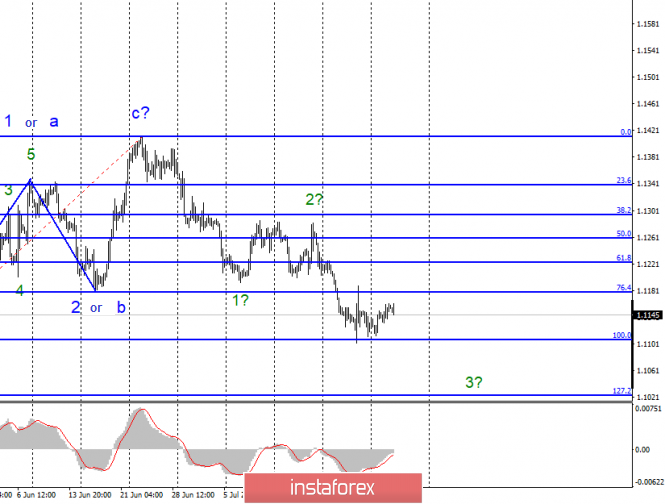

EUR / USD

On Tuesday, July 30, trading ended for EUR / USD by an increase of another 10 basis points. However, even the overall growth of the euro is now too small to imply anything more than the usual corrective wave of 3 downward trend. Tonight, it will be known whether the Fed will satisfy Donald Trump's requests to lower the key rate. Markets will surely be satisfied. Economic data recently in America had a negative trend. Inflation has slowed. Negotiations with China are in place. Thus, with the rate cut by 25 bp - the matter is almost solved. However, I believe that this will not put much pressure on the US currency. There are not much problems in the European Union. Economic indicators are not better, and the rate is at the level of 0% (deposit rate is altogether at 0.4%). So the rate cut to 2, 25% will not change the balance of power between the economies of the EU and the US and their currencies. Only specific signals from the chairman of the Fed Powell about the readiness to cut rates and on the next meetings can play against the dollar.

Purchase goals:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1106 - 100.0% Fibonacci

1.1025 - 127.2% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build the downward trend. Lowering sentiment in the Forex market remains. Thus, I recommend selling the pair with targets near the levels of 1.1106 and 1.1025, which equates to 100.0% and 127.2% Fibonacci, according to a new MACD signal down.

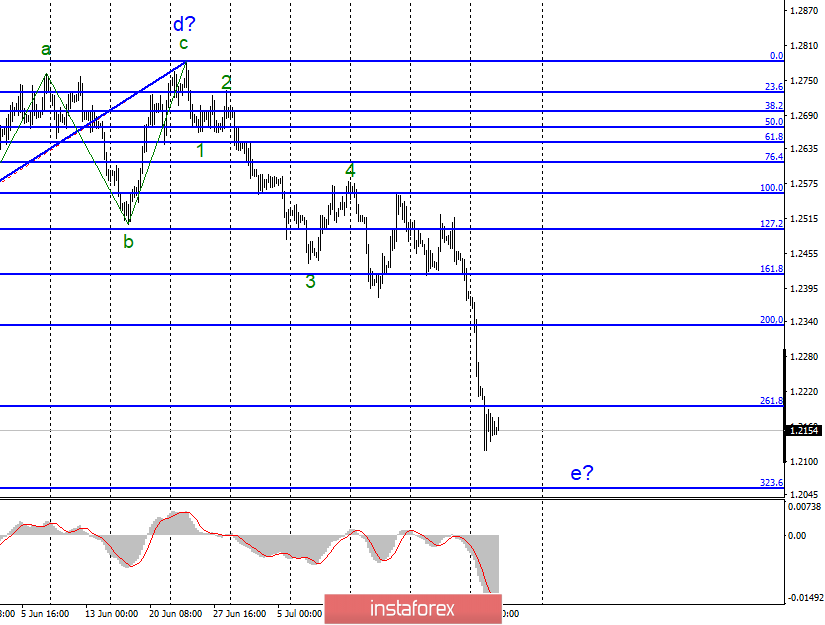

GBP / USD

The GBP / USD pair fell on July 30 by 65 basis points and continues to build a downward wave. Since tonight, the outcome of the Fed meeting and the decision on the rate will be known, it would be necessary to analyze a couple of pound-dollars precisely in the context of this event. However, the pound sterling is now more interested in events related to Brexit. The British pound fell to 28-month lows, as the probability of Brexit deal rose sharply with the assumption of the post of Prime Minister Boris Johnson. Thus, the evening events can be completely ignored by the market. But still, they should not be overlooked. And if Jerome Powell holds a press conference for future rate cuts, it might even support the dollar in tandem with the pound. Based on the current wave marking, the downward wave does not look complete.

Sales targets:

1.2056 - 323.6% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar tool now implies a complication of the downward trend. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated mark of 1.2056.