Gold is again in demand amid a flight from risks and a weakening of the US dollar. The instrument bounced off from its annual low and goes up, with a potential to return to the area of 1300-1302. Such dynamics contribute to the sharply clouded fundamental background for the US dollar. And although it is too early to talk about the completion of a large-scale dollar rally, the situation on the market has changed significantly - even compared to Wednesday.

Ironically, the pressure on the dollar on Thursday is exerted by the same factors that contributed to its growth. Only now they have come, figuratively speaking, with a "minus" sign.

First, we are talking about the trade relations between China and the United States. Last Sunday, the US Treasury Secretary encouraged dollar bulls with his speech, saying that the parties prevented a trade war between the countries. He also announced an extended deal without going into details: according to him, the negotiators are still negotiating the details of the agreement. Literally the next day - on Monday - the dollar began its next offensive across the entire market. Traders came to the conclusion that the months-long epic of the US-China conflict has come to an end, and this factor will indirectly affect the determination of the Fed members regarding the pace of tightening monetary policy this year.

As it turned out, the market hastened to such conclusions: the problem of trade relations with China is still relevant and is far from being fully resolved. Such conclusions can be drawn from the tone of the statements of Donald Trump. With the help of the usual method of communication (Twitter), he said that he was not satisfied with the progress of negotiations with China, and the agreements reached have the status of initial. "We still have a long way to go," the US president said. It is likely that such rhetoric could be ignored by the market (because Trump is famous for outrageous matches), if not for the situation with ZTE.

The largest company in China is engaged in the supply of telecommunications systems, mobile gadgets, also developing various technological solutions. The main market is the United States, so when the company got into the US sanctions list, it was on the verge of collapse. Losses are estimated at billions of dollars (according to the latest data, about $3.2 billion). The Chinese company got into the "black list" of the White House after being caught in trade with Iran and North Korea (ZTE sold them equipment with American parts).

In the beginning of this week, information emerged about the fact that the United States and China have both agreed on the fate of ZTE - the company will allegedly get a relatively small fine and resume their trade on American soil. However, on Wednesday, Donald trump refuted this information, stressing that "there are no agreements on this matter." He allowed the resolution of this situation, but under rather strict conditions: in his opinion, the fine should be increased to one and a half billion dollars, and the company should carry out significant changes in personnel at the level of the Board of Directors.

Trump's rhetoric about ZTE in particular, and about the talks with China in general, suggests that Beijing and Washington are still far from reaching a full-fledged deal, and the optimism of the US Treasury Secretary was somewhat premature. In fact, the countries decided to postpone the trade war, but it's too early to talk about a "truce".

The second factor that is putting pressure on the dollar is the Fed, which once again cooled the fervor of dollar bulls. The minutes of the May meeting published on Wednesday turned out to be as "dovish" as the text of the accompanying statement. The members of the regulator do not intend to restrain inflation, which, in their opinion, only temporarily exceeded the target level (we are talking about the PCE indicator).

The Fed has clearly hinted at the June rate hike, but the market is already expecting this move with a 90 percent probability. However, the further steps of the regulator remain questionable-judging by the rhetoric of the Fed members, the basic scenario for this year will remain in force, contrary to the hopes of dollar bulls. In addition, the protocol focuses on the uncertainty in relations with China. According to the Fed, the trade conflict with China may affect the economic indicators of the US, in particular, inflation. The Fed did not dare to assess (or predict) the extent of this influence, but the very fact that this problem was mentioned speaks volumes– especially in the light of recent events.

Thus, the growth of gold is due to the weakening of the US currency. The current fundamental picture has suspended the dollar rally, although it is impossible to speak about the reversal of the trend. In addition, gold and yen are rising in price against the backdrop of events in Turkey, where the national currency collapsed to record lows. The market has resumed flight from risk, so protective tools again began to be in demand.

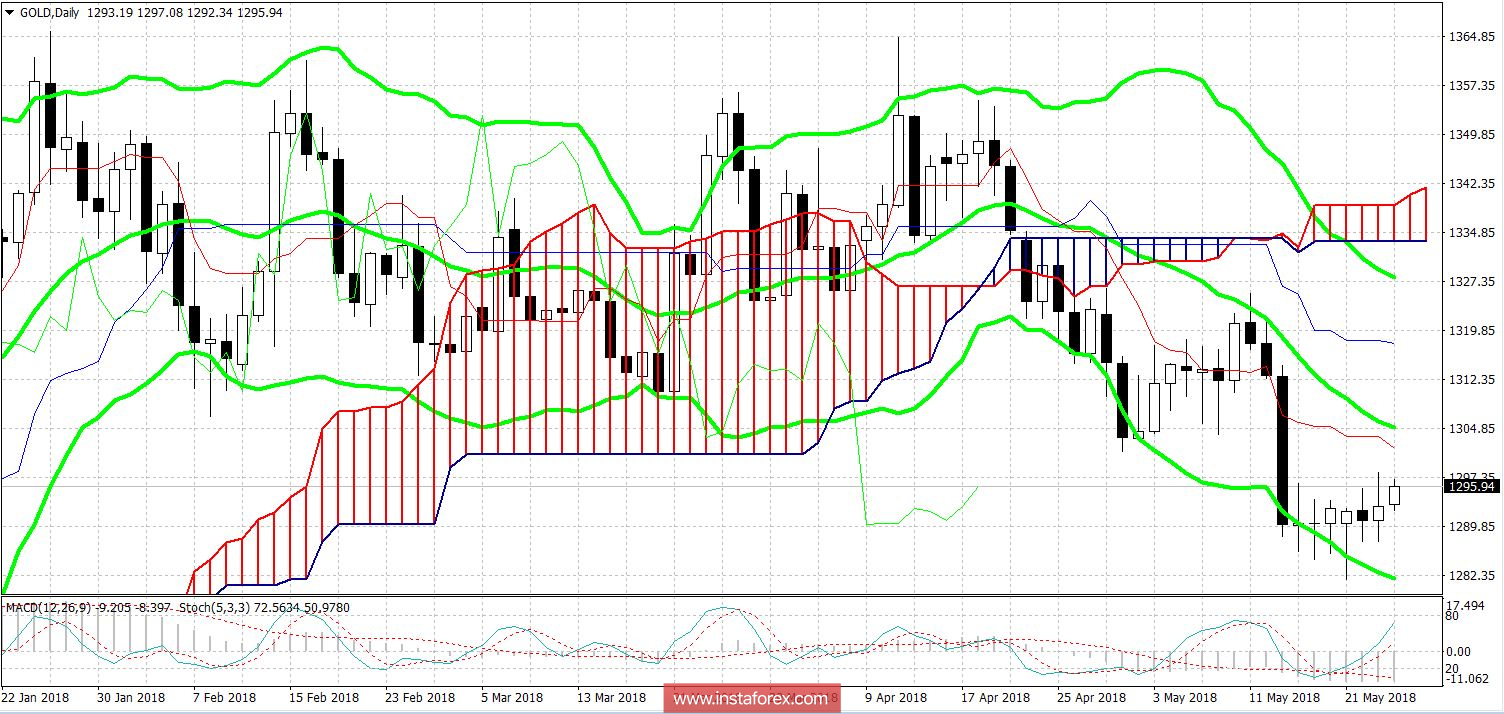

Speaking directly about gold, the first level of resistance here is the mark of 1301.30 (Tenkan-sen line on the daily chart). In order to break through this level, an additional information pulse is required. In general, the instrument remains within the downward trend, as D1 is between the average and the lower lines of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku Kinko Hyo indicator. The support is the mark of 1281.66-this is the price low of the current year, which coincides with the lower line of the Bollinger Bands on D1.