Wave picture of the chart H4:

On the cross chart from March 2, there is a distinct descending zigzag. The wave has reached the minimum level of elongation down. The proportions of the parts of the wave are observed. The turn signals on the chart have not yet been observed.

The wave pattern of the graph H1:

The bear's wave of April 13 is the final part (C) of a larger model. The quotations have reached the upper limit of a wide zone of a likely reversal.

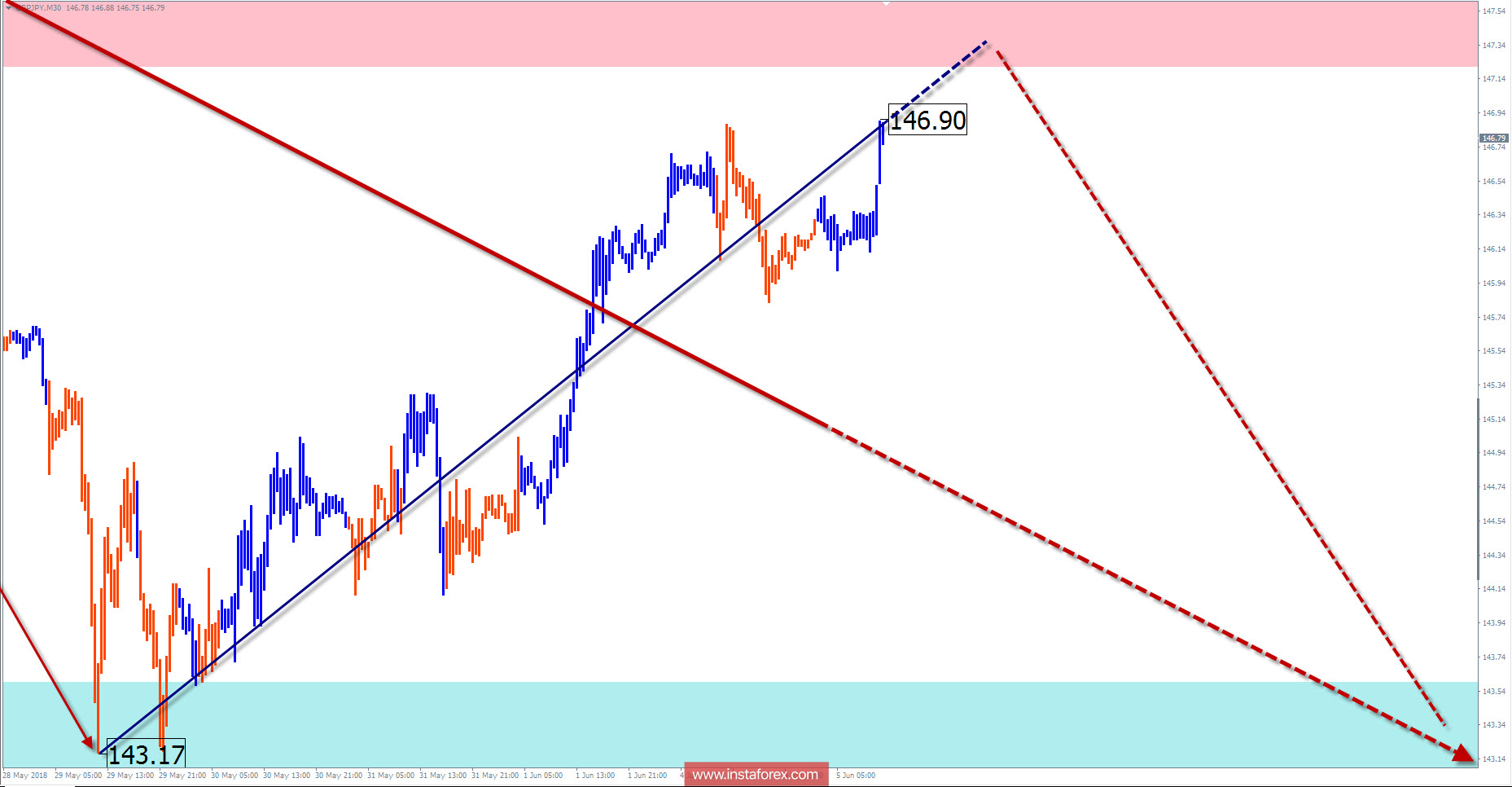

The wave pattern of the M15 chart:

Starting from May 29, the price forms an upward wave. It does not have a reversal potential, but it can become the first part of a larger bullish wave.

Recommended trading strategy:

The sales are limited, possible only for the supporters of inter-style trading style. On a larger scale, signals for purchase have not been formed.

Resistance zones:

- 147.20 / 147.70

Support zones:

- 143.60 / 143.10

Explanations to the figures: Simplified wave analysis uses a simple 3-part waveform (A-B-C). At each TF the last incomplete wave is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the wave counting according to the technique used by the author. The solid background shows the generated structure, dotted - the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need confirmation signals from your trading systems!