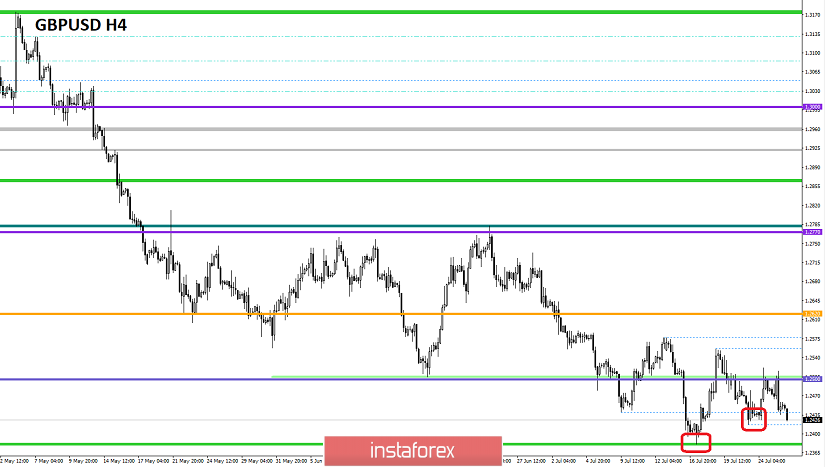

Over the previous trading day, the pound / dollar currency pair showed a volatility equal to the average daily of 80 points, as a result of having an attempt to restore the original movement. From the point of view of technical analysis, we see that the periodic level of 1.2500 played the role of resistance, restoring bearish interest in the market. As discussed in the previous review, traders were divided into several factions: The first attributed themselves to the obvious bears and held downward positions from July 19-22. The latter were insured and covered their previously open sell positions at the time of the rebound on July 24, but they still retained a downward interest. So yesterday, they were actively looking at points to restore short positions; the third faction closed down positions by zero and took a waiting position. Considering the trading chart in general terms (daily timeframe), we see that the theory for the "Correction" tact has not yet arrived and that the "Impulse" tact in global terms is still valid. It has been justified and there is a prerequisite for updating the minimum.

The news background of the past day contained statistical data on the volume of orders for durable goods in the United States, where they expected an increase, but not such a development. To begin with, the previous data on stocks were, to put it mildly, not very much, -1.3%, but they were revised, and it turns out that everything was much worse, -2.3%. In fact, the data came out very positive, an increase of 2.0%, and, of course, against this background, the dollar went to strengthen. Yesterday, there was an ECB meeting at the center of the event, where the rate was left unchanged, which is normal in principle, but before this event, several publications were respected for several days in a row and experts persistently pushed through the topic of lowering the rate, as if preparing for the gulf of their deals. Of course, after the speech of the ECB Head Mario Draghi and the final arrangement of all points over all the discussions, the euro did not start a childish storm, and the pound, in turn, continued to wobble on its own wave. What is the reason for the lack of correlation between pairs? We begin with the fact that there is a correlation as such, but not in the current period of time. The pound is experiencing big problems, and with the current appointment of a new prime minister, there is a distinct stupor, fear and ambiguity, and for this reason, the steps are rather awkward. Kohl started talking about a new prime minister, then a few words about his first speech in this position in the parliament. Boris Johnson believes that Britain is still not sufficiently ready to leave the European Union without concluding an agreement, until October 31 wherein the possibility of a Brexit deal remains. Boris also added that it intends to boost negotiations with Europe regarding the terms of the exit and trade agreement. After such statements, an arbitrary smile arises, about which revision of the deal is meant, if so many times our favorite European Commission head Jean-Claude Juncker explained to his colleagues that there will be no revision.

And by the way, Jean-Claude Juncker did not keep himself waiting, and promptly duplicated his previously designated conditions to the new prime minister.

"Juncker confirmed that the EU's position on this is unchanged. In his opinion, the exit agreement is the best and only possible deal. "

Today, in terms of the economic calendar, we have data on GDP (2Q) in the United States, which will certainly interest traders. According to preliminary forecasts, economic growth is expected to slow down from 3.1% to 1.8%.

The upcoming trading week in terms of the economic calendar begins sluggish and boring, but from the environment of "Heavy Metal". The Fed meeting with a possible reduction in the key rate, given by the ADP with the subsequent non-farm outcome, will also have a meeting with the Bank of England, but it is unlikely that there will be something super-ordinary.

The most interesting events were displayed below --->

Wednesday, June 19

United States 12:15 UTC+00 - Change in the number of people employed in the non-farm sector from ADP (July): Prev. 102K ---> 153K forecast

United States 18:00 UTC+00 - Fed interest rate decision: Prev. 2.50% ---> Forecast 2.25%

United States 18:30 UTC+00 - FOMC Press Conference

Thursday, June 20

United Kingdom 08:30 UTC+00 - Manufacturing Business Index (PMI) (July): Prev. 48.0 ---> Forecast 49.2

Bank of England meeting followed by a press conference

United States 14:00 UTC+00 - Manufacturing PMI from ISM (July): Prev. 51.7 ---> Forecast 52.7

Friday, June 21

United Kingdom 08:30 UTC+00 - Index of business activity in the construction sector (July): Prev. 43.1

United States 12:30 UTC+00 - Change in the number of people employed in the non-agricultural sector (July): Prev. 224K ---> 160K forecast

United States 12:30 UTC+00 - Unemployment rate (July): Prev. 3.7% ---> Forecast 3.6%

These are preliminary and subject to change.

Further development

Analyzing the current trading chart, we see that the pound is still seeking to update new lows, storming the 1.2430 mark, which previously held us. Traders, in turn, held downward positions with the hope of a move to 1.2381, but they will actively talk about this after the breakdown of the 1.2417 mark (July 23). It is likely to assume that in the case of overcoming the value of 1.2417, we will move towards 1.2381, but we should not forget about the statistics from the United States, which may contain a strong fall.

Based on the available information, it is possible to decompose a number of variations, let's specify them:

- We consider buying positions in two variations: the first, in the case of another deceleration within 1.2420 / 1.2430, with another refinement; the second option, already in the case of support in the range of 1.2380. In any case, there must be a confirmation of a rebound.

- If we do not have sell positions, then the point is considered to be around 1.2417, with the primary move to 1.2381.

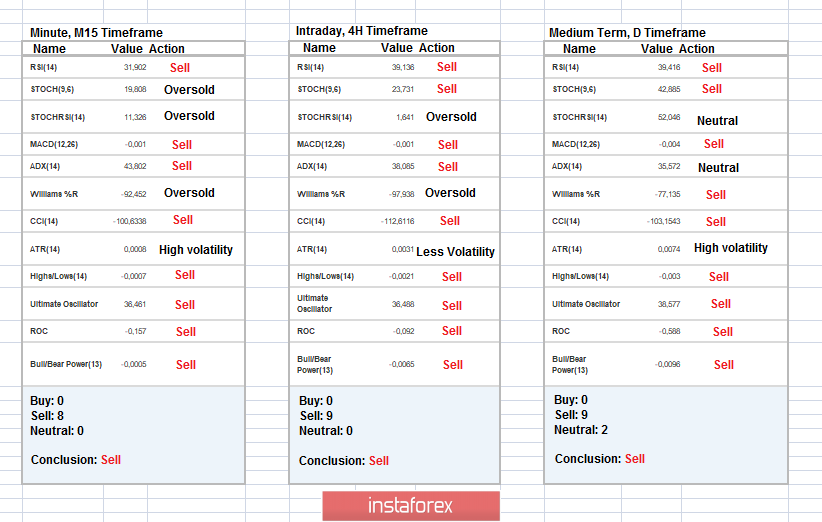

Indicator Analysis

Analyzing a different sector of timeframes (TF), we see that indicators in the short, intraday and medium term perspective are fixated on a downward trend, which is quite justified against the general background of the market.

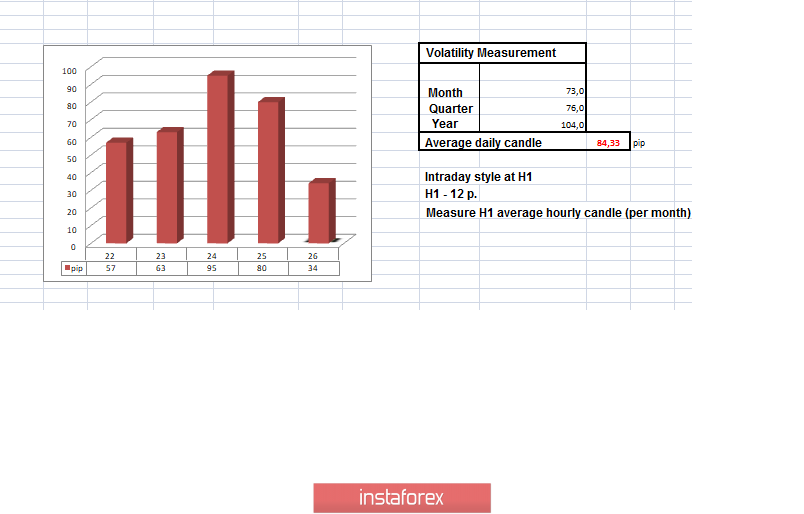

Weekly volatility / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year.

(July 26 was based on the time of publication of the article)

The current time volatility is 34 points. It is likely to assume that the volatility will be limited to the daily average and the current framework in the form of price values.

Key levels

Zones of resistance: 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300.

Support areas: 1.2381 *; 1.2350 **; 1.2100 **; 1.2000.

* Periodic level

** Range Level

*** The article is based on the principle of conducting a transaction, with daily adjustment