Yesterday, the American president expressed his opinion once again about the trade war being waged by his administration with China. Trump believes that he can reach a trade agreement with China and the problem that exists around Huawei will be solved. The American president is also confident that the Chinese authorities have an advantage over the United States, as they constantly weaken their currency. Meanwhile the Federal Reserve is on the way back and does not lower interest rates.

Criticism of the Fed chairman is not the first time that the American president has sounded. This time, Trump noted that some of the Fed's decision-makers in monetary policy are not suitable for this.

As for the fundamental statistics, which was published yesterday, the market took it rather calmly as a whole.

According to the Conference Board, the employment trends index rose to 111.63 points in May against the revised April value of 110.21 points. The agency noted that, the decline in the index will be quite moderate despite some slowdown in employment growth.

Yet, the decline in inflation expectations once again confirms the need for the Fed to resort to lower interest rates.

According to the Fed-New York report, it is predicted that in a year inflation will be 2.5% and in three years will be 2.6%, which is 0.1% lower than the April figures. Let me remind you that the Fed is closely monitoring inflation expectations, and a decrease in interest rates is likely if it fails to reach the target inflation rate of 2% on an ongoing basis. The market inflation expectations for the next five years also remained below 2%.

As for the general technical picture of the EUR/USD pair, it is likely that the demand for risky assets will continue in the context of possible changes in the Fed's monetary policy. If we talk about the short-term forecast, support is seen at the level of 1.1290 while the breakthrough of intermediate resistance in the area of 1.1330 will lead to a larger uptrend of the trading instrument with updating highs in the areas of 1.1370 and 1.1430.

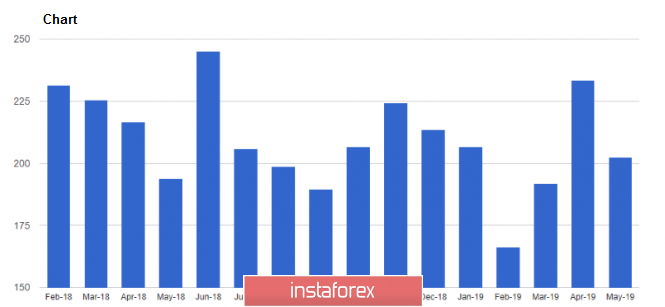

As for the Canadian dollar, yesterday's data on a sharp decline in the bookmarks of new homes did not frighten buyers. The USD/CAD pair remained at its lows and apparently, will continue to decline.

According to a report by the Canada Mortgage and Housing Corp., the number of bookmarks for new homes in May 2019 decreased by 13.3% to 235,460 homes. The agency noted that the volatility of laying houses in Canada continued with the fall in May, following a strong increase in April.