GBPUSD

In the first half of the day, traders' attention was also focused on the Bank of England's decision on interest rates.

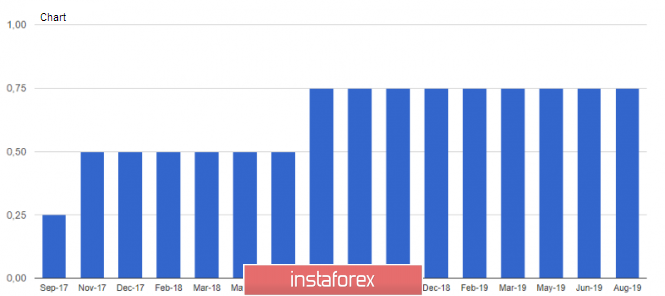

So, the Bank of England left the key interest rate at 0.75%, and the decision to maintain the key rate at 0.75% was made with a ratio of 9-0 votes.

But more attention was focused on statements about whether the Central Bank will raise interest rates in the future, as planned at the last meeting, or in the new conditions Brexit will abandon such measures.

The Bank of England noted that they predict a gradual, limited growth of the key rate in the next few years if Brexit goes smoothly. The next increase in the key rate will also depend on the recovery of global economic growth, which, as we may remember, is slowing.

Also, the Central Bank noted that against the background of the increased probability of Brexit without an agreement, interest rates can be lowered if necessary.

It can be concluded that the monetary policy has been partially revised and changed. We can expect an increase in interest rates in the UK, or even talk about it, only after 100% clarity in the situation with Brexit. In the meantime, the pound will continue to remain under pressure, as the "lifeline", which could be thrown today by the Bank of England, is not necessary to wait.

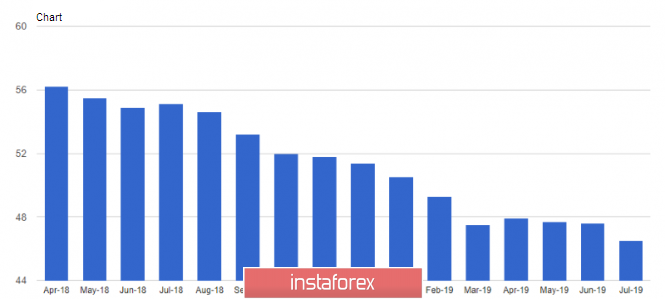

Data on activity in the UK manufacturing sector also put pressure on the pound. According to the report, the index of supply managers for the manufacturing sector in the UK in July this year remained below 50 points and amounted to 48.0 points, indicating a decline in the activity.

EURUSD

Activity in the manufacturing sector of the eurozone weighed on the euro in the first half of the day. Weak external demand, which continues to decline due to the protectionist policy of the White House and the US trade conflicts with a number of countries, including China - all this affects the production sector, which continues to decline, gradually slowing the overall rate of economic growth.

According to the Markit report, the purchasing managers' index (PMI) for the manufacturing sector in Italy in July remained below 50 points and amounted to 48.5 points, while it was expected to decline to 48.0 points. Back in June, Italy's production PMI was 48.4 points.

In France, the same indicator for the manufacturing sector in July fell below 50.0 points to 49.7 points, indicating a decline in activity, although in June it was 51.9 points. Economists had expected the index to rise to 50.0 points.

Well, the leader among a number of countries is Germany, where the purchasing managers' index (PMI) for the manufacturing sector fell to 43.2 points in July against 45.0 points in June this year. Economists had forecast the figure at 43.1 points. Given that the German economy is well "sharpened" for the export of goods, a sharp drop in external demand especially affects the production sector.

The overall indicator for the eurozone also did not please traders and economists. According to the statistics agency Markit, the purchasing managers' index (PMI) for the production sector of the eurozone in July 2019 fell to 46.5 points against 47.6 points in June this year, which almost coincided with the forecasts of economists.

The slowdown in the manufacturing sector is yet another confirmation that the eurozone economy needs additional stimulus in such difficult times. Almost no one doubts that the European Central Bank will lower interest rates during its meeting in September this year. Until then, the pressure on the European currency will only increase.

As for the current technical picture of the EURUSD pair, the bears have reached a large support level of 1.1030, but the "stop" is a temporary phenomenon. Today's reports on the state of the US manufacturing sector may have a positive impact on the US dollar. The support breakout of 1.1030 will provide the bears with a new "window", which will lead to a decrease in the trading instrument in the area of the lows of 1.0990 and 1.0950. In the case of an upward correction, the growth will be limited by the intermediate resistance of 1.1070, and it is better to open larger short positions after updating the maximum of 1.1100.