EUR/USD

On Tuesday, the euro came under pressure from unfavorable economic statistics, but investors missed the data ahead of the Fed's FOMC decision on Wednesday. French GDP for the 2nd quarter was 0.2% against a forecast of 0.3%, personal incomes and consumer spending in the US showed an expected increase of 0.4% and 0.3%, respectively. But trading volumes were not large, as the euro rose by 11 points.

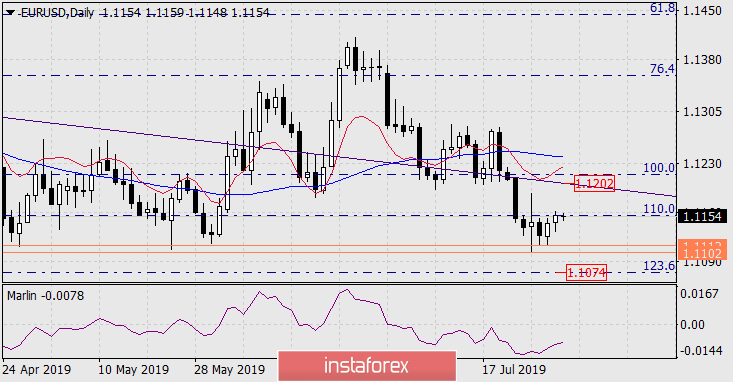

The price reached a Fibonacci level of 110.0% on the daily chart, where it stayed until today's Asian session. The signal line of the Marlin oscillator was discharged - it rose upwards, which may be a sign of a continued decline in case of favorable fundamental component.

On the four-hour chart, the price reached the balance and MACD line, and also lingered in them. The primary signal for a further decline is the departure of the price below 1.1132. Next, we expect to overcome the support zone of 1.102/12 and further decline to 1.1074 and 1.0985.

But today, the Fed will announce the decision on the rate with a market likelihood that it would decrease by a quarter point at 100%. The risk of a short-term growth in the euro to the line of the price channel at 1.1202 (daily), of course. In our opinion, today's rate cut is quickly being absorbed by the market, since, in parallel with the Fed, the European Central Bank also pursues a policy of easing, and amid deteriorating European economic indicators. Western media claim that the Fed rate cut has already been taken into account in the price. We do not agree with this statement, but the message is clear - financial institutions do not want a weakening dollar, which fits into our concept of a strong dollar in the long run.

Therefore, we see two scenarios for the euro's near development: an immediate downward movement after a decision on the rate, and especially after Jerome Powell's press conference, where a pause in the mitigation cycle can be mentioned, and a downward movement after a short-term growth to 1.1202.