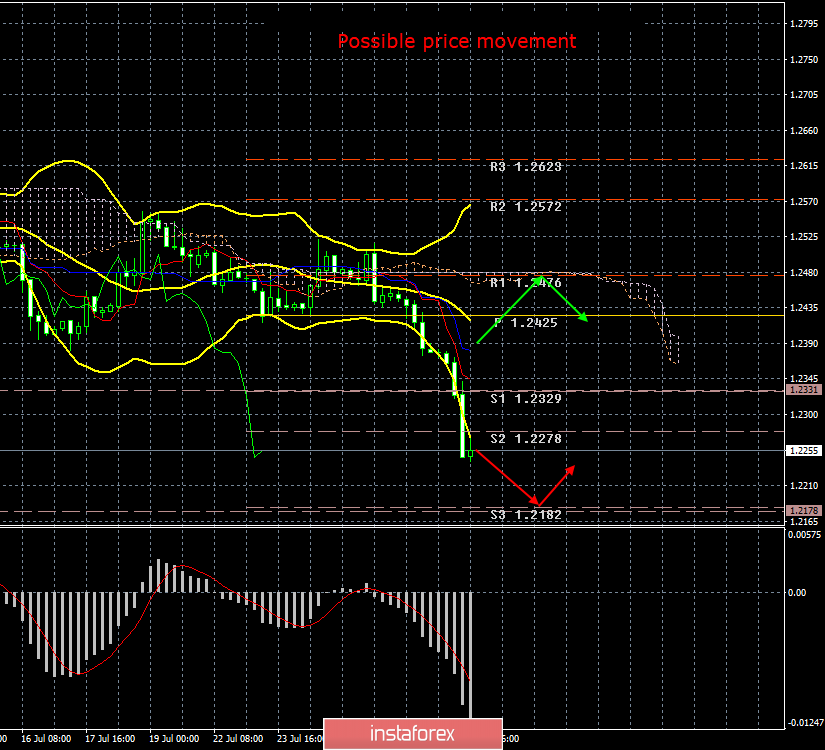

4-hour timeframe

The amplitude of the last 5 days (high-low): 58p - 64p - 96p - 81p - 84p.

Average amplitude for the last 5 days: 77p (76p).

For the nth attempt, Boris Johnson still realized that the European Union was not ready to enter into new negotiations, or decided to start a large-scale bluff by organizing preparations for a "hard" Brexit. We are talking about a huge amount from the British budget, which will be spent on advertising an unorganized "divorce" with the European Union. Johnson intends to inform every citizen of the United Kingdom and convince him that the hard Brexit is not as scary as opposition political forces say. For example, Laborites who vehemently oppose this option. However, not only Laborists oppose Brexit "without a deal." The Confederation of British Industry, an independent organization that protects British industrialists before the government, announced that neither the EU nor the United Kingdom were prepared for such a scenario. Uncontrolled Brexit, according to the PCU, will cause problems in 24 of the 27 UK regions. In principle, the same opinion is shared by the head of the Bank of England, Mark Carney, and many other analysts. The British Parliament is frankly against such an outcome. The question still remains: how is Boris Johnson going to conduct a hard Brexit through Parliament? Nothing has been announced about special elections yet, respectively, the composition of the Parliament remains the same, which has already repeatedly blocked even the possibility of conducting an unorganized Brexit. Based on the foregoing, it is possible that Johnson is actually bluffing, trying to push Brussels into new negotiations. But the British pound and foreign exchange market do not support the optimism and intentions of Johnson. The UK currency continues to fall down, actively traded on July 29.

Trading recommendations:

The pound/dollar currency pair resumed the increased downward movement. Thus, it is now recommended to continue selling the pound sterling with the goal of a support level of 1.2182.

After the pair is consolidated above the critical line, it will be possible to buy the British currency, however, with extreme caution and small lots. The first goal is the level 1.2476.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.