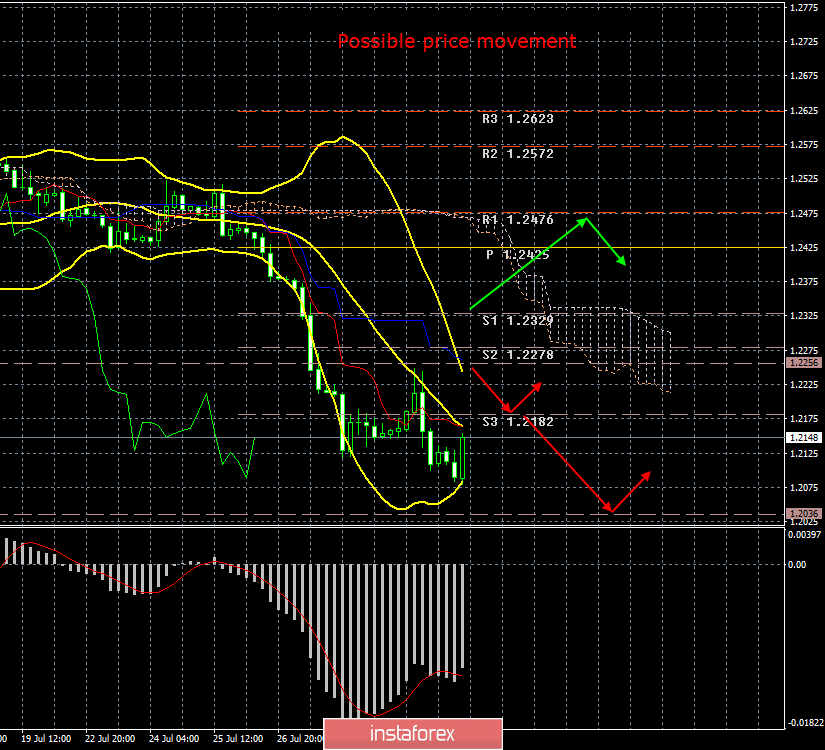

4-hour timeframe

The amplitude of the last 5 days (high-low): 81p - 84p - 170p - 106p - 116p.

Average amplitude for the last 5 days: 111p (107p).

The forex market did not expect anything new and interesting from the meeting of the British regulator. In principle, it ended as expected by most experts and traders. The key rate remained unchanged, at the level of 0.75%, as well as the monthly volume of redemption of government bonds. The balance of votes among the members of the monetary committee was also unambiguous at 9-0 in favor of the absence of changes. At the press conference, Mark Carney said that the UK banking system is ready for any outcome of Brexit, and its preparation for the country's withdrawal from the European Union began immediately after the referendum in 2016. However, traders are more interested in whether the British economy will survive the "hard" Brexit? It will withstand and survive, but what will the consequences be? The forecasts are completely disappointing, the fall of the main macroeconomic indicators, the pound sterling rate, the outflow of labor, the outflow of investments, the growth of unemployment and other problems inherent in the crisis. In addition, if the composition of the United Kingdom also leaves Northern Ireland and Scotland, who opposed the "divorce" from the EU? In general, Mark Carney did not reassure the markets with his statements about the stability and readiness of the banking system. The index of business activity in the UK manufacturing sector slightly exceeded analysts forecasts, but still remained below the level of 50.0. Thus, the decline is observed in Great Britain's industry. At the US trading session, the lowest pullback of the GBP/USD pair began, however, as in the case of the euro, it is not known how long it will last. Tomorrow macroeconomic statistics will come from the UK and from the United States, so a quiet Friday with profit taking before the weekend will not work.

Trading recommendations:

The pound/dollar currency pair may begin a round of corrective movement. Thus, it is now recommended to wait for the completion of this turn and resume selling the pound sterling with a target level of 1.2036.

It will be possible to buy the British currency no earlier than consolidating the pair above the critical line, but with extreme caution and in small lots. The first goal is the resistance level of 1.2476.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.