The euro / dollar pair starts the week again with corrective growth. The market, willy-nilly, was dragged into Italian political battles, as the macroeconomic calendar is practically empty today. In the United States and Britain, trading floors are closed. The Americans celebrate Remembrance Day, and the British celebrate the spring holiday.

Against the backdrop of the absence of macroeconomic news or comments by officials of leading Central Banks, traders are forced to follow the dynamics of the external fundamental background. It's not just about Italy. The focus of the market and the situation in the oil market, and the US-China trade talks, and a possible meeting between Donald Trump and Kim Jong-un.

But if we talk directly about the European currency, then the market is focused on the events in Rome. Over the weekend, a lot of news came from Italy, which in different ways affect the mood of traders. For example, the main reason for the growth of the European currency is that the Italian president did not approve for the post of Minister of Economy Paolo Savona, who is known for his eurosceptic views. He was an ardent opponent of Italy's accession to the European Union, calling this step "an incredible historical mistake." He repeatedly (and in a rather tough form) criticized the creation of the eurozone and the process of economic expansion of the Germans. It was he who developed, three years ago, a detailed plan for Italy's withdrawal from the euro area with the subsequent withdrawal from the EU.

At the same time, Savona is a fairly experienced economist and politician. He held various positions in the Central Bank of Italy, headed the Public Policy Department and even was the Minister of Industry. In other words, in case of his appointment, Brussels would receive in the person of Paolo Savona a strong and competent political opponent. And, given the rhetoric of the coalition agreement of the League and the Five-Star Movement, there can be no doubt that the newly appointed minister of economy would have his hands untied in the context of realizing his "anti-integration" intentions.

Therefore, when the Italian president did not support this appointment, the European currency received an unconditional reason for corrective growth. This explains the morning growth of EUR / USD to the level of 1.1730.

However, it is worth noting that this circumstance only gives an occasion to open short positions on a pair at a more favorable price. There is no question of any kind of reversal of the trend, even the corrective growth choked rather quickly, emphasizing the priority of the southern trend.

The fact is that the Italian president by his refusal essentially aggravated the political crisis in the country. There was a so-called "domino effect". After the president refused to appoint Paolo Savona, followed the refusal of Giuseppe Conte to lead the coalition government. While Conte was the coordinated figure of "Five Star Movement" and "League". Months of negotiations on the formation of the government turned out to be worthless, and the whole fragile political structure of the future coalition alliance immediately collapsed.

Gloomy rumors spread in the country. According to one version, the issue of impeachment against the Italian president will be considered in the parliament. According to another version, it is a matter of an extraordinary parliamentary election, which may take place in the fall of this year. Also, we should not forget about the "factor of Silvio Berlusconi", which recently received rehabilitation of the court and now can lead state institutions. He can act as an intermediary and become a compromise figure, preserving Italy in the framework of the European integration course.

Thus, the temporary optimism of bulls EUR / USD is too unreliable. The fundamental background for the euro remains negative, while the dollar is trying to restore its positions throughout the market. The other day, it became known that the leaders of the United States and North Korea can still meet, despite the sharp mutual attacks. On Saturday, Kim Jong-un met again with South Korean President Moon Jae In, where the North Korean leader voiced a "firm intention" to hold a historic meeting. After that, the level of geopolitical tensions again declined, and this fact allowed the US currency to gain momentum, including paired with the euro.

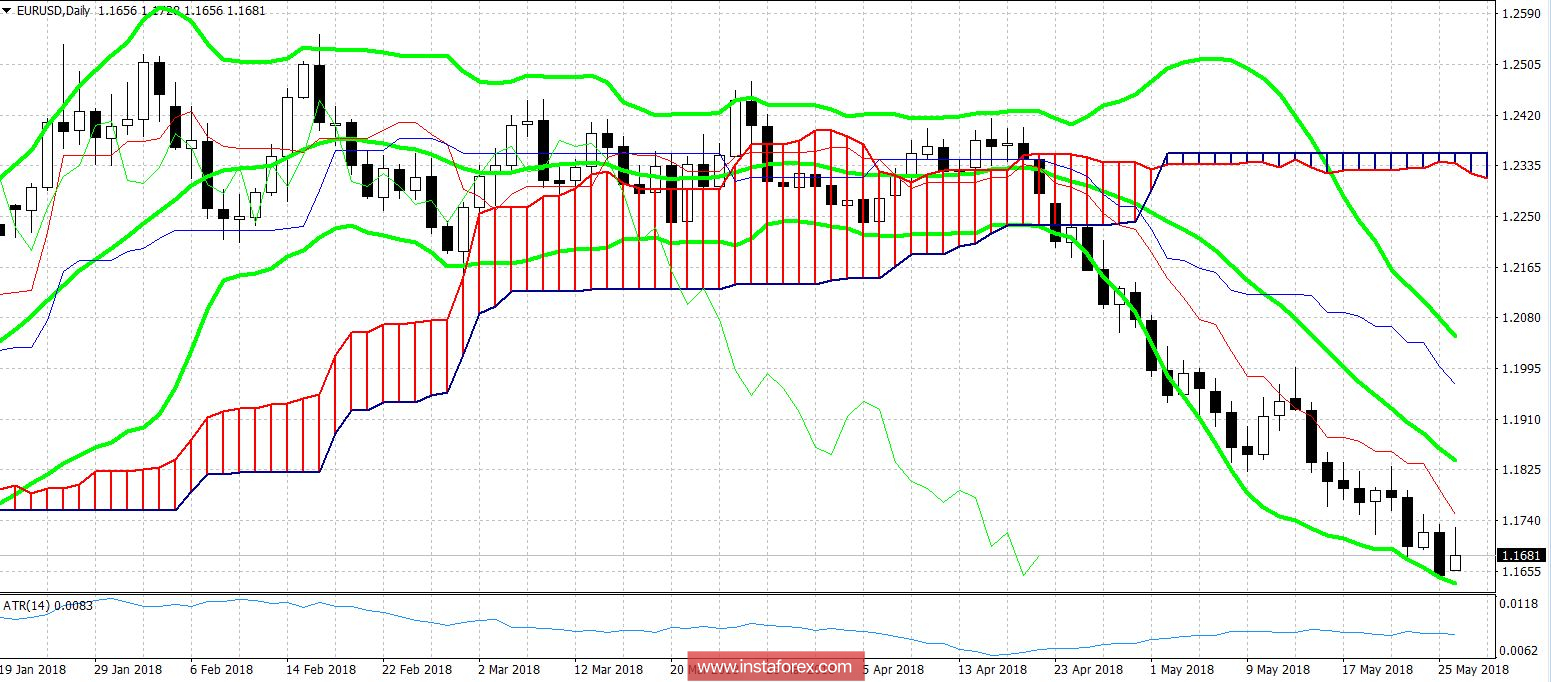

On the technical side, the situation has not changed either. On the daily chart, the pair EUR / USD is trading in a downward direction, consolidating under the bearish signal "line parade" indicator Ichimoku Kinko Hyo. Also, the pair is between the middle and bottom lines of the Bollinger Bands indicator, which is in the extended channel. The lower line of this indicator is the price target of the bearish testing and corresponds to the level of 1.1625. The resistance level is the price of 1.1750, this is the line Tenkan-sen indicator Ichimoku Kinko Hyo. Given the established fundamental background, it will be extremely difficult for the EUR / USD bulls to overcome this level, therefore for any northern recoil. Now, it is advisable to consider short positions.