The dollar continues to hold a positive outlook on the wave of speeches with comments from FRS members, who on Friday, confirmed the need to continue the cycle of gradual increases in interest rates.

President of the Federal Reserve of Atlanta Raphael Bostic said that "there are many reasons why I think that you need to raise rates gradually." In his opinion, in the absence of really serious changes, the regulator can continue the course chosen earlier without large losses.

The head of the Federal Reserve Bank of Dallas Robert Kaplan in his comments on Friday said that he was in favor of a gradual increase in interest rates. And known for his "conservative" views on the change in monetary policy, Charles Evans noted that he was observing "the recent rise in price pressure". It can be said that three heads of federal banks made it clear that there is a need to continue raising interest rates further, but only need to do it gradually.

In the wake of these performances, the US dollar received good support on the last day of the week, and its index resumed the rally, which began more than one month ago. Moreover, the decline in the yield of government bonds could not stop this trend. The yields last week turned on the wave of growth of geopolitical tension, produced by D. Trump. Thus, the profitability of the benchmark of 10-year Treasuries after reaching a local maximum of 3.128% fell to 2.931% on Friday.

The decrease in yield below the key level of 3.0% is a risk for the dollar, but most likely, it will not be significant, as the markets win back the actual one hundred percent expectation of the key interest rate at the June meeting for the next 0.25%.

Considering this, we believe that the dollar has real stable growth prospects against the major currencies and, above all, against the European ones.

Forecast of the day:

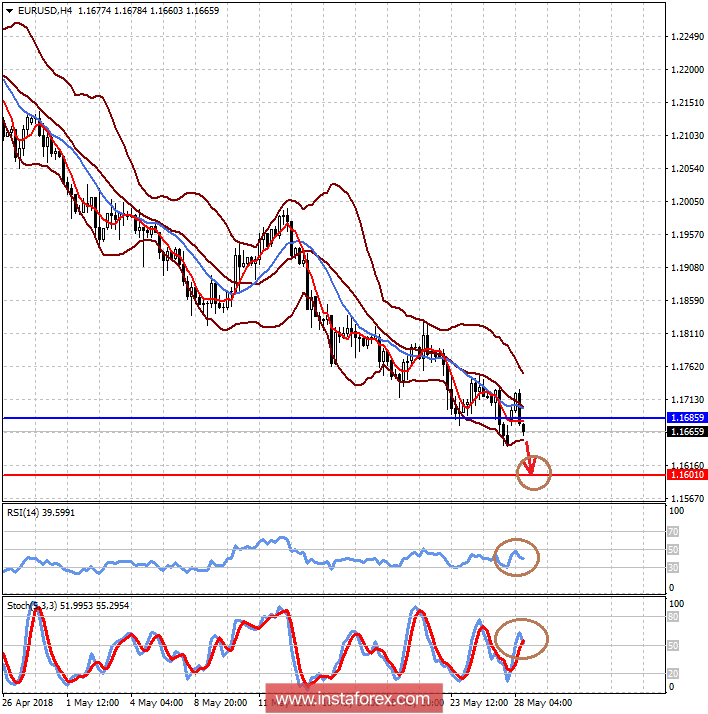

The currency pair EUR / USD remains in the short-term downtrend. It is likely that it will continue to decline on the wave of expectations of higher interest rates in the US next month. On this wave, the pair may fall to 1.1600.

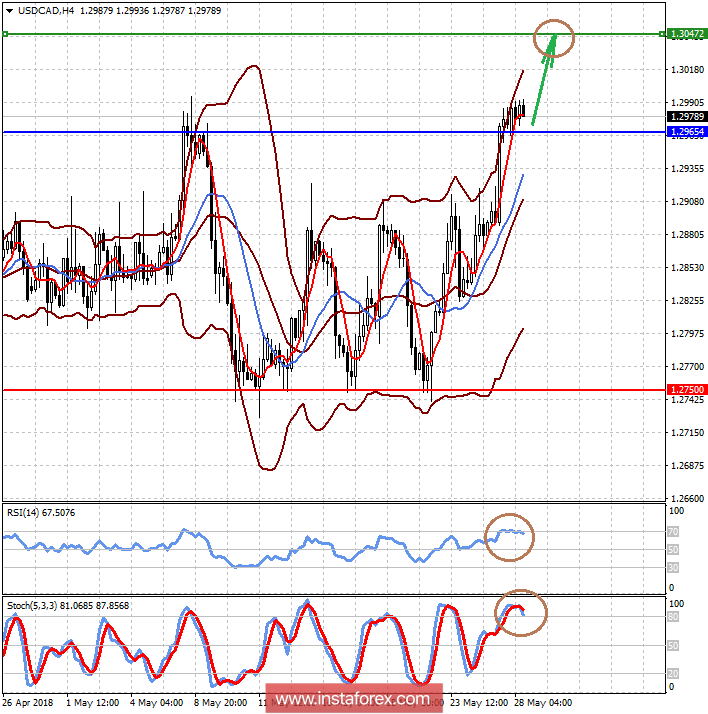

The currency pair USD / CAD is trading above the level of 1.2965. It can adjust to this mark, but on the wave of a probable continuation of the decline in oil prices, it could rise to 1.3045.