To open long positions on EURUSD, you need:

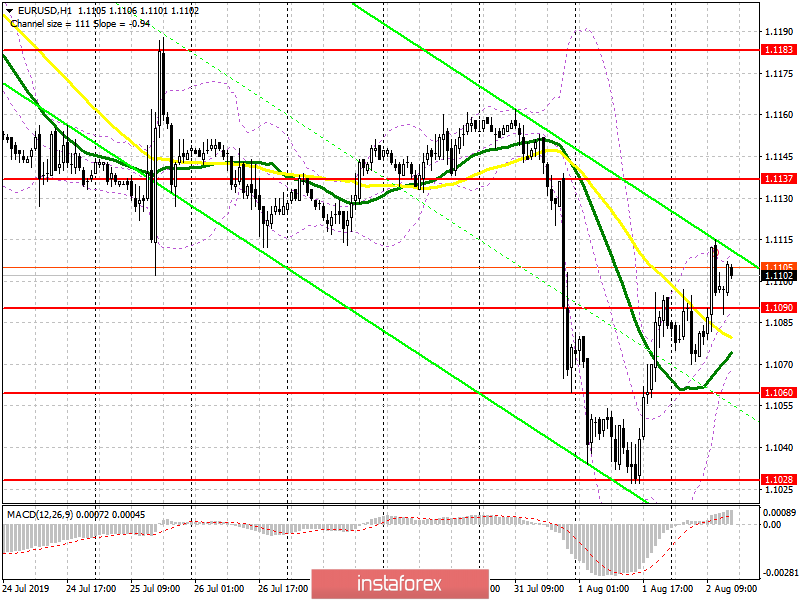

A good report on the sharp rise in retail sales in the eurozone led to a strengthening of the European currency in the morning, even though producer prices fell sharply, which is another sign of a slowdown in inflation. Buyers formed a new support level of 1.1090, but the further movement will depend on the report on the US labor market. Weak indicators of growth in the number of employed in the non-agricultural sector will lead to a further strengthening of EUR/USD in the resistance area of 1.1137, where I recommend taking the profit. If the report will move down below the level of 1.1090, then it is best to look at long positions on a false breakdown in the area of 1.1060, where buyers will try to form the lower limit of the new upward channel or buy the euro to rebound from the minimum of 1.1028.

To open short positions on EURUSD, you need:

Bears will count on a good report on the US labor market and on the return of EUR/USD to the support level of 1.1090, which will be the first signal for the opening of short positions in the area of the minimum of 1.1060, where I recommend taking the profit. However, the main goal of the sellers will be the support around 1.1028, which will indicate the continuation of the bearish trend in the short term. If the report on the United States does not surprise traders, the next fixation of profits and the growth of the euro to the resistance of 1.1137 are not excluded, from which I recommend to open short positions immediately on the rebound.

Indicator signals:

Moving Averages

Trading is above 30 and 50 moving averages, but it will be possible to talk about the continuation of the bullish correction only after the data.

Bollinger Bands

In the case of a downward movement, the lower limit of the indicator will support the area of 1.1065.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20