To open long positions on GBP/USD, you need:

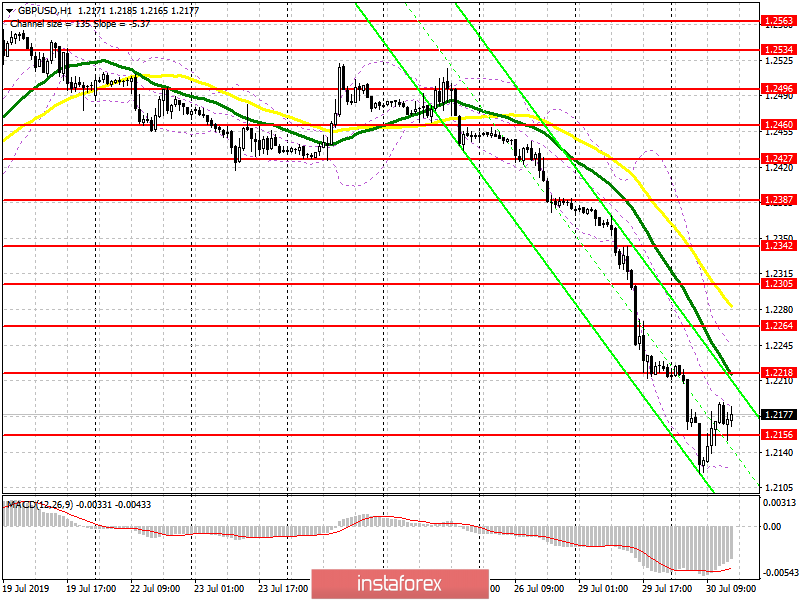

Buyers of the pound are in no hurry to return to the market, and the current small growth is associated with profit-taking on short positions after a major drop formed at the end of last week. Buyers formed intermediate support in the area of 1.2156, and all emphasis is now placed on it. The formation of a false breakout in this range in the second half of the day can lead to further growth of GBP/USD in the resistance area of 1.2218, where I recommend taking the profit. However, the key goal will be the resistance of 1.2264, where bears will try to build the upper limit of the downward channel. In the scenario of further GBP/USD decline and return to the support level of 1.2156, it is best to return to long positions after updating the monthly minimum in the area of 1.2100 or a rebound from larger support of 1.2040.

To open short positions on GBP/USD, you need:

Sellers cannot yet worry about the current upward correction, and even large "gaps" in the resistance area of 1.2218 and 1.2264 will not lead to a change in the current trend. You can open short positions on a false breakout from the first level of 1.2218, and sell immediately on a rebound from the maximum of 1.2264, where sellers will build the upper limit of the current downward channel. However, the main scenario for the continuation of the downward trend will be a return to the support level of 1.2156, which will lead to an update of the monthly lows of 1.2100 and 1.2040, where I recommend taking the profit. Any statements by the new British Prime Minister on the UK's withdrawal from the EU without an agreement will continue to have a negative impact on the pound.

Indicator signals:

Moving Averages

Trading is below 30 and 50 moving averages, which indicates a further decline in the pair.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.2240 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20