The euro managed to strengthen its position against the US dollar in the morning after a good report on retail sales in the eurozone, which rose sharply.

Retail sales in the eurozone rose in June, which will certainly support economic growth in the 2nd quarter of this year. The increase in household expenditure also indicates a continued level of confidence among the population and an optimistic outlook for the future. However, a number of uncertainties, especially with Brexit and the US-China trade conflict, which is only getting worse, remain the main deterrent for consumers.

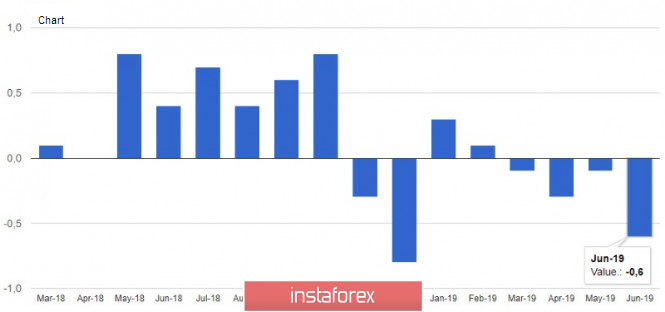

According to the data, retail sales in the euro area in June this year increased by 1.1% compared to the previous month, which is the strongest growth since November 2017. Compared to the same period in 2018, sales increased by 2.6%. Data for May were revised for the worse, as initially reported a drop in sales by 0.3%, and the actual value was -0.6%.

However, the positive report on retail sales moved to the background, and the growth of the euro slowed after it became known that producer prices in the eurozone fell sharply. According to the Eurostat Bureau of statistics, the eurozone producer price index (PPI) in June of this year decreased by 0.6% compared to the previous month, while compared to the same period of the previous year, prices rose by only 0.7%.

Such news, of course, is a very bad signal for the European Central Bank, which is struggling to return to the target level of the value in the area of 2.0%. However, without monetary easing and the launch of an asset repurchase program, this goal will remain elusive next year, not to mention this one.

This morning, I said that Donald Trump has approved new additional duties of 10% on goods from China in the amount of 300 billion dollars. Closer to lunch, the Ministry of Foreign Affairs of China made a number of statements in this regard. The Department noted that they will take all necessary measures if the US imposes new duties, and said that if the US wants a trade war, they would receive it, and Beijing would easily take part in it. The ministry also drew attention to the fact that some words from the US President about good relations with China are not enough, and now, it is the turn of the White House to confirm the words with deeds.

Thus, China has made it clear that it is categorically against the new US duties, as they will violate the consensus between Xi and trump. So far, there have been no other statements on this score from the American president.

The British pound remained under pressure after the release of the report on the purchasing managers' index (PMI) for the construction sector in the UK, which in July this year remained below 50 points, indicating a reduction.

According to the company Markit, PMI for the construction sector amounted to 45.3 points against a minimum of 43.1 points in June this year. The construction sector remains under pressure against the background of low demand, as well as due to the prevailing economic uncertainties, primarily related to Brexit.