Yesterday's decision of the Federal Reserve System on interest rates did not surprise anyone. Another question is how the committee is going to proceed, given the pressure from the White House and the current situation in the world economy and trade.

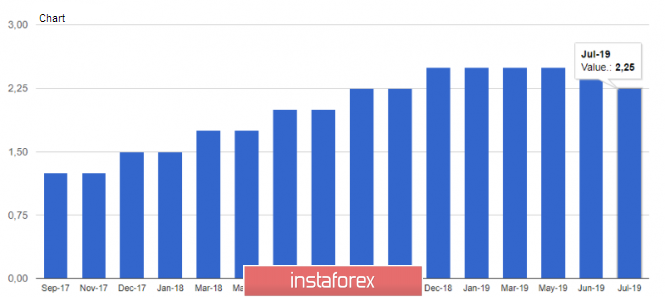

According to the data, yesterday, the Central Bank set the range of interest rates on federal funds between 2.00% and 2.25%, lowering it from the level of 2.50%. For this decision, the committee on open market operations of the Fed voted by a vote of 8 to 2. The Fed also lowered the discount rate by 0.25 percentage points to 2.75%.

In statements that were immediately made after that, it was noted that the Fed lowered the rate by a quarter of a percentage point, but left the "door open" for further reductions this year. Expected sustainable growth of the economy, but uncertainty remains, therefore, it is necessary to monitor the economic data as you ponder the future course of interest rates.

One of the reasons for the lowering of interest rates was the weak inflation on which the Federal Reserve relied when making such a decision. It also became known that the portfolio reduction program was completed earlier by two months before the schedule.

During his speech, Fed Chairman Jerome Powell tried to reveal in more detail the further course of monetary policy but mainly focused on the stability of the economy and the importance of analyzing the incoming data.

Powell said that prospects remain favorable as the economy grew at a healthy pace in the first half of 2019. The current rate cut is intended to protect against downside risks from trade and the tense situation in the world. The Fed Chairman also noted that weak global growth, weak inflation, and uncertainty around trade speak in favor of lowering the rate, but the economic indicators are close to our goals. Yesterday's actions of the Fed were aimed at maintaining favorable prospects for the economy.

Powell also stressed that the current rate cut "definitely has a safety aspect" rather than a systemic one, as trade tensions have a significant impact on the economy. The head of the Fed also made it clear that the rate cut is not the beginning of a long cycle of easing, but an adjustment in the middle of the cycle. Therefore, the committee's further action on monetary policy will depend on the data received.

Given all this, traders continued to buy the US dollar, as they did not hear anything in the statements that could significantly affect the current monetary policy in the medium term. Expectations of lower interest rates in the eurozone are a more "slippery" topic, given the fact that they are already at zero. Therefore, the course of further strengthening of the US dollar will be a better solution.

Yesterday's reports on the US economy were ignored by the market, despite the growth of jobs.

According to ADP, the number of jobs in the US private sector increased by 156,000 in July 2019, thanks to good employment growth in both small and large companies. Economists had forecast an increase of 150,000. The leader of growth was the service sector, where the number of jobs increased by 146,000.

But the business barometer of Chicago in July fell again below the mark of 50 points.

According to the report, the purchasing managers' index (PMI) of Chicago in July fell by 5.3 points to 44.4 points. Economists had expected the index to be 50.5 points. Let me remind you that the index value above 50 indicates an increase in the activity.

As for the current technical picture of the EURUSD pair, the bears have reached a large support level of 1.1030, but the "stop" is a temporary phenomenon. Today's reports on the state of the manufacturing sector of the eurozone countries may have a negative impact on the exchange rate of risky assets, which will continue to decline against the US dollar. The support breakout of 1.1030 will provide the bears with a new "window", which will lead to a decrease in the trading instrument in the area of the lows of 1.0990 and 1.0950. In the case of an upward correction, the growth will be limited by the intermediate resistance of 1.1070, and it is better to open larger short positions after updating the maximum of 1.1100.