The euro remained to trade in a narrow side channel paired with the US dollar after the release of reports on the PMI index for the sphere of servants of the eurozone, which grew. This allowed the bulls to strengthen the defense level of 1.1275 and prevent a new wave of lower risk assets.

According to data, the purchasing managers' index (PMI) for Italy rose to 50.1 points in June, while in May it was 50.0 points exactly. Economists had expected the index to fall to 49.9 points, which would indicate a reduction in activity.

In France, the similar purchasing managers' index for the service sector continued to grow in June and amounted to 52.9 points against 51.5 points in May. However, economists were counting on a more powerful fortification in the area of 53.1 points.

In Germany, everything is also in order with the sphere of services. There, the purchasing managers' index (PMI) strengthened in June to 55.8 points against 55.4 points in May, while the forecast was 55.6 points.

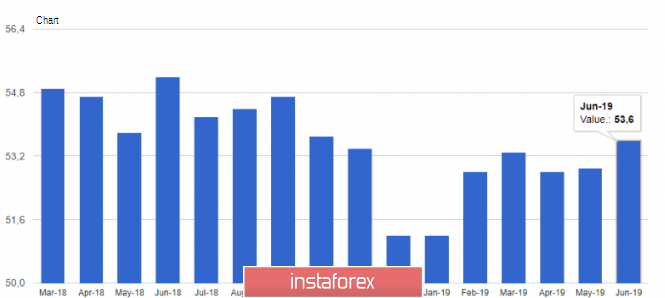

All this had a positive effect on the overall indicator for the euro area, which in June was 53.6 points, whereas in May it was at the level of 52.9 points. The data exceeded the forecasts of economists, who expected the growth of the eurozone service sector to 53.4 points. Despite the good performance in terms of activity, the euro's response to the data was very restrained.

Today, there was news that the current CEO of the International Monetary Fund, Christine Lagarde, will definitely be appointed to the new president of the European Central Bank. Let me remind you that the term of Mario Draghi as president of the ECB expires on October 31 and cannot be extended.

Lagarde's appointment to this post was unexpected since she has no experience in the field of monetary policy, which cannot be said about other candidates who are more closely connected with the financial sphere. It can be concluded that all key decisions on the planned interest rate reduction in the euro area and the return of the bond redemption program can be made until October of this year, and the new ECB head will not interfere with these decisions at the beginning of his work.

As for the technical picture of the EURUSD pair, the bears did not succeed in breaking through the support of 1.1275, and therefore the entire emphasis remains precisely at this level. Only a breakdown of the range of 1.1275 will lead to a larger downward bearish impulse paired with an exit to the lows of 1.1240 and 1.1200. In the upward correction scenario, a large resistance is seen in the maximum area of 1.1340.

The British pound is expected to fall against the US dollar after it became known that the UK economy continues to experience difficulties. According to the results of surveys of supply managers, the uncertainty associated with Brexit affects the activity in the UK services sector, which is the mainstream economy.

According to the report, purchasing managers' index (PMI) for services fell to 50.2 points in June from 51.0 points in May, which indicates a very high probability of stagnation. Let me remind you that the index value above 50 keeps the growth of activity.

In IHS Markit noted that the sharp decline is directly related to the uncertainty around Brexit, which will further contribute to slowing the growth of the country's economy.