Today, all markets are focused on the outcome of the Fed meeting on monetary policy. Investors are confident that the Central Bank will cut the key interest rate by 0.25%.

Indeed, the market believes with a probability of 78.1%. According to the dynamics of futures on federal funds rates, the regulator will lower the key interest rate by a quarter of a percentage point. However, there are also a number of market participants who are sure that the decision will be made to lower the rates immediately by 0.50% up to a range from 1.75% to 2.00%. This possibility is estimated at 21.9%. All data are accounted at the time of this writing.

In our opinion, it is not the fact of the decision to reduce the cost of borrowing that is important anymore but rather, what the bank will undertake in the future. Are they going reduce further the level of interest rates?

This is really a fundamental question. Recently, the situation in the American economy has improved somewhat, we have indicated this earlier. But, as we see it according to our mandate, the Central Bank should consider longer-term prospects in the national economy, rather than the current dynamics, which, of course, is important, but not decisive. For example, some economic indicators contain in their values the effect of a time lag. This fully applies to the labor market, which is now at its historical highs over the past 60 years. However, at the same time, according to the latest data, the US GDP fell in growth in the second quarter to 2.1% from 3.1%, although a decrease was expected to be more noticeable to 1.8%. At the same time, the most important inflation rate for the Fed, the basic index of personal consumption expenditures added 1.6% in annual terms, rather than the expected 1.7%. The deflator of this indicator fell to 1.4% from 1.5% in annual terms. It was expected that it will maintain a growth rate of 1.5%. An ambiguous picture is also noted in production figures.

An additional negative for the US economy is still the trade confrontation between the United States and China, the end of which is not yet visible.

In general, we can say that the Fed will have to act proactively in this situation and not wait until the economic situation begins to show a steady decline. Given this, we believe that lowering interest rates will not be a one-off and turn into a whole cycle. In this situation, not only the US, the stock market will receive significant support, which can only intensify if at least some sane trade agreement between Washington and Beijing is reached this week. On this wave, the course of the American dollar will be under pressure.

It is likely that if today J. Powell signals that this decrease may not be single, the dollar will drop sharply against most major currencies.

Forecast of the day:

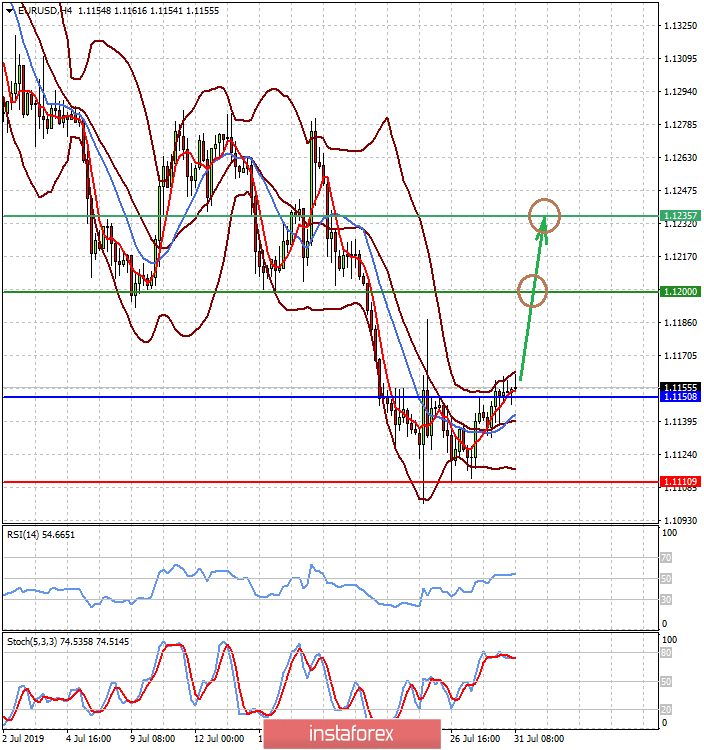

The EUR/USD pair is trading above the level of 1.1150 and its growth may continue to 1.1200 and even to 1.1235 if the Fed makes it clear that the rate reduction will not be once time

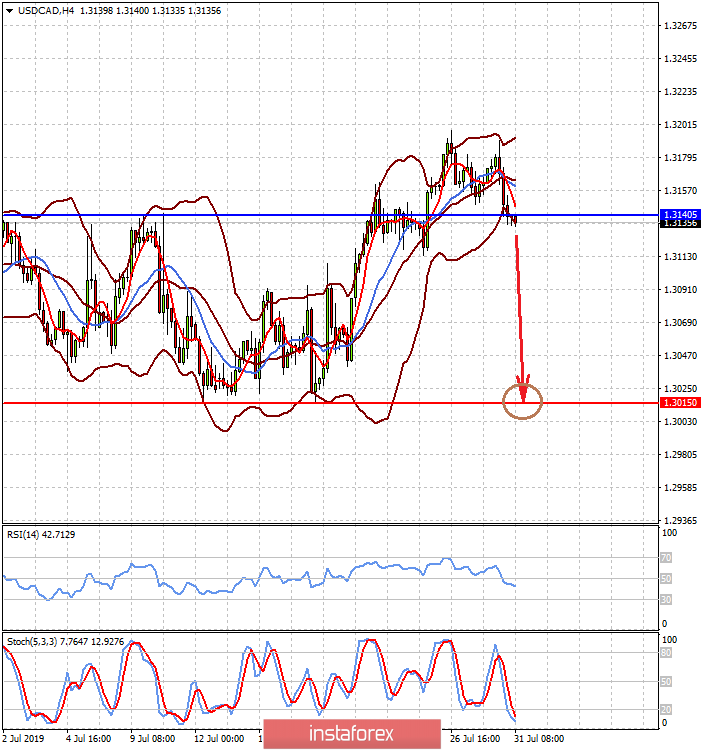

The USD/CAD pair s below 1.3140 on the wave of the release of data on oil reserves from the American Petroleum Institute, which showed a marked drop. The pair may continue to decline to 1.3015 in the wake of the Fed's decision to lower interest rates.