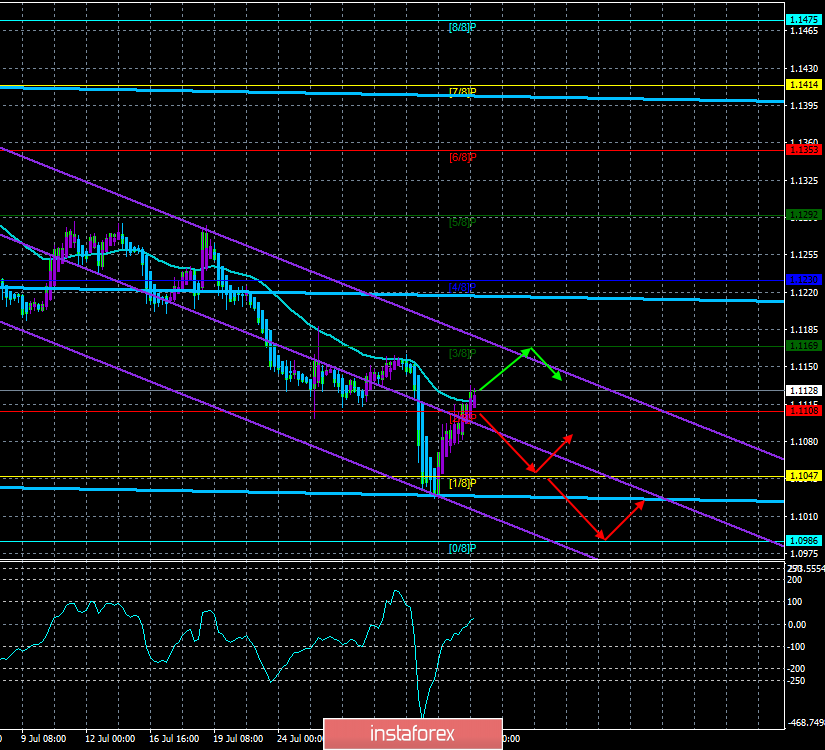

4-hour timeframe

Technical data:

The upper linear regression channel: direction – sideways.

The lower linear regression channel: direction – down.

The moving average (20; smoothed) – sideways.

CCI: 23.8672

On Friday, August 2, the main attention of traders was focused on macroeconomic statistics from the States. In general, this news package did not disappoint, which once again suggests that the June failure statistics was an accident, and the negative trend, though present (the slowdown of the US economy) is not as bad as it seems. The number of new jobs created outside the agricultural sector in July amounted to 164,000, which is fully consistent with the forecast of experts. Unemployment remained at 3.7%. A little earlier, on the morning of the same day, the eurozone published a report on retail sales, which unexpectedly also turned out to be better than the expectations of the foreign exchange market and amounted to +2.6% y/y with a forecast of +1.3%. The euro received an upward momentum in the morning. However, we also believe that now is the time for another upward correction for the euro/dollar pair, and this explains more the strengthening of the European currency. Still, no matter how strong the US dollar is, high demand cannot last forever. And now it may be time for a timeout. However, today will not be another boring Monday. Both in the European Union and in the United States, indices of business activity in the service sector will be published today, as well as composite indices. Recall that business activity in the industrial sector of the EU is in the "red zone", and in the US – is approaching this very "red zone". The service sector is getting a little better. At the moment, the euro has recovered to the moving average line, and from a technical point of view, its future depends on the ability of bulls to overcome the moving average.

Nearest support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD currency pair continues to be adjusted. On August 5, therefore, it is recommended to resume sales of the euro/dollar pair with the targets of 1.1047 and 1.0986 in case of a pair rebound from the MA.

It is recommended to buy the euro/dollar in small lots if the bulls manage to gain a foothold above the moving average line, with the first target Murray level of "3/8" - 1.1169.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.