To open long positions on EURUSD, you need:

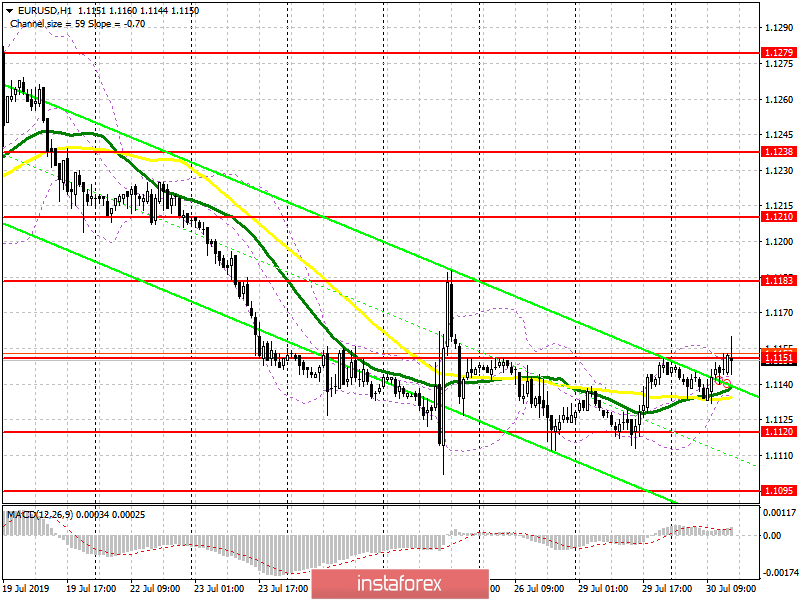

The absence of important fundamental statistics, apart from the indicator of consumer confidence, which remained at a negative level in the eurozone, led to the preservation of low market volatility, and inflation data in Germany returned the pair to a major resistance of 1.1151, which I drew attention to in my morning review. Only a breakthrough and consolidation above this range will allow the bulls to count on the continuation of the upward correction in the area of the upper boundary of the wide side channel of 1.1183, where I recommend taking the profit. If the bulls are not able to get to the level of 1.1151, I recommend returning to long positions only after updating the intermediate support of 1.1120 or to rebound from the lower border of the side channel in the area of 1.1095.

To open short positions on EURUSD, you need:

Once again, the bears will count on a breakthrough of the support of 1.1120, which could not be done yesterday in the absence of important fundamental statistics. Fixing below this level will give a new impetus to the downward trend, which will lead to new lows in the area of 1.1095 and 1.1068, where I recommend taking the profits. The formation of a false breakout in the resistance area of 1.1151, which bears are now trying to form, will be a signal to open short positions in EUR/USD. However, much will depend on the data that will be released on consumer confidence in the US in the afternoon. Good performance will return to the euro seller's market. With a weak report and the growth of EUR/USD above the resistance of 1.1151, it is best to return to short positions on the rebound from the maximum of 1.1183 or from a larger area of 1.1210.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

Volatility is low, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20