When failures are so quickly redeemed, as in the case of gold in early July, there is no doubt – the market is under the total control of the bulls. They raised the XAU/USD quotes to the maximum level for the last 6 years. It was their activity that allowed ETF reserves to grow for 14 consecutive days and reach their peak in 2013. In this regard, the worst daily dynamics of precious metals for more than a year after the announcement of the results of the G20 summit only pleased buyers. They had an excuse to buy something cheap.

The de-escalation of the US-China trade conflict has increased global risk appetite and put pressure on safe-haven assets. The States abandoned their idea to impose duties on all imports of China and made concessions for Huawei, and Beijing promised to buy more American agricultural products. Opponents returned to the negotiating table, and the yield of 10-year Treasury bonds seems to be firmly entrenched above the psychologically important level of 2%. Bad news for gold, which does not bring interest income and is not able to compete with debt obligations in the event of an increase in interest rates on them.

As further events have shown, the joy of the "bears" was short-lived. Investors digested the information received from the G20 summit and came to the conclusion that before the end of the US-China trade war, a lot of water will leak. In addition, the States intend to deploy military action in the other direction and attack Europe. In connection with the illegal subsidizing of Airbus, Washington intends to increase the number of duties on European imports from $17 billion to $21 billion, and these are just flowers. Berries will begin later when the issue of tariffs for the import of cars from the Old to the New World will be considered. Protectionism continues to walk through the world, which increases the risk of a recession and contributes to the decline in bond yields.

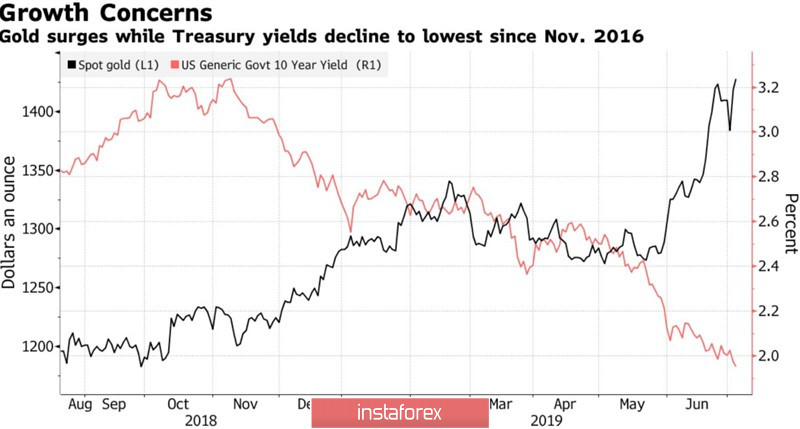

Dynamics of gold and US bond yields

The central banks are also forced to respond to signs of a targeting recession. The RBA has twice reduced the cash rate to a record low of 1% and, according to Black Rock's largest asset manager, could raise the rate to 0.5% in 2020. Mark Carney warns of a serious slowdown in the British economy in the case of disorderly Brexit, and representatives of the ECB talk about the feasibility of resuscitation QE. The possible appointment of Christine Lagarde as head of the European Central Bank added fuel to the fire. The French woman in 2014 urged the Governing Council to buy assets.

Low rates of the global debt market are the guiding star of gold. They allow the "bulls" on XAU/USD to turn a blind eye to such negative drivers for them as the stability of the US dollar and the rally of US stock indices.

Technically, after the precious metal reached the target by 161.8% on the pattern AB=CD, a natural rollback to 23.6% of the CD wave followed. The inability of the "bears" to gain a foothold below this level indicates their weakness. Updating the June high will allow the bulls to continue the attack. Its target is the level of 200% for the model AB=CD.