NZD/TRY has been quite impulsive with the recent bearish momentum while residing inside the corrective range between 3.7570 and 3.8550 area. Turkey has certain rate cut bias, so TRY managed to gain momentum over NZD which is expected to extend further as the market sentiment shifts.

New Zealand reported a better-than-expected trade surplus for June, but it came on the back of a fall in imports as exports decreased suddenly. This is a fresh sign that global trade is contracting. The New Zealand Dollar/ Turkish Lira has shown a correction from the last few weeks. The New Zealand Trade Balance for June was reported at 365M monthly and at -4,937M 12-month year-to-date where the predictions were a figure of 100M and of -5,105M. Investors can compare this to the New Zealand Trade Balance for May which was reported at -264M monthly and at -5,492M 12-month year-to-date. Exports for June were reported at 5.01B and imports came in at at 4.65B. RBNZ also indicated further easing in August and pointed out that the risks related to trading activity have been strengthened but the downside risks remained unchanged to the employment and inflation outlook. The RBNZ is expected to converge with the RBA over time, depending on the incoming data.

On the other hand, the Central Bank of Turkey declared a policy easing by cutting the policy rate by 425bp to 19.75% vs market consensus of 250bp at its July rate-setting meeting. With the decision, the ex-post real policy rate that had been low or sometimes even negative since the global crisis dropped sharply to 400bp from more than 800bp before vs the average ex-post policy rate for EM peers around 300-400bp. The bank explained on the recently released data and provided opportunities for the near term. On the inflation front, it recognized the ongoing downtrend on the back of a deceleration in unprocessed food and energy prices, along with a contribution from domestic demand and the tight monetary policy. The inflation report will be released next week showing the evidence of inflation forecast where the current expectation is slightly the projections of the April. The year-over-year increase in consumer prices peaked last October near 25.25%. In June it stood at 15.72%. Before the weekend, the central bank's survey of inflation expectations over the next 12 months fell to 13.90% from nearly 16.5% at the end of last year.

As of the current scenario, despite the positive trade balance report, NZD could not manage to attract market sentiment over TRY which indicates the strength TRY have over NZD. Ahead of the ANZ business confidence from New Zealand along with the Turkish trade balance, the New Zealand Dollar/ Turkish Lira is expected to continue the bearish pressure where the ultimate target will be at 3.50.

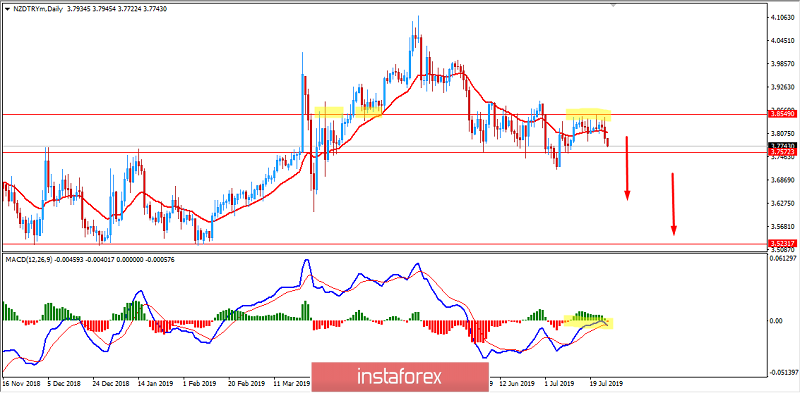

TECHNICAL OVERVIEW:

The price is currently pushing lower with an impulsive bearish pressure after rejecting off the corrective range resistance of 3.8550 area while MACD moving averages also crossed rejecting the resistance of 0.00 level. The preceding trend was bearish and after such consolidation, the price is expected to push lower as it remains below 3.8550 area with a daily close. The price having no Bullish Divergence to oppose the current bearish momentum is expected to lead to further downward pressure in the coming days which may lead the price lower towards 3.50 support area.