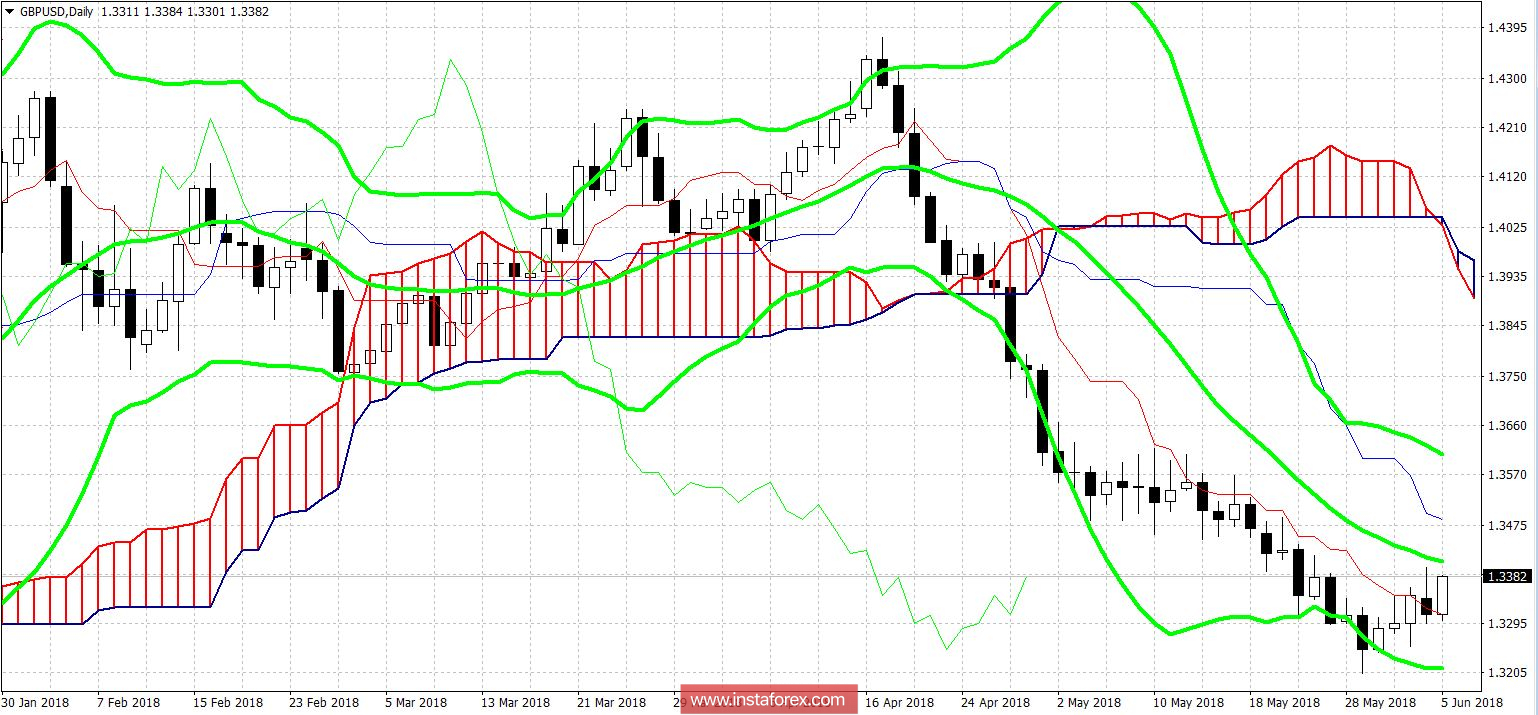

The pound paired in the dollar, after reaching the annual minimum (1.3203), is trying to restore its positions. However, it is not possible to return to the framework of the northern trend. The pair is forced to trade in the flat, reacting mainly to the behavior of the US currency, which in turn reacts to the external fundamental background. The economic calendar for this week is almost empty, so the pair is more likely to drift in the range of 1.3250-1.3485 until the end of the five-day trading period. But the next week promises to be interesting.

Next week, data on the growth of US inflation and the results of the June meeting of the Fed will be published. In addition, we learn about the data on the labor market in Britain and British inflation. Indirectly, the dynamics of the pair will be affected by the results of the meeting of the European Central Bank, where the fate of the stimulating program will be decided.

Despite such a concentration of the most important events of a fundamental nature, for the pound, the most important day of the next week will be June 12. On this day, British parliamentarians will discuss key amendments to the Brexit bill. Legislators will have to accept or reject a dozen amendments, which will determine the strategy of the "divorce proceedings" with the European Union.

As you know, the issue of Brexit is an absolute priority for the British currency. Any positive macroeconomic statistics can easily be crossed out by the pessimistic prospects of 2019. One can recall several situations where the pound was actively losing its positions throughout the market, despite the growth of key economic indicators. One reason was the increased probability of "hard" Brexit. There were also mirror situations, when the pound rose in price amid the recession of the economy due to the diplomatic successes of London and Brussels.

That is why the key macroeconomic indicators of Britain, which will be published next week, will play an important but secondary role. They will enhance or weaken the effect of the main event of a fundamental nature. The fact is that the above-mentioned 15 amendments will determine the long-term strategy of the country's exit from the EU. Their general essence is reduced to "curbing" the government of Theresa May in the issue of Brexit, minimizing the possibility of making independent decisions.

For example, the British Cabinet wants to abolish the norm, which allows the parliament to make decisions about the fate of Brexit in the event that London and Brussels do not conclude a mutually beneficial deal. Another amendment will not allow the British government to adopt bylaws that will essentially change the European legal norms. This can only be done with the consent of parliamentarians. Another important point (especially in the context of the foreign exchange market) is the preservation of close economic ties with the European Union. This amendment also runs counter to the policy of Theresa May, which advocates the country's exit from the customs union. The British Parliament can consent to the extension of the Kingdom's membership within the common market of the EU.

Thus, if the Lower House of the British Parliament takes a pro-European stance, the pound will receive a powerful impetus for its growth. Let me remind you that the spring weakening of the British currency in tandem with the dollar was due not only to the strength of the Greenback, but in many respects to the uncertainty with Brexit. Optimism in this matter will play a key role for the recovery of the currency.

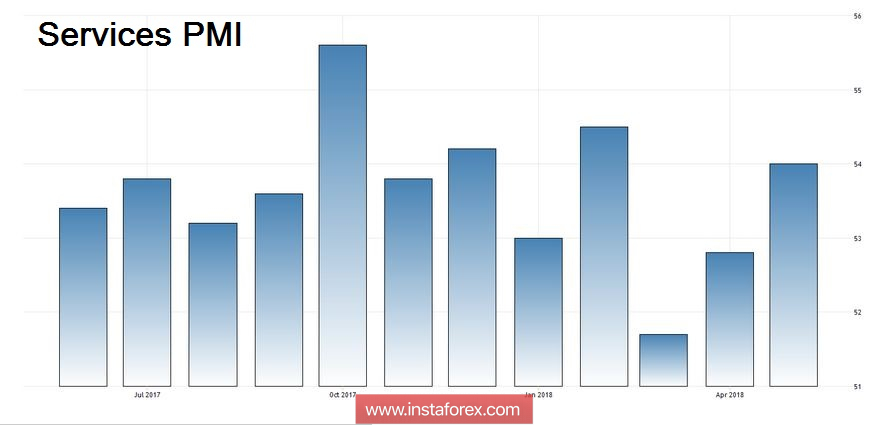

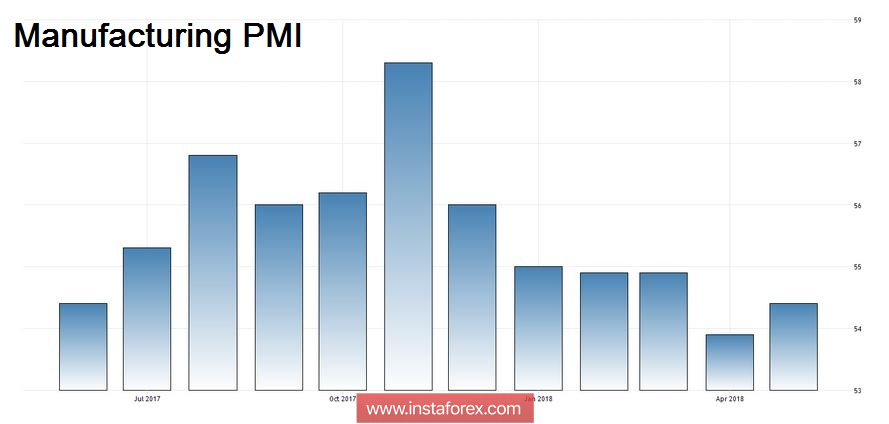

It is also worth recalling that the macroeconomic indicators of Britain demonstrate growth again. Literally today, the pound jumped to 1.3380 after the release of data on PMI in the service sector. The indicator demonstrates positive dynamics for the second month in a row and today, it came out better than expected, reaching 54 points. The PMI index in the manufacturing sector also exceeded the forecast values, confirming the economic recovery. Labor market and inflation showed less impressive, but at the same time, a good result. The unemployment remained at a record low level of 4.2%, and the consumer price index in the monthly reached 0.4% after a decline to 0.1%. If these indicators again show growth next week, this will be an additional reason for the recovery of the pound / dollar pair. But only on one condition, if parliamentarians approve pro-European amendments to the Brexit law.

From the technical point of view, the pair is in the downlink with a support level of 1.3210 (the lower line of the Bollinger Bands indicator on the daily chart). If we talk about the level of resistance, here we are dealing with the mark of 1.3485 (the line Kijun-sen) and 1.3605 (the upper line Bollinger Bands on D1). When overcoming these targets, one can count on the development of the northern movement to 1.3901, which corresponds to the lower boundary of the Kumo cloud.