Overview:

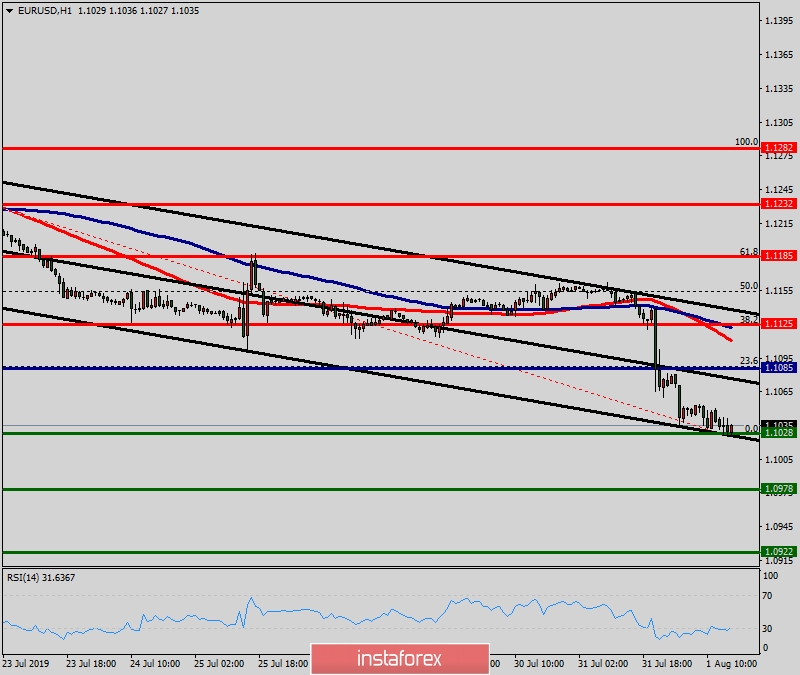

Pivot point: 1.1085

The EUR/USD pair fell from the level of 1.1085 which represents the daily pivot point towards 1.1028 yesterday. Now, the current price is set at 1.1035. On the H1 chart, the resistance is seen at the levels of 1.1085 and 1.1125. Besides, the weekly support 1 is seen at the level of 1.1028. Today, the EUR/USD pair is continuing to move in a bearish trend from the new resistance level of 1.1085, to form a bearish channel. Amid the previous events, we expect the pair to move between 1.1085 and 1.0978. Therefore, sell below the level of 1.1085 with the first target at 1.1028 in order to test the daily support 1 and further to 1.0978 (S2). On the other hand, if the pair fails to pass through the level of 1.1028, the market will indicate a bullish opportunity above the level of 1.1028. The market will rise further to 1.1125 so as to to return to the weekly pivot point and resistance onerespectively. Additionally, a breakout of that target will move the pair further upwards to 1.1185.

Trading recommandations:

The market is likely to show signs of a bearish trend around the spot of 1.1085. In other words, sell orders are recommended below the pivot point (1.1085) with the targets at the level of 1.1028 and 1.0978.

Key levels

- Risistance 2: 1.1185

- Risistance 1: 1.1125

- Pivot point: 1.1085

- Support 1: 1.1028

- Support 2: 1.0978

Comment:

- The daily pivot is seen at the level of 1.1085.

- The market is still in a downptrend. We still prefer the bearish scenario.