The eurozone data released in the morning did not make any significant changes in the market situation but pointed to the necessary changes in the course of monetary policy. Despite the fact that German consumer sentiment is likely to worsen in August of this year, and this will happen against the backdrop of a slowdown in the global economy, the euro strengthened slightly before the publication of the Fed's interest rate decision, which will be known tomorrow.

The report of the GfK research group noted the risks of trade conflicts and uncertainty of Brexit prospects, which puts direct pressure on consumer sentiment. According to the data, the leading index of consumer confidence GfK in August 2019 fell to 9.7 points against 9.8 points in July. The data completely coincided with the forecasts of economists. The index of economic expectations in July fell to -3.7 points from 2.4 points in June, the index of propensity to buy fell to 46.3 points.

Data on the assessment of their prospects by eurozone companies may affect the decision of the European Central Bank on monetary policy, as the weakening of confidence in companies confirms the need for policy easing. A special problem is noted by companies in the manufacturing industry, where the level of pessimism has reached a very high value.

According to the report of the European Commission, the indicator of sentiment in the eurozone economy in July 2019 fell to 102.7 points against 103.3 points in June. As noted above, the eurozone manufacturing sentiment indicator fell immediately to -7.4 points in July from -5.6 points in June, and capacity utilization fell to 81.9% in April from 82.8% in January.

Let me remind you that last week, weak indices of supply managers also came out, which together indicates a slowdown in economic growth and increases the likelihood of easing the ECB's policy in the near future. Many experts now expect the Central Bank to lower rates in September this year.

Preliminary data on inflation in Germany provided only temporary support for the euro, but it was not possible to get beyond even the intermediate resistance level of 1.1150.

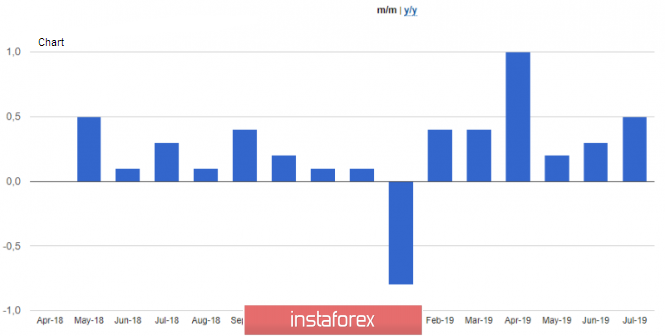

According to the report, the consumer price index (CPI) of Germany in July 2019 increased by 0.5% compared to June and by 1.7% compared to the same period of 2018. Economists had expected growth of only 0.3% and 1.5%, respectively. As for the harmonized index according to the EU standard, consumer prices in July increased by 0.4% and by 1.1% per annum.

Today, there was news from the Chinese Politburo, which stated that the economy faces new risks and challenges, as well as increased downward pressure, which requires additional incentives. It is expected that the Chinese authorities will stabilize investments in the manufacturing industry, as well as will begin to stimulate medium and long-term financing of plants and private companies.

The Politburo also promised to effectively deal with the consequences of trade disputes with the United States and stimulate domestic demand.

Apparently, the US President Donald Trump did not like the new course of the PRC much, since immediately after the Politburo report, he warned China about a much tougher trade deal that would be proposed if he was elected for a second term, thereby hinting at the need to agree to the current conditions. Also, the American President drew attention to the fact that China is behaving very badly and does not fulfill its promises to purchase agricultural products, an agreement on which was reached during the recent negotiations.

As for the current technical picture of the EURUSD pair, serious changes in the market will take place tomorrow, when the Federal Reserve announces its decision on interest rates.

In the meantime, the growth of the trading instrument is limited by the resistance of 1.1150, the breakthrough of which can only briefly strengthen the upward correction in risky assets, which will lead to the update of the larger level of 1.1185, formed last week. In the case of a return of pressure on the European currency, and such a scenario is more likely, support will be provided by a weekly minimum in the area of 1.115 or a larger area of 1.1090, from which profit taking before the important decision of the Fed will be visible in the market.