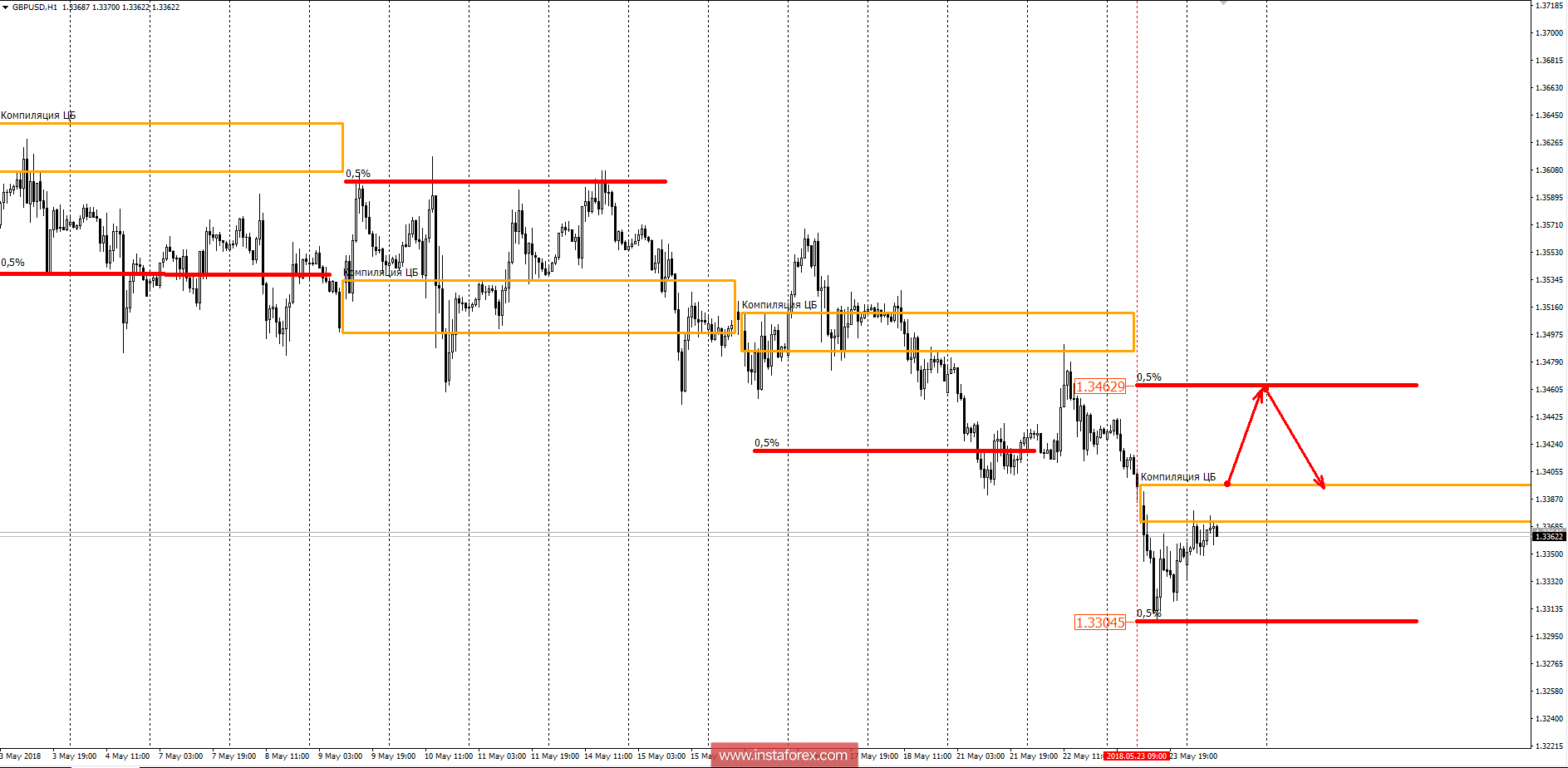

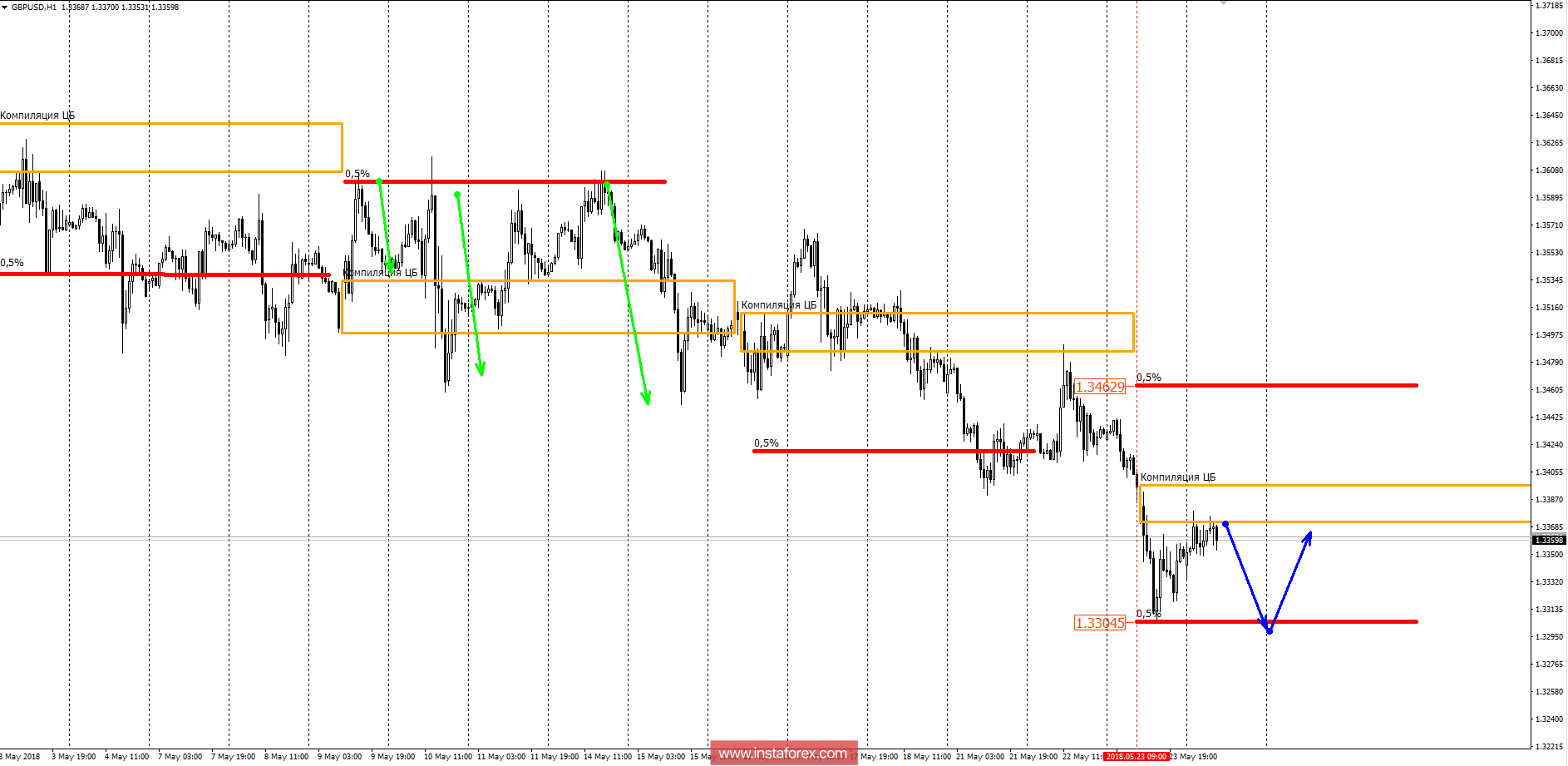

Yesterday, the open market was in regular operations which allows determining the compilation zone of the Central Bank. Today, the pair is trading near the specified zone which indicates the need to search for a pattern. Yesterday's decline was 0.5% (1.3304) from the compilation zone, which indicate growth in demand. If decline happened yesterday is completely absorbed, the rate will be able to gain a foothold above the zone of bank compilation, then the pair will enter the phase of medium-term accumulation where transactions from the range of interest rates will come to the fore. Examples of the flat movement can be seen in the first weeks of May. Priority of termination remains downward.

The priority is the depreciation. In order to achieve this, the pair should continue to trade below the compilation zone of the Central Bank. The first target of the fall is the yesterday's low, formed after the benchmark interest rate test 1.3304. Holding sales below the rate level is acceptable, but it will require the transfer of short positions to break-even. Do not forget that a reversal of a strong downward momentum will require a strong absorption nearly of the entire previous decline, and the emergence of a large player is also necessary to set a certain level of limit orders. To see this level, it is required to cross through stopping the fall during the American sessions within a certain narrow range. An example of this may be the similar stoppage three weeks ago, where the rate level was a stiff barrier to growth.

* The presented market analysis is informative and does not constitute a guide to the transaction.