To open long positions on GBP/USD, you need:

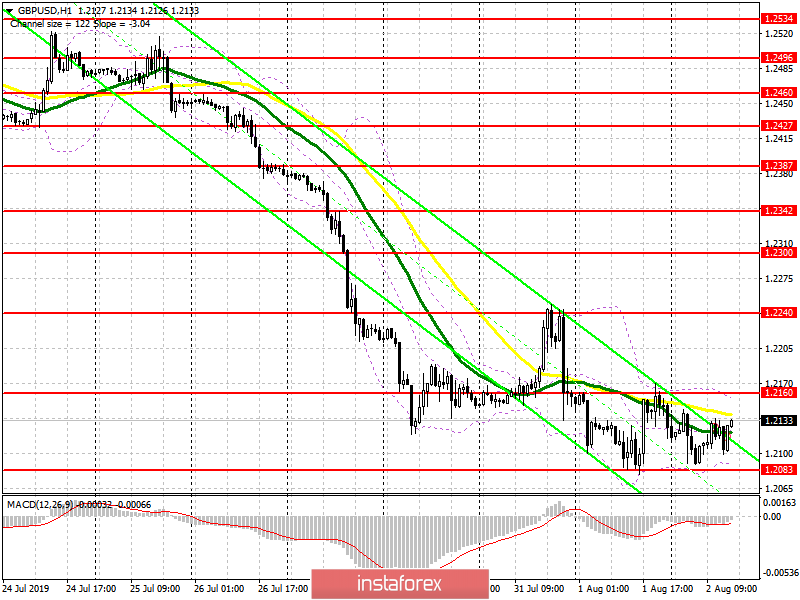

The situation in the pair has not changed compared to the morning forecast and much will depend on the US labor market report. Bulls still need to keep the level of 1.2083, the formation of a false breakdown on which will allow them to count on a re-upward correction to the resistance area of 1.2160, where I recommend taking the profits. Only the consolidation above this range, after weak data on the unemployment rate in the US, will allow us to start a conversation on the continuation of the pound's growth in the area of the maximum of 1.2240. In the scenario of further decline of GBP/USD, it is best to look at long positions from the lows of 1.2040 and 1.1985.

To open short positions on GBP/USD, you need:

Sellers still need the support of 1.2083, the breakthrough of which will only strengthen the bearish trend and lead to an update of the lows of 1.2083 and 1.2040, where I recommend taking the profit. However, we should not forget that the data on the US labor market can affect traders, and a weak report on the number of employed in the non-agricultural sector will force to fix the profit in the US dollar, which will lead to an upward correction in GBP/USD. In this scenario, it is better to count on short positions after the formation of a false breakout in the resistance area of 1.2160, or to sell the pound from the maximum of 1.2240, which was formed at the beginning of this week.

Indicator signals:

Moving Averages

Trading is below 30 and 50 moving averages, indicating a further decline in the pound.

Bollinger Bands

Volatility has decreased, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20