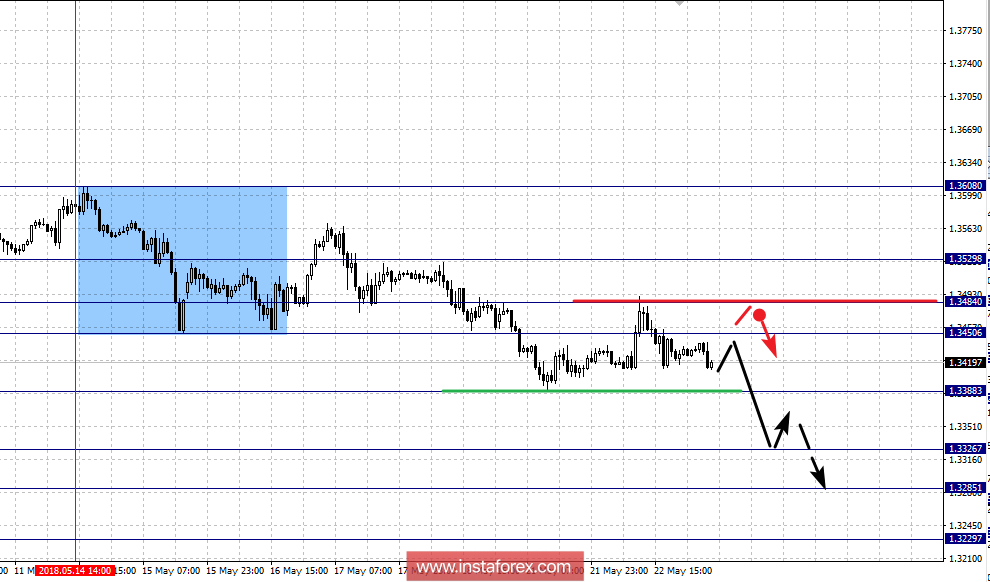

For the Pound / Dollar pair, the key levels on the scale of H1 are 1.3529, 1.3484, 1.3450, 1.3388, 1.3326, 1.3285 and 1.3229. Here, we continue to follow the downward structure of May 14. The continued downward movement is expected after the breakdown of 1.3388. In this case, the target is 1.3326 and in the corridor of 1.3326 - 1.3285 is the short-term downward movement, as well as consolidation. We consider the level of 1.3229 to be a potential value for the downward trend, after which we expect a pullback to the top.

The short-term uptrend is possible in the corridor of 1.3450 - 1.3484 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3529 and this level is the key support for the downward structure.

The main trend is the downward cycle from May 14

Trading recommendations:

Buy: 1.3450 Take profit: 1.3482

Buy: 1.3486 Take profit: 1.3527

Sell: 1.3386 Take profit: 1.3328

Sell: 1.3324 Take profit: 1.3287

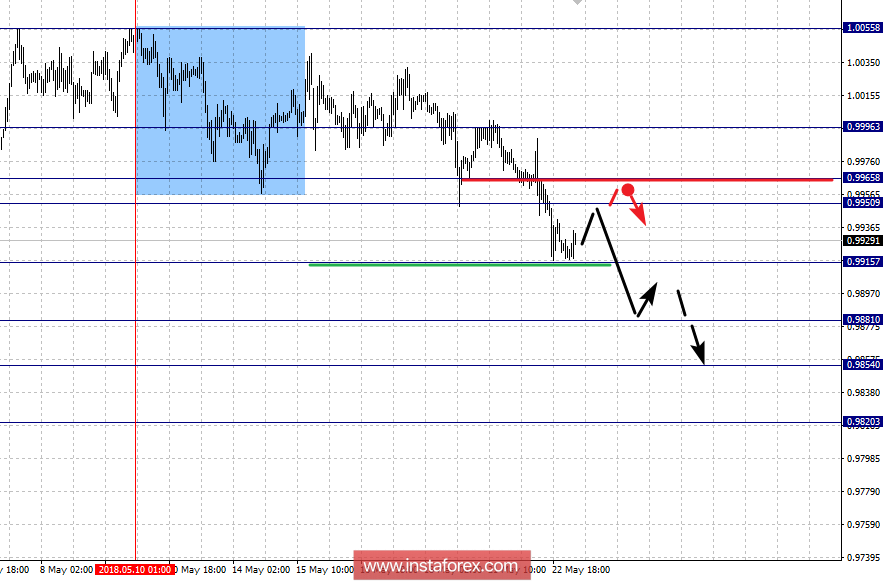

For the pair Dollar / Franc, the key levels on the scale of H1 are: 0.9996, 0.9965, 0.9950, 0.9915, 0.9881, 0.9854 and 0.9820. Here, we continue to follow the downward cycle from May 10. The continued downward movement is expected after the breakdown of 0.9915. In this case, the target is 0.9881 and in the corridor of 0.9881 - 0.9854 is the short-term downward movement, as well as consolidation. The potential value for the bottom is the level of 0.9820, upon reaching which we expect a rollback to the top.

The short-term upward movement is possible in the corridor of 0.9950 - 0.9965 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9996 and this level is the key support for the downward structure.

The main trend is the downward structure of May 10.

Trading recommendations:

Buy: 0.9950 Take profit: 0.9964

Buy: 0.9967 Take profit: 0.9992

Sell: 0.9913 Take profit: 0.9883

Sell: 0.9878 Take profit: 0.9855

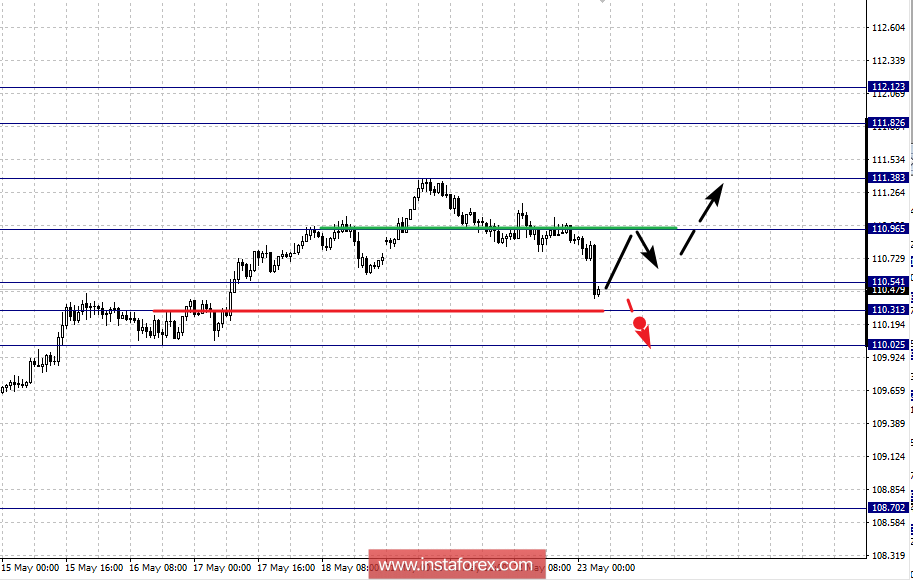

For the pair Dollar / Yen, the key levels on the scale of H1 are: 112.12, 111.82, 111.38, 110.96, 110.54, 110.31 and 110.02. Here, we follow the development of the upward structure of May 4 and at the moment, the price is in correction. The continued upward movement is expected after the breakdown of 110.98. In this case, the target is 111.38 and near which is the consolidation. The potential value for the top is the level of 111.82, upon reaching which we expect consolidation in the corridor of 111.82 - 112.12, as well as a pullback downwards.

The short-term downward movement, as well as consolidation are possible in the corridor of 110.54 - 110.31 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 110.02 and this level is the key support for the top.

The main trend is the upward structure of May 4, the correction stage.

Trading recommendations:

Buy: 110.98 Take profit: 111.36

Buy: 111.40 Take profit: 111.80

Sell: 110.52 Take profit: 110.33

Sell: 110.28 Take profit: 110.04

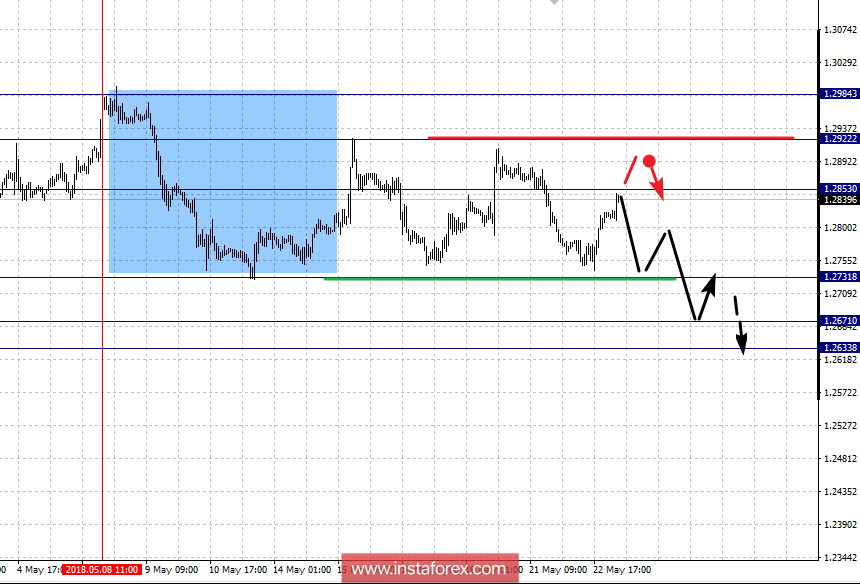

For the Canadian Dollar / Dollar pair, the key levels on the scale of H1 are: 1.2984, 1.2922, 1.2853, 1.2731, 1.2671 and 1.2633. Here, we follow the formation of a downward structure from May 8. The continued downward movement is expected after the breakdown of 1.2731. In this case, the target is 1.2671 and in the range of 1.2671 - 1.2633 is the consolidation.

The short-term upward movement is possible in the range of 1.2853 - 1.2922 and the breakdown of the last value will have to create initial conditions for the upward cycle. Here, the potential target is 1.2984.

The main trend is the formation of a downward structure from May 8.

Trading recommendations:

Buy: 1.2855 Take profit: 1.2920

Buy: 1.2924 Take profit: 1.2982

Sell: 1.2730 Take profit: 1.2671

Sell: Take profit:

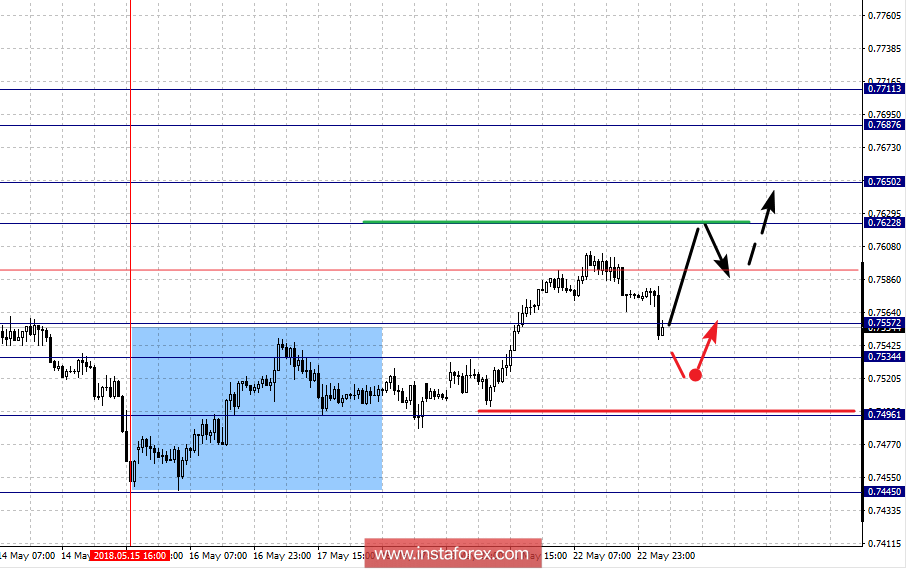

For the Australian Dollar / Dollar pair, the key levels on the scale of H1 are: 0.7711, 0.7687, 0.7650, 0.7622, 0.7557, 0.7534 and 0.7496. Here, we follow the upward cycle from May 15 and at the moment, the price is in correction. The continued upward movement is expected after the breakdown of 0.7590. Here, the first target is 0.7622 and in the corridor of 0.7622 - 0.7650 is the short-term upward movement, as well as consolidation. The breakdown at the level of 0.7650 should be accompanied by a pronounced upward movement to the level of 0.7687. The potential value for the top is the level of 0.7711, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 0.7557 - 0.7534 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.7496 and this level is the key support for the upward trend.

The main trend is the local upward structure of May 15.

Trading recommendations:

Buy: 0.7590 Take profit: 0.7620

Buy: 0.7624 Take profit: 0.7650

Sell: 0.7555 Take profit: 0.7536

Sell: 0.7532 Take profit: 0.7500

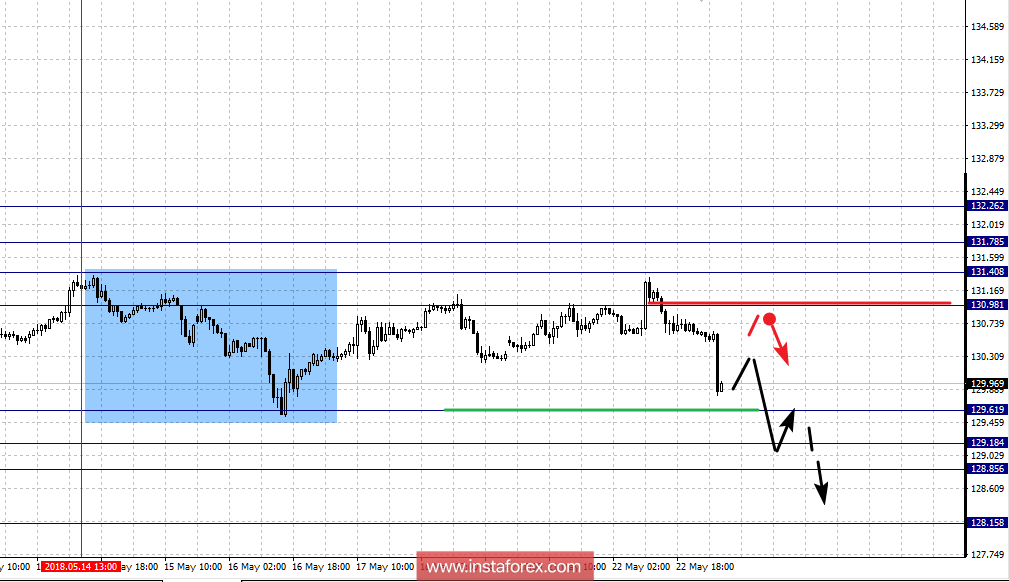

For the pair of Euro / Yen, the key levels on the scale of H1 are: 132.26, 131.78, 131.40, 130.98, 129.61, 129.18, 128.85 and 128.15. Here, the situation has shifted in a downward direction. The development of the downward movement from May 14, we expect after the breakdown of 129.61. Here, the first target is 129.18 and in the corridor of 129.18 - 128.85 is the consolidation. The potential value for the bottom is the level of 128.15, from which we expect the departure to correction.

The continuation of traffic to the top is possible after the breakdown of 130.98. In this case, the first target is 131.40 and in the corridor of 131.40 - 131.78 is the consolidation. The potential value for the ascending structure is, for the time being, the level of 132.26.

The main trend is the equilibrium situation. The formation of the potential for the bottom of May 14.

Trading recommendations:

Buy: 131.00 Take profit: 131.40

Buy: 131.42 Take profit: 131.75

Sell: 129.60 Take profit: 129.20

Sell: 128.85 Take profit: 128.20

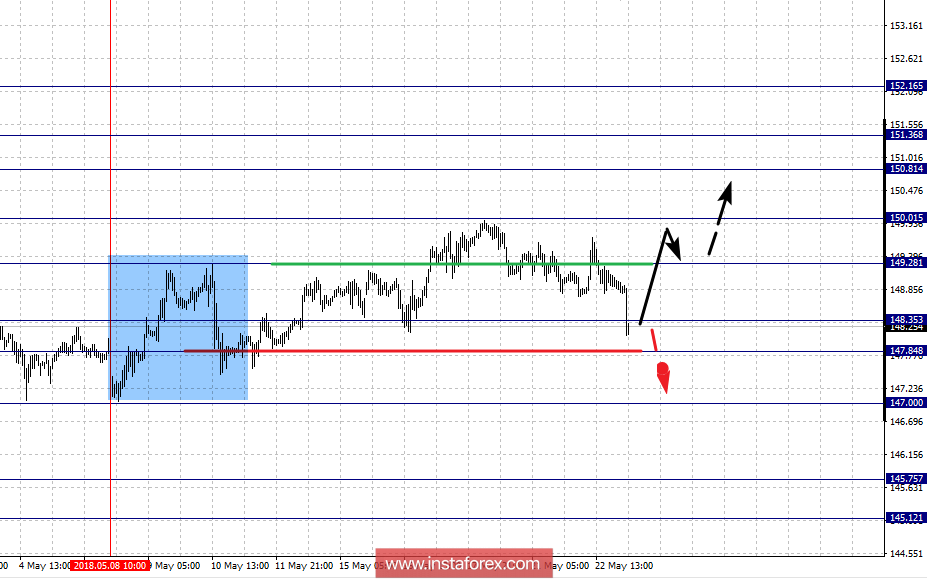

For the Pound / Yen pair, the key levels on the scale of H1 are: 152.16, 151.36, 150.81, 150.01, 149.28, 148.35, 147.84, 147.00, 145.75 and 145.12. Here, the price is close to the lifting of the ascending structure from May 8, for which a breakdown of the level of 147.84 is required. The continuation of the upward movement is expected after the breakdown of 149.28. In this case, the first target is 150.01 and the breakdown of which will allow us to count on the move to 150.81 and in the corridor of 150.81 to 151.36 is the consolidation of the price. The potential value for the top is the level of 152.16, upon reaching which we expect a departure to correction.

The short-term downward movement is possible in the corridor of 148.35 - 147.84 and the breakdown of the last value will have to develop a downward structure. In this case, the target is 147.00, near this level is the consolidation.

The main trend is the upward structure of May 8, the stage of deep correction.

Trading recommendations:

Buy: 149.30 Take profit: 150.00

Buy: 150.10 Take profit: 150.80

Sell: 147.80 Take profit: 147.00

Sell: 146.90 Take profit: 145.80