By hook or by crook. Looking at how Jerome Powell ignored criticism, Donald Trump decided to change tactics. He announced the introduction of a 10% tariff on Chinese imports of $300 billion, pushing the Fed to further reduce the rate. The owner of the White House believes that it should be 1.5%, which is 0.75 percentage points below the current level. If the Central Bank justifies its July decision on monetary expansion with growing international risks, why not increase them even more?

Trump would like to see a 3% GDP growth, some weakening of the US dollar, lower compared to the current cost of borrowing and not tired of rewriting the historical highs of the S&P 500. In fact, the US stock index is developing a correction that started after the announcement of the results of the FOMC meeting. Contrary to the rate cut, the US dollar rose and the shares fell, as investors did not receive what was expected from Jerome Powell: "dovish" rhetoric and the door open for further monetary expansion.

Furthermore. The debt market reacted to the introduction of additional duties on Chinese imports by falling the yield of 10-year Treasury bonds to the lowest level since 2016. The indicator is below the federal funds rate, which indicates that the debt market requires the Fed to continue weakening its monetary policy. CME derivatives raised the chances of rate cuts by 25 bps at the September FOMC meeting from 60% to more than 90%.

Dynamics of the yield of US bonds and the Fed rate

The US economy looks significantly better than the European one. In the second quarter, it expanded by 2.1%, while the eurozone GDP increased by a modest 0.8% y/y. The yield of US bonds is higher than the German, French and other European counterparts, but the potential of the ECB's monetary expansion looks limited, and the Fed's capabilities are wider. This circumstance leaves the EUR/USD bulls with a chance for revenge.

The US labor market report for July did not give any special hints to the main currency pair. Actual employment growth outside the agricultural sector +164 thousand striking way meets the consensus experts Bloomberg. As, however, the unemployment rate of 3.7%. Average wages rose slightly faster (+0.3%) than expected, but this did not cause the EUR/USD to swing in one direction or another.

Week to August 9 in terms of the economic calendar is presented as a kind of calm after the storm. Investors' attention will be focused on commodity currencies and the release of data on American business activity in the service sector. Perhaps the most interesting question of the five-day period will be whether China will answer Donald Trump's increase in tariffs.

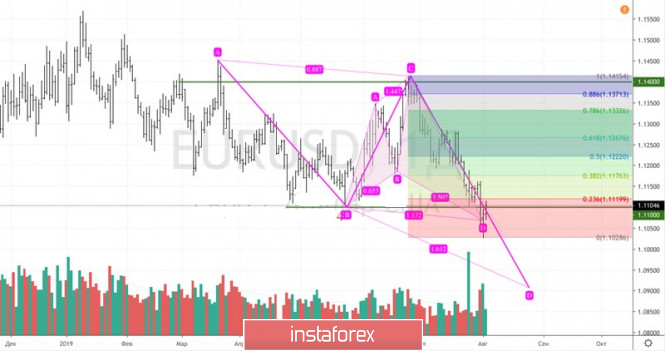

Technically, the update of the August minimum will allow the bears to continue the attack in the direction of the target by 161.8% according to the pattern AB=CD. On the contrary, the rebound of quotations from the convergence zone near the target by 113% according to the Shark model will create conditions for correction in the direction of 23.6%, 38.2% and 50% of the CD wave.

EUR/USD, the daily chart