To open long positions on GBP / USD pair, you need:

Buyers are fighting for the level of 1.2100 but there is very little hope of an upward correction. If the data on the US manufacturing index turns out to be better than economists' forecasts, we can expect pressure to return in the GBP/USD pair. In this scenario, it is best to open new long positions after updating the next annual lows around 1.2040 and 1.1985. If buyers still manage to make a false breakdown at 1.2100 and gain a foothold above this range in the second half of the day, the task will be to return to the resistance of 1.2160. Here, a larger upward correction can start in the pair to the maximum of 1.2240, where I recommend fixing the profit.

To open short positions on GBP / USD pair, you need:

Keeping the interest rates unchanged, as well as the general approach to monetary policy by the Bank of England, was quite expected. In such a scenario, the pressure on the pound should continue. The breakthrough of the level of 1.2101 will lead to the continuation of the bearish trend that is aimed at the lows in the area of 1.2040 and 1.1985, where I recommend taking profits. If data on the American economy disappoints traders, GBP/USD growth in the resistance area of 1.2160 is not excluded, where bears will again begin to actively return to the market. However, it is better to open larger short positions to rebound from the resistance of 1.2240.

Indicator signals:

Moving averages

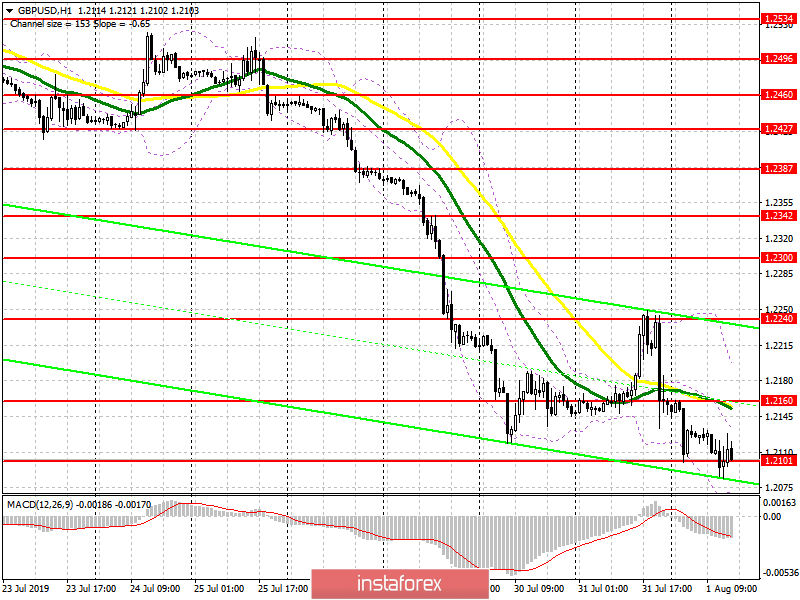

Trading is below 30 and 50 moving averages, which indicates a further decrease in the pound.

Bollinger bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.2170 will act as a resistance, from where you can open short positions immediately to the rebound.

Description of indicators

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20