Forecast for May 23:

Analytical review on the scale of H1:

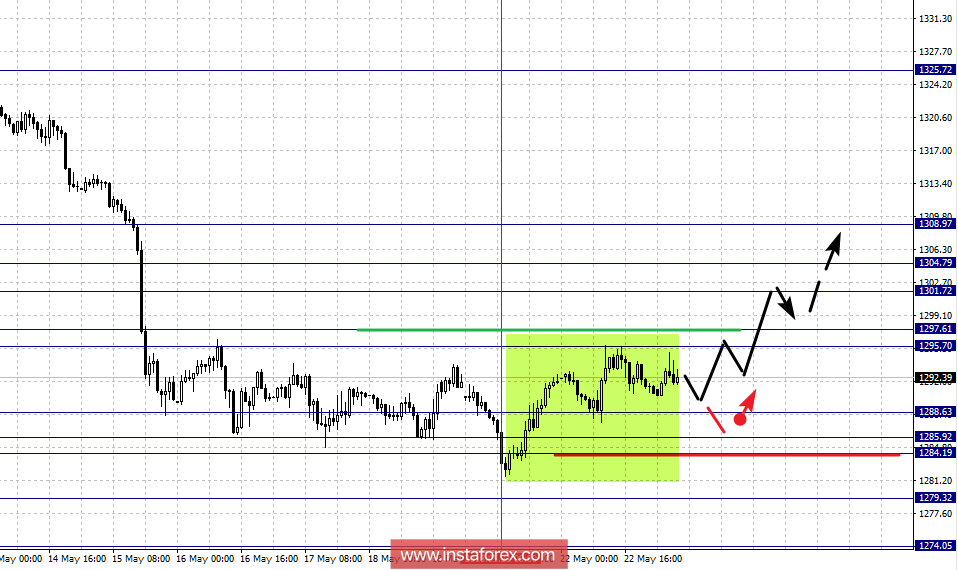

For Gold, the key levels on the scale of H1 are: 1308.97, 1304.79, 1301.72, 1297.61, 1295.70, 1288.63, 1285.92, 1284.19 and 1279.32. Here, the price has formalized the potential initial conditions for the top of May 21. The continued development of the upward trend is expected after the pass at the price of the noise range of 1295.70 - 1297.61. In this case, the target is 1301.72 and in the corridor of 1301.72 - 1304.79 is the short-term upward movement, and also consolidation. The potential value for the upward structure from May 21 is the level of 1308.97, upon reaching which we expect a pullback downwards.

The departure in the correction is possible after the breakdown of 1288.63. Here, the target is 1285.92 and from this level, there is a high probability of a turn upwards. The range of 1285.92 - 1284.19 is the key support for the upward structure. Its passage by the price will have to develop the main downward trend. Here, the target is 1279.32.

The main trend is the formation of the potential for the top of May 21.

Trading recommendations:

Buy: 1297.61 Take profit: 1301.70

Buy 1304.80 Take profit: 1308.60

Sell: 1288.60 Take profit: 1286.00

Sell: 1284.00 Take profit: 1279.60